Credit Cards

Chime Credit Builder Visa Credit Card application: how does it work?

Like everything on the Chime Credit Builder Visa card, the application process is simple, easy, and efficient. If that's something you appreciate on a credit issuer, you're going to love this credit card.

Advertisement

Chime Credit Builder Visa credit card: no more excuses to keep a poor credit score

It’s time to build a perfect credit score with the help of a Chime Credit Builder Visa credit card. Improve your score to achieve your goals with no annual fee and no credit check.

You know that a better credit score can get you a better deal to achieve your new house, your new car, or any other life project that you have.

And don’t let any card issuer convince you to settle for a bad credit card just because you don’t have a good score. Chime is different and you’ll get a lot of benefits. Get your Chime Credit Builder Visa credit card and start your journey towards an excellent credit score.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The first step to getting this card is to open a Chime account. So, if you’re already a Chime client, all you have to do is apply directly for the Chime Credit Builder account.

To open your account access the Chime website and get started. Chime will request the following information:

- Your full name

- Date of birth

- Email and password to create your login

- Social Security Number

- Financial info: income and employment

Read the terms and conditions, check the boxes and you’ve finished the first step of your application process. Now, download the app, log in, and set up your account.

Apply using the app

You can make the whole application process directly through the mobile app, just as you do on the website.

As you’ll have to download the app to use your account anyway, you can jump ahead and apply on the app.

Advertisement

What about another recommendation: Applied Bank® Gold Preferred® Secured Visa® Credit Card

The Applied Bank® Gold Preferred® Secured Visa® Credit Card is another good option for building credit. Everyone has a chance to get approved, regardless of their credit scores.

With a small annual fee and a 9.99% APR, this card is worth it. Get your credit history reported to all three major credit bureaus and watch your score grow.

The following post will tell you how to get this card and you’ll soon enjoy the benefits of an excellent credit card.

Applied Bank® Gold Preferred® application process

Wondering how to apply for the Applied Bank® Gold Preferred® Secured Visa® Card? Learn everything you need to know here, including application requirements.

Trending Topics

Upgrade Rewards Checking application: how does it work?

Get ready to take advantage of our Upgrade Rewards Checking! Apply now and enjoy no hidden fees and cash back on expenses! Read on!

Keep Reading

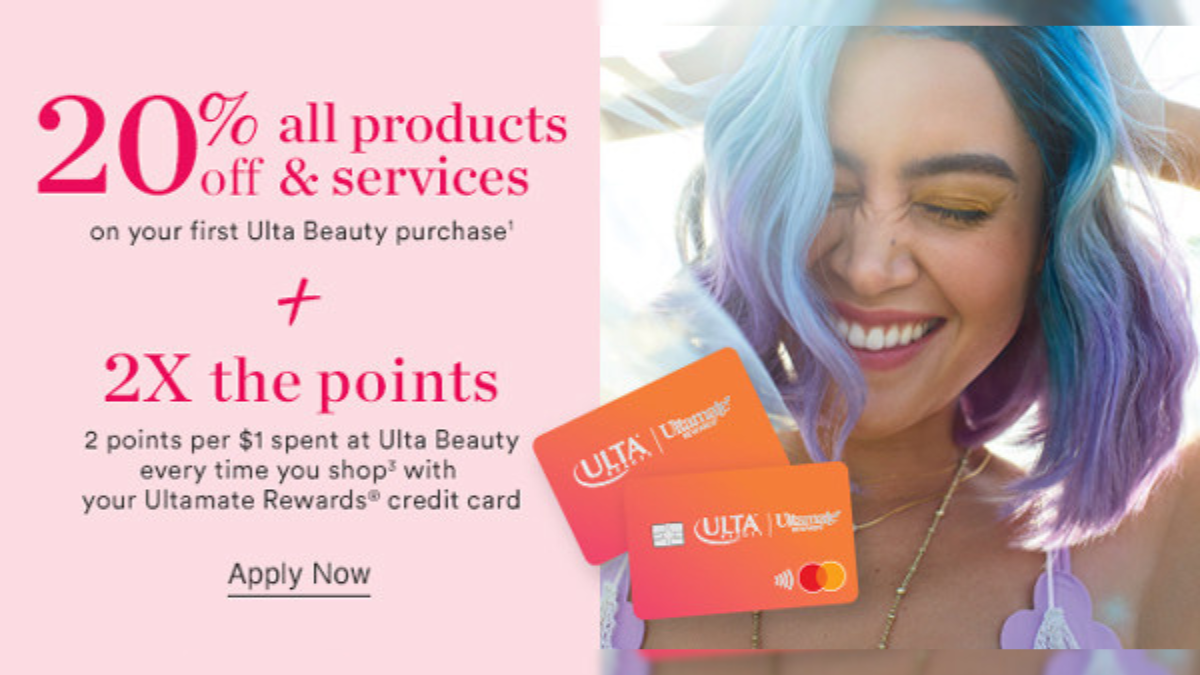

Beauty on a Budget? An Ulta Credit Card Honest Review

Earn 20% off your first beauty purchase at Ulta with the credit card in our review: Ulta Credit Card. Find out other benefits here!

Keep Reading

Merrick Bank Personal Loan review: how does it work and is it good?

In this Merrick Bank Personal Loan review, you will learn about how it works, and the pros and cons of their personal loan products.

Keep ReadingYou may also like

Housing Assistance: find out what are your options

Are you looking for housing assistance? This guide will help you understand your options and how to apply. Keep reading!

Keep Reading

8 tips on how to make the most from refinancing

If you're looking to make the most of refinancing, getting well informed about this is vital. With these 8 tips, you'll be ready for it.

Keep Reading

How to pick the right rewards card for your needs

Learn how to pick a rewards card with these tips. You can get the best credit card that suit your lifestyle and get many benefits.

Keep Reading