Financial Education

Credit repair companies: worth it or not?

This article will give you the information to decide whether credit repair companies are worth your time and money. Keep reading!

Advertisement

Find out if you should use a credit repair service

Source: Adobe Stock

Are you among the millions of people in the USA with bad credit? If so, you may be wondering if you should use a credit repair service.

The most common myths about your credit score

Do you know what affects your credit score? Here are the most common credit score myths debunked to help you understand it and deal better with it. Keep reading!

In this blog post, we’ll explore what credit repair services are, how they work, and whether or not they’re worth your money. Stay tuned!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

How do credit repair companies work?

Credit scores are an important part of getting loans or other financial transactions.

If you have bad credit, it can be difficult to obtain these services because employers might refuse your application if they see that the score is too low.

There are many reasons why people might have poor credit, such as unpaid bills or even fraud.

So, these things can make it difficult for you to purchase items like homes and cars.

Credit repair companies offer to help fix credit reports for a fee. They contact the credit reporting agency on the consumer’s behalf and dispute negative information.

If the credit repair company is successful, the negative information is removed from the credit report.

Some credit repair companies use aggressive tactics, often promising more than they can deliver.

Others may try to charge fees before they do any work.

Some credit repair companies are even fronts for scams, luring people in with false promises of fixing their credit reports and disappearing with their money.

The easiest way to improve your credit score: a qu

Want to know the easiest way to improve your credit score? Check out our guide for the quick and easy steps you can take today!

Pros of using credit repair companies

- Help to improve your credit score: By using a credit repair company, you can improve your credit score and make it more likely that you’ll be approved for credit products in the future.

- Dispute errors on your credit report: If there are errors on your credit report, they can lower your credit score and make it more difficult to get approved for credit products. By working with a credit repair company, you can dispute the errors on your credit report and get them removed.

- Negotiate with creditors: If you cannot make payments on your debts, you may be able to negotiate with your creditors to lower your payments or interest rates.

- Provide guidance and support: A credit repair company can provide guidance and support. They can answer any questions you have and help you to navigate the process of repairing your credit.

- Save you time and hassle: Repairing your credit can be time-consuming and frustrating. If you’d rather not deal with the hassle of repairing yourself, a credit repair company can do it.

Advertisement

Cons of using credit repair companies

- You might not need one: If your credit score is already good, you might not need a credit repair company. You can do anything a credit repair company can legally do for you at little or no cost.

- They might not be able to deliver: Credit repair companies often make big promises, such as “we’ll get all the negative information off your credit reports.” That’s not only misleading — it’s simply not possible.

- They could cost you more: Some credit repair companies charge high monthly fees and add on extra costs, such as an initiation fee, even if they don’t improve your credit score.

- They might try shady tactics: Some questionable credit repair companies use illegal methods to remove negative information from your credit reports, such as creating a new credit identity — also known as an “EIN” or employer identification number — using someone else’s Social Security number.

Can credit repair companies hurt your credit score?

While credit repair companies may be able to help some consumers improve their credit scores, in other cases, they may harm consumers’ creditworthiness.

Some credit repair companies engage in practices that can lead to credit score damage, such as “file segregation.”

It is when a credit repair company disputes all of the information on a credit report, regardless of whether it is accurate or not.

This practice can lead to credit score damage because it causes the credit reporting agency to investigate each item on the report, which takes time and resources.

Advertisement

How much does it cost to repair credit?

The costs can vary if you’re looking for a credit repair company that will take on your entire situation.

Most charge one-time setup fees and monthly services with different rates depending on the needed assistance.

Some even offer premium packages tailored specifically towards those who want more than just basic help from their provider.

Is hiring a credit repair company worth it?

Credit repair companies often promise to help consumers improve their credit scores by disputing negative items on their credit reports.

While it is true that credit repair companies can save you time and effort by managing the credit dispute process for you, it is important to remember that you can also dispute credit items yourself for free.

In addition, credit repair companies may charge high fees, which may not be worth it if they cannot significantly improve your credit score.

Therefore, hiring a credit repair company is not necessarily the best option for everyone.

It is important to weigh the pros and cons before making a decision.

How to choose the best credit repair company for your finances?

With so many credit repair companies, how do you know which is right for you?

Here are three things to look for when choosing a credit repair company: experience, certification, and online reviews.

When it comes to experience, you want to make sure the credit repair company you’re considering has been in business for a while.

It shows they know what they’re doing and have a proven track record.

