Credit Cards

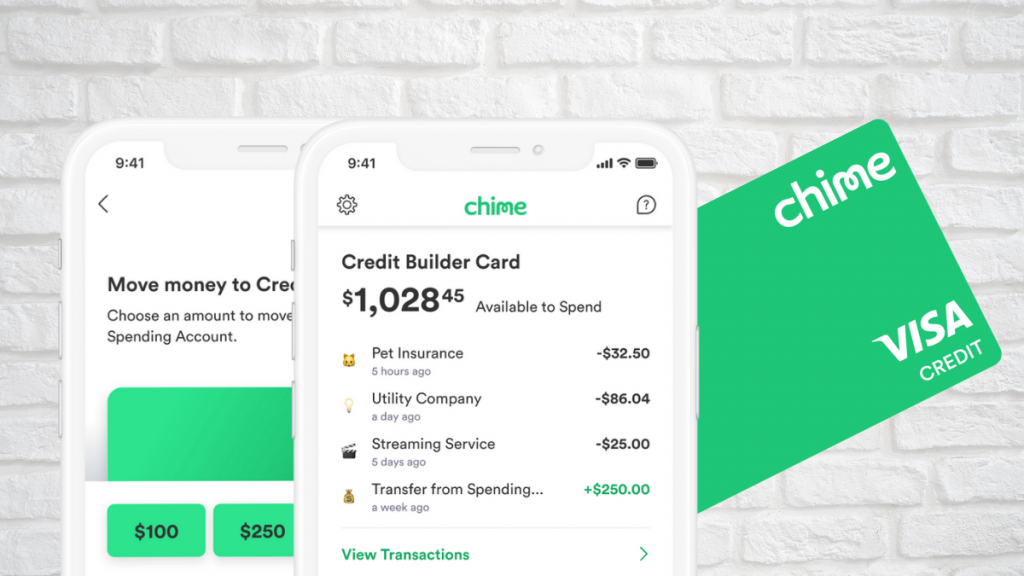

Chime Credit Builder Visa card review: get your credit score back in shape!

No fees and no security deposit, but also no APR and no credit check. That's how amazing your Chime credit card will be. This review will tell you if this credit card is legit.

Advertisement

Understanding Chime Credit Builder Visa credit card: no fees and no credit check to get yours

The Chime Credit Builder Visa is the perfect credit card to build your credit score or improve the one you already have. And the best part of it: no fees and excellent benefits!

How to get Chime Credit Builder Visa credit card?

If you're dreaming of a perfect credit score, count on Chime Credit Builder Visa credit card to make your dreams come true. Learn how to apply today.

Unlikely other credit cards, Chime will not take advantage of your current financial situation. You don’t have to accept a bad credit card just because you don’t have a good credit score.

Chime Credit Builder Visa is a legit credit card. Keep reading this review to understand how it works.

- Sign-up bonus: This card is currently not giving sign-up gifts to its card members.

- Annual fee: No annual fee. Pay $0 per year.

- Rewards: There are no rewards like cash back or points to use this card.

- Other perks: Modern mobile app, no credit check, and no risk of creating debt.

- APR: No APR on this credit card! Read the review to understand why.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Chime Credit Builder Visa credit card: how does it work?

Chime is not a bank, it is a financial fintech that provides checking accounts and a Visa credit card to build your credit score.

It is very simple, yet incredibly efficient. First, you have to open your account at Chime and transfer money to it. Then, your credit card is linked to it, and you set the amount you’d like to spend with your card.

There is no rewards program, so it works basically to improve your credit score. However, it is drastically more advantageous than secured cards or the bad unsecured credit cards available for people with no credit history.

Chime Credit Builder Visa credit card: should you get one?

This credit card is so simple and efficient there it is hard to find a disadvantage to it. But as this is a full review, we’ll show you the pros and cons of the Chime Credit Builder Visa credit card in the following.

Advertisement

Benefits

- No fees to open your account or to use the credit card.

- Don’t worry about your credit score. As there is no way to create debt, Chime will not perform any credit check to give you this credit card.

- The mobile app is intuitive and complete.

- You may notice something special about this credit card: there is no APR. That’s because there is no way to carry a balance, as your balance is on “auto pay” according to your deposit.

Disadvantages

- If you’re looking for a way to earn rewards like cash back, this is not the card for you, as it has no rewards program.

- You’ll have to open a Chime account to get your Chime Credit Builder Visa credit card. However, the account will cost you $0.

Advertisement

Credit score required

Everything on this card is cohesive, including its application process. As the purpose of the card is to build a good credit score, they do not require a good credit score for you to obtain the card. That makes sense, right?

Chime Credit Builder Visa card application: how to do it?

It’s time to build a strong credit card and achieve new goals in your life. If you want to apply for this card and start improving your credit history right away, read the following post and we’ll tell you how to get this amazing credit card.

How to apply for a Chime Credit Builder Visa cred

If you're dreaming of a perfect credit score, count on Chime Credit Builder Visa credit card to make your dreams come true. Learn how to apply today.

Trending Topics

Discontinued Apple products are worth thousands online

If you've got an old Apple product lying around, it could be worth a lot of money. Here's how to find out if your device is worth selling.

Keep Reading

Can you get a credit card with no job?

Need a credit card but don't have an income? Find out if you can get a credit card with no job, and explore your possibilities. Read on!

Keep Reading

Learn to apply easily for the LightStream Personal Loan

Ready to apply for a Lightstream Personal Loan? Look no further! We've got all the information you need right here! Borrow up to $100K fast!

Keep ReadingYou may also like

Medicaid: get the health care you deserve

Learn about who can benefit from Medicaid and how to apply for this important government healthcare program. Keep reading!

Keep Reading

Federal loans vs Private Loans: which is better?

What do you know about Federal Loans vs Private Loans for students? If you're in college or if you intend to be, this content is for you!

Keep Reading

Obamacare: all you need to know about the program

Find out how Obamacare can help you get health care coverage for your family, plus what it covers and who is eligible. Read on!

Keep Reading