Finances

High-yield savings vs. money market: find the best account for you

Compare high-yield savings accounts and money markets .Find out which is better based on the interest rate, and fees. Keep reading!

Advertisement

Compare high-yield savings accounts and money market accounts

High-yield savings or money market? Saving money is crucial to your financial health, but it can be challenging to know where to start.

Do you put your money in a high-yield savings account or a money market account? What’s the difference, and which one is right for you?

Marcus by Goldman Sachs Personal Loans

If you want to learn how to apply for a personal loan at Marcus by Goldman Sachs Personal Loans, we can help. The application process is easy!

Keep reading more about the differences between high-yield savings and money market accounts.

Also, learn some tips on choosing the best account for your needs. Check it out!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

High-yield savings account

High-yield savings are a type of investment account that offers a higher interest rate than a traditional savings account.

The interest rate is usually tiered, meaning that the higher your balance, the higher the interest rate you’ll earn.

High-yield savings accounts also have a higher interest rate and fewer costs than other types of accounts.

Check the benefits of high-yield savings accounts:

Pros

- Compound interest daily;

- FDIC insured;

- Easy to manage your money ( most high-yield savings accounts are online);

- Most don’t offer monthly fees.

Advertisement

Cons

- High minimum balances;

- Variable interest rate;

- Not so attractive to long-term investments because inflation may grow;

- A limited number of withdrawals;

- Transferences take about a day to be completed.

What is a private loan for students?

Paying for college education is not easy, but you can count with a private student loan to help you. Is it a good idea? This content will clarify this question.

Money market account

A money market account is a high-yield savings account that generally pays higher rates than a regular savings account.

Money market accounts are FDIC insured and offer check-writing privileges, making them a convenient way to save money and earn interest.

While the interest rate on a money market account is usually higher than the rate on a regular savings account, there may be restrictions on how often you can withdraw money from the account.

A money market account, unlike a regular savings account, generally needs a higher minimum balance.

They also have the ability to pay better interest on your funds than a traditional savings account.

See the pros and cons of Money Market accounts.

Advertisement

Pros

- Earn interest;

- Insured deposits;

- Accessible cash.

Cons

- An expensive minimum deposit is required;

- Lower yield than some banking products;

- Withdrawals are limited.

Main differences between a high-yield savings account and a money market account

Most people are familiar with savings accounts offered by banks and other financial institutions.

A high-yield savings account is a type of savings account that offers a higher interest rate than a traditional savings account.

Money market accounts are essentially savings accounts with a few checking account features.

Also, they typically require a higher minimum balance and offer check-writing privileges.

Here are five main differences between a high-yield savings account and a money market account:

1. Interest rates

Money market accounts and high-yield savings accounts are both types of deposit accounts offered by banks and credit unions.

They both typically offer higher interest rates than regular savings accounts.

Money market accounts may have higher interest rates than high-yield savings accounts, but they also usually have higher minimum balance requirements.

It means you need more money in the account to earn the higher interest rate.

2. Minimum balance requirements

Money market accounts often have higher minimum balance requirements than high-yield savings accounts.

So you may need to keep more money in a money market account to earn the highest interest rate.

On the other hand, high-yield savings accounts typically have lower minimum balance requirements than money market accounts.

It makes them a good option for people who don’t have much money to deposit into an account.

Both types of accounts offer higher interest rates than regular savings accounts, so it’s a good idea to compare rates before you decide which one is right for you.

3. Fees

Money market accounts sometimes have associated fees, while high-yield accounts usually do not.

So, check with your bank or financial institution to see if there are any fees with either type of account before you open one.

4. Check Writing

Money market accounts typically offer check-writing privileges, while high-yield savings accounts do not.

If you think you need to write checks from your account, then a money market account may be your better choice.

5. Access to funds

Money market accounts generally offer slightly easier access to your funds than high-yield accounts.

With a money market account, you can typically write checks or withdrawals using an ATM card.

On the other hand, with a high-yield savings account, you may need to transfer funds to another account to access your money.

Which account should you choose: high-yield savings or money market?

Money market and savings accounts are both good choices when you want to earn interest on your deposited funds.

First, money market accounts typically have higher interest rates than savings accounts and offer check-writing and debit card privileges.

However, they may also have higher minimum balance requirements and limit the number of transactions you can make each month.

Savings accounts offer slightly lower interest rates than money market accounts but usually have no minimum balance requirements and allow unlimited transactions.

