Investments

How to invest with Qtrade Direct Investing: Maximize Returns

Begin your investment journey with Qtrade Direct Investing. Our guide covers the essentials, from setting up your account to using their intuitive platform and diverse investment tools for financial growth.

Advertisement

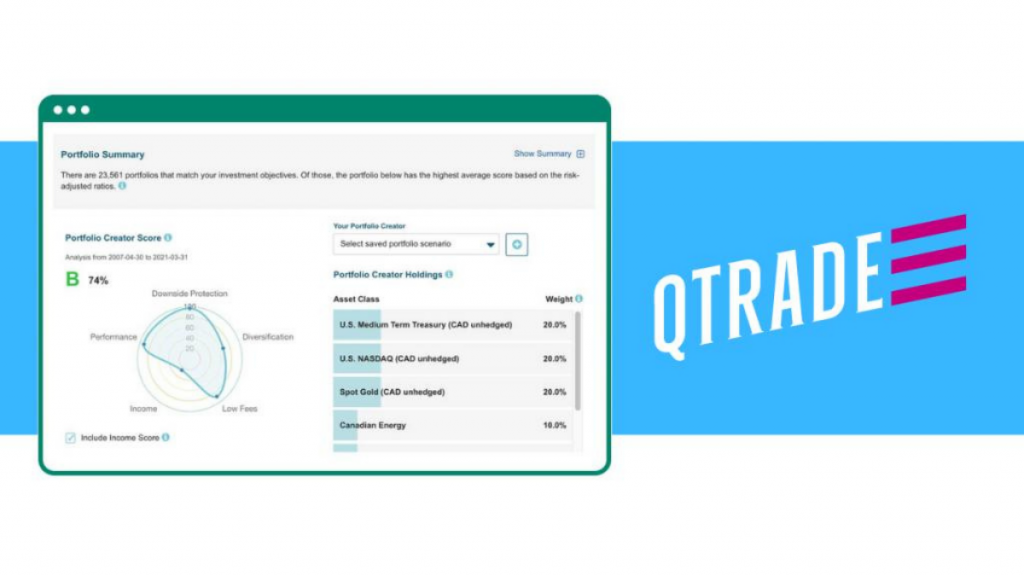

Unlock the secrets to successful investing with Qtrade’s advanced tools

Beginning to invest with Qtrade Direct Investing is a journey towards financial empowerment. Their platform offers a unique blend of tools and services for all.

Curious about maximizing your investment potential? Our comprehensive article lays out everything you need to know to invest with Qtrade Direct Investing. Dive in!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

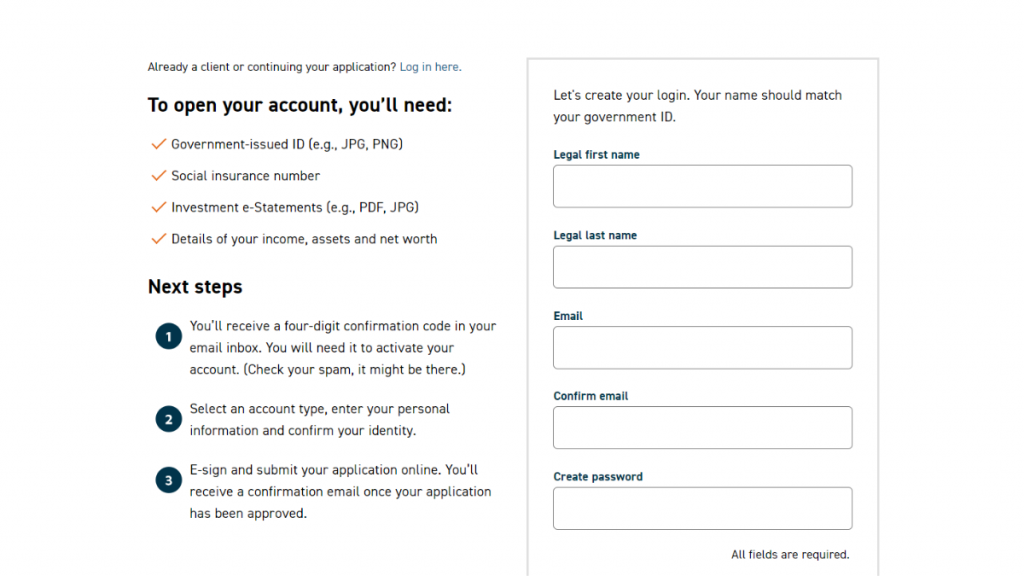

Open account online

As an online broker, the process to open your account is entirely online too. You can go to the Qtrade website and find the “open an account” button.

These are documents and information you’ll need to have in your hands:

- Social Insurance Number

- Investment e-statement

- Income

- Assets

- Net worth

- Your ID (government-issued)

First, create a login with a legal name, email, and password. Then, you will receive a confirmation code in your email. Check your inbox to get it and go back to the website.

This second step must take you no more than 20 minutes. To proceed, there are a few things you’ll have to inform on your investor profile:

- Personal information (address, phone, birth date, etc.)

- Financial background (your annual income, your source of income, net worth, assets, etc.)

- Confirm your identity.

The last step is to e-confirm your application, and you’ll soon get a response if you got approved or not.

Join using the app

Starting with Qtrade Direct Investing is seamless. Download their mobile app from your app store and launch it to begin the account setup process.

On the app’s main screen, select ‘Sign Up’ and fill in the necessary personal information. This includes your name, address, and contact details.

Next, you’ll be guided to answer some questions about your investment experience and goals. These help tailor Qtrade’s services to your needs.

Finally, complete the identity verification process. Once approved, you can fund your account and start trading right from your mobile device.

Advertisement

New in the investing world? Learn the tips and tricks!

Qtrade Direct Investing stands out as a robust and user-friendly platform. Its array of tools and resources cater to both novice and experienced traders.

Whether you’re looking to start trading stocks, bonds, or explore other investment opportunities, Qtrade offers a reliable and intuitive environment.

For those new to the world of investing, or looking to refine their strategies, Qtrade Direct Investing provides an excellent starting point.

But if you’re interested in expanding your investment knowledge before diving into trading, explore our article below.

We’ve prepared a complete guide, packed with insights and tips to kickstart your investment journey in the Canadian market. Read on!

How to Start Investing in Canada

If you're new to the investing world, it can be tricky to know where to start. In this guide, we'll walk you through how to invest in Canada.

Trending Topics

Learn to apply easily for the SoFi Mortgage

Do you want to apply for a mortgage with SoFi mortgage? Read on to a complete guideline that covers all you need to know.

Keep Reading

R.I.A. Federal Credit Union Mastercard® Rewards Card: apply today

Unlock the potential of shopping with the R.I.A. Federal Credit Union Mastercard® Rewards Card! Apply today and start saving big!

Keep Reading

How to prepare for buying a house in 2023

Are you planning on buying a house within the next year? Check out these tips to get yourself prepared! Read on.

Keep ReadingYou may also like

Application for the Old Navy card: how does it work?

The Old Navy card will reward every purchase at any GAP Inc. store. If you like fashion tendencies, learn how to apply and get benefits.

Keep Reading

Apply for the Southwest Rapid Rewards® Premier Credit Card

Apply for Southwest Rapid Rewards® Premier Credit Card today and enjoy exclusive benefits! Earn 30k bonus points and more!

Keep Reading

ClearMoneyLoans.com review: how does it work and is it good?

Get to know a personal loan lender platform that accepts different credit scores. Read on to a ClearMoneyLoans.com review.

Keep Reading