Next, you’ll want to see if the credit repair company is FICO certified.

It means their credit experts have undergone extensive training and are up-to-date on the latest credit repair laws and regulations.

Finally, take a look at online reviews. See what other people are saying about the credit repair company’s services.

If you see a lot of positive reviews, that’s a good sign.

But if you see mostly negative reviews, that’s a red flag, and you’ll want to consider another company.

By following these three steps, you’ll be on your way to finding the best credit repair company for your needs. Learn how to calculate your credit score below!

Learn how to calculate your credit scores!

Understanding how your credit score will be calculated is the first step to increasing it. So, find out essential information about it. Read on!

Trending Topics

Application for the Luxury Gold card: how does it work?

Your wallet will get heavier with the Luxury Gold card. Take it to your best trips. Learn how to apply for this golden credit card.

Keep Reading

Citi Custom Cash℠ Card: a guide to the application

Learn how to apply for the Citi Custom Cash℠ Card: earn unlimited cash back without worrying about an annual fee!

Keep Reading

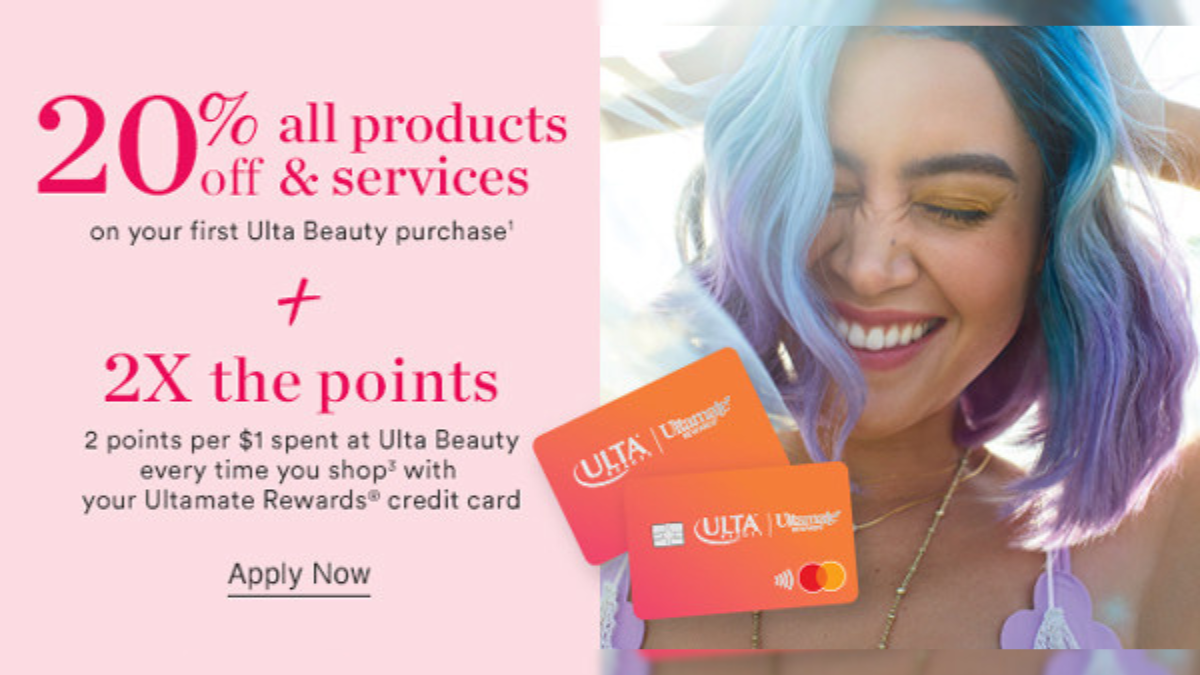

Beauty on a Budget? An Ulta Credit Card Honest Review

Earn 20% off your first beauty purchase at Ulta with the credit card in our review: Ulta Credit Card. Find out other benefits here!

Keep ReadingYou may also like

Learn to apply easily for the Happy Money Personal Loan

Do you want to apply for the Happy Money Personal Loan? This post will teach you how. Read on to learn more!

Keep Reading

Application for the Total Visa® Card: how does it work?

The Total Visa® Card targets your bad score. Start rebuilding credit. Get it right now with an online application. Check it out!

Keep Reading

First Progress Platinum Select Mastercard® Secured Credit Card review

Bad credit won't let you down! Read our review on the First Progress Platinum Select Mastercard® Secured Credit Card to learn more!

Keep Reading