So, when deciding which account is proper for you, it’s important to consider your savings goals and how you plan to access your funds.

Second, money market accounts offer higher interest rates and flexibility but may require you to keep a larger balance.

Savings accounts offer a more traditional banking experience with fewer restrictions but may not earn as much interest.

Ultimately, the best decision is the one that aligns with your financial goals.

We hope this article has helped you understand the differences between high-yield savings accounts and money markets.

Both of these account options offer great benefits, so it’s essential to research and find the one that best suits your needs.

And if you want to understand more about how to improve your finances, read our post below to learn about how your credit score works!

Credit score: top 10 questions answered

Do you ever wonder what your credit score is? Or how can you make it better? You're not alone! In this blog post, we'll answer some of the most common credit score questi

Trending Topics

Chase Sapphire Preferred® Card review

The Chase Sapphire Preferred® Card has a $95 annual fee, but it comes with several perks that may be worth the cost. Check out our review!

Keep Reading

Learn to apply easily for True American Loan

Apply for the American Personal Loan: The step-by-step that will get you started today. Keep reading to find out more!

Keep Reading

Total Visa® Credit Card review: Visa card for people with poor credit

The Total Visa® Credit Card targets your bad score. Rebuild credit. Get it right now with an online application. Check it out!

Keep ReadingYou may also like

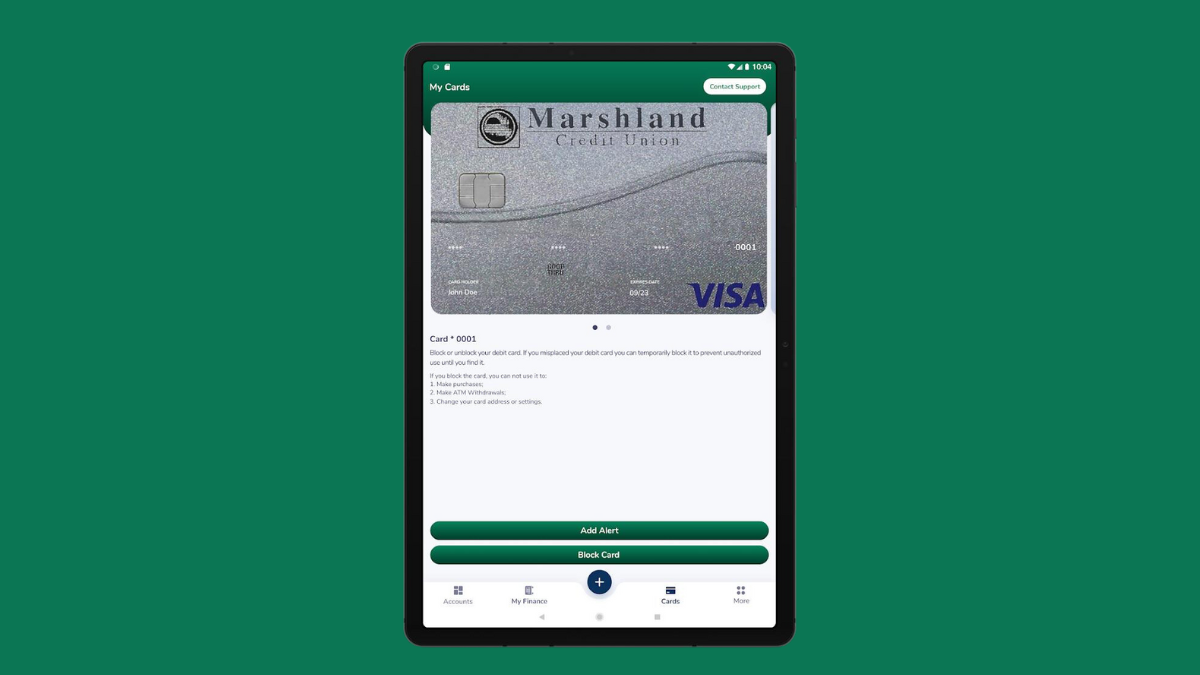

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading

OppLoans Personal Loan review: how does it work and is it good?

Here is an OppLoans Personal Loan review with its features. Borrow up to $4K with no hidden fees! Keep reading to learn everything you need!

Keep Reading

American Airlines AAdvantage® MileUp® application: how does it work?

Find out if the American Airlines AAdvantage® MileUp® is right for you, and learn how to apply here. Read on!

Keep Reading