Credit Cards

Application for the Luxury Gold card: how does it work?

If you need some extra luxury in your life, this card is for you. Consider applying for the Luxury Gold card and get the VIP experience you deserve. This article will show you how to get one.

Advertisement

All information about The Centurion® Card from American Express has been collected independently by The Mad Capitalist.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Luxury Gold Card: 2% cashback to buy everything you wish for your next trip.

If you’re looking for a beautiful and luxurious card, you have just found it: the Luxury Gold card. This card is for people who appreciate exclusivity and premium service.

If you can afford it, the benefits are there for you to enjoy. As with other premium travel cards, you’ll have special conditions to access airport lounges and an average of $500 in credits to upgrade and eat well at the best hotels. You can also count on a concierge service to help you plan your trips and book the best hotels and tables in restaurants.

Does this card interest you? So please keep reading to learn how to apply for it.

Apply online

You can apply online for the Luxury Gold card in the comfort of your home. Access the Luxury Card website (and take a good look at it; the website’s minimalist design is exquisite). It has three credit card options. Find the Gold among them.

You’ll find more info about the card benefits and conditions to get yours there. When you’re ready, hit the “apply now” button. You’ll get redirected to a form. Pay attention to filling everything with the correct information. After reading the terms and conditions, check every box and agree with the $995 annual fee.

As soon as you send your form, you’ll get an instant response and will be able to proceed with the process.

Advertisement

Apply using the app

To get this golden card you need to apply on their website.

Luxury Gold credit card vs. The Centurion® Card from American Express

There are several options for exclusive cards with luxurious benefits. One of the most famous is the American Express Centurion, a status symbol in high society. Compare it with the Luxury Gold credit card:

| Luxury Gold card | The Centurion® Card from American Express | |

| Credit Score | Excellent | Excellent |

| Annual Fee | $995 | $5,000 (+$10,000 of Initiation Fee) |

| Regular APR | 14.99% variable APR (0% Intro APR for 15 months) | Prime Rate + 21.99% (variable) |

| Welcome bonus | No welcome bonus. | Membership Reward Points – variable to each client |

| Rewards | 1x point per dollar in every purchase with 2% cashback redemption rate. | 1X Membership Rewards® Points for each dollar spent on eligible purchases. |

To receive the invitation for a Centurion membership, you need to be an American Express customer already. If you’d like to give The Centurion® Card from American Express a chance to have you as a cardholder, you can ask for an invitation.

We have an article about the application process. Are you curious to see what it takes to get this card? Just check the following content.

How do you get American Express Centurion?

The Centurion® Card from American Express is an ultra-exclusive travel card. Learn how to apply for the invitation, asking to be considered for the Centurion Membership.

Trending Topics

The Centurion® Card or The Platinum Card® from American Express: choose the best!

The Centurion® Card or The Platinum Card® from American Express? We've made a comparison to help you decide which is best.

Keep Reading

A simple process: Apply for the PayPal Prepaid Mastercard®

Looking to apply for the PayPal Prepaid Mastercard®? We'll walk you through our step-by-step from start to finish - qualify easily!

Keep Reading

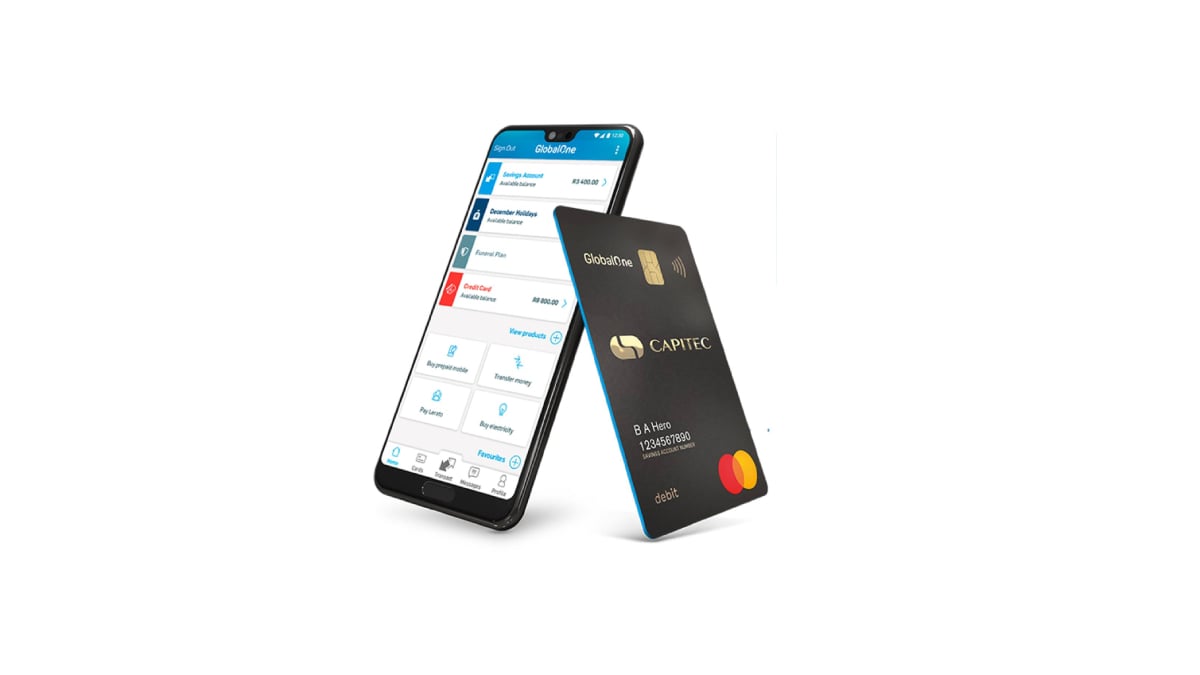

Learn how to download the Capitec Bank App

Find out how to quickly and easily make the Capitec Bank App download. Read on to learn how to enjoy banking online with this app!

Keep ReadingYou may also like

Is the U.S. headed for a housing crisis?

Could a housing crisis be on the horizon for the United States? Find out what factors could lead to one and how it would impact the economy.

Keep Reading

Bank of America Customized Cash Rewards credit card review: is it worth it?

Is the Bank of America Customized Cash Rewards credit card right for you? See its benefits, such as cashback and $0 annual fee, and find out!

Keep Reading

The crypto winter is coming

Crypto has been on a downward spiral over the past few months. What will happen to digital tokens in 2022? Read on for more.

Keep Reading