Credit Cards

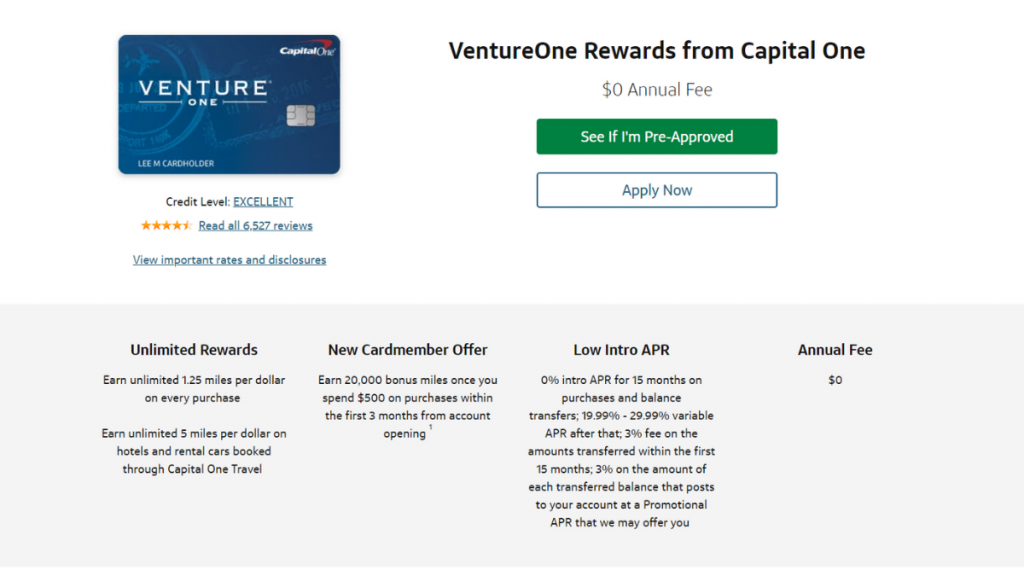

Capital One VentureOne Rewards Card review: $0 annual fee

Thinking of upgrading your credit card game? Dive into our Capital One VentureOne Rewards Credit Card review! Secure 0% intro APR for 15 months!

Advertisement

Earn up to 5 Miles for Every Purchase – 0% intro APR

Do you want to travel the world earning miles with a no-annual-fee credit card? Learn more about the Capital One VentureOne Rewards Card in this review.

Apply for the Capital One VentureOne Rewards Card

Don't waste time searching for ways to apply for the Capital One VentureOne Rewards Credit Card. Earn unlimited miles on purchases!

Understand the pros and cons, fees, and reward redemption options. Keep reading!

- Credit Score: Good-excellent;

- Annual Fee: $0;

- Purchase APR: 0% intro APR for the first 15 months, then 19.99%, 26.24%, or 29.99%, depending on your creditworthiness;

- Balance Transfer Fee: 3% for the first 15 months; 4% at a promotional APR that Capital One may offer you at any other time.

- Cash Advance APR: 29.99% (variable);

- Cash Advance Fee: Either $5 or 5% of the amount of each cash advance, whichever is greater;

- Welcome Bonus: Earn 20K bonus miles after spending $500 on purchases during the first 3 months of account opening;

- Rewards: Earn 1.25 miles on every purchase and 5 miles on hotels and car rentals booked through Capital One travel;

- Terms apply.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Capital One VentureOne Rewards Credit Card: how does it work?

The Capital One VentureOne Rewards Credit Card is a no-annual-fee travel card.

While it offers some solid perks, such as the 0% intro APR for 15 months and the ability to earn miles on every purchase, it falls short compared to other cards with more rewards.

There’s a 3% balance transfer fee for the first 15 months. Then, 4% at a promotional APR that you may be offered at any other time.

Rewards

You will earn 5 miles on Capital One Travel purchases and 1.25 miles on all other purchases.

Advertisement

Redemption

There are no reward caps for this card. You can use your miles to get reimbursement for any travel purchase or book a trip through Capital One Travel.

Additionally, you can transfer your miles to more than 15 travel loyalty programs, giving you flexibility in using your rewards. Each mile is worth 1 cent when booking travel.

0% intro APR

This credit card comes with a 0% intro APR for 15 months.

After that period, an APR of 19.99%, 26.24%, or 29.99% will be applied, depending on your creditworthiness.

Advertisement

Welcome Bonus

In addition to the perks above, the Capital One VentureOne Rewards Credit Card also offers a bonus of 20K miles.

For that, you have to spend $500 on purchases during the initial 3 months of account opening.

Capital One VentureOne Rewards Credit Card: should you get one?

If you’re looking for a low-cost travel card with a good to excellent credit score, then the Capital One VentureOne Rewards Credit Card is a suitable choice.

However, if you’re seeking more value in terms of rewards, other cards in the same category might be a better fit for your needs.

So, if you aren’t sure if this card is for you, review the Capital One VentureOne Rewards Credit Card advantages and cons below.

Pros

- No annual fee;

- 0% APR intro period;

- Flexible rewards;

- No rewards caps.

Cons

- Requires a high credit score.

Credit score required

Indeed, the Capital One VentureOne Rewards Credit Card brings amazing benefits to cardholders. Therefore, you’ll need good to excellent credit to qualify!

Capital One VentureOne Rewards Credit Card application: how to do it?

Ready to apply for the Capital One VentureOne Rewards Credit Card? Stay tuned for our step-by-step guide on securing this card and enjoying its benefits. Read on!

Apply for the Capital One VentureOne Rewards Card

Don't waste time searching for ways to apply for the Capital One VentureOne Rewards Credit Card. Earn unlimited miles on purchases!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Trending Topics

Capital One Venture Rewards Credit Card review: is it worth it?

Wondering if Capital One Venture Rewards Credit Card is worth it? It has excellent benefits for travelers. Check the pros and cons here!

Keep Reading

The hidden cost of banking: 6 common bank fees you may not know about

Millions of people are fed up with the fees banks charge. Take a closer look at 6 common bank fees and how to avoid them. Keep reading!

Keep Reading

Types of investment accounts: learn the best for investors

There are many different types of investment accounts. Do you know which one is the best for you? Read this content to find out.

Keep ReadingYou may also like

Learn how to download the Dare App and manage your anxiety and stress

Find out how to download the Dare app to manage your anxiety issues and panic attacks. Keep reading to start!

Keep Reading

Learn to apply easily for Rocket Loans

Learn how to apply for Rocket Loans and take control of your finances today! Borrow up to $45K and receive it in one business day!

Keep Reading

Apply for the First Latitude Select Mastercard® Secured Credit Card

The First Latitude Select Mastercard® Secured Credit Card is a low maintenance option with a modest annual fee. Check out how to apply!

Keep Reading