Credit Cards

Intro APR: Apply for the Capital One VentureOne Rewards Card

Learn how to apply for the Capital One VentureOne Rewards Credit Card online now. $0 annual fee and amazing rewards! Read on!

Advertisement

Apply from Anywhere: Mastering the Online Application Process

Are you going to apply for the Capital One VentureOne Rewards Credit Card? Then we’re here to assist you in comprehending the application process.

Discover what’s essential when applying and see our comparison with a credit card in the same category. Keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The Capital One VentureOne Rewards Credit Card is a low-cost travel card without an annual fee. So, if you want to add it to your wallet, follow our guide to apply.

Application form

Begin by visiting the Capital One website and locating the page dedicated to the Capital One VentureOne Rewards Credit Card to apply.

Then, complete the online application form. Provide your personal details, including your Social Security number and financial status.

Advertisement

Terms and conditions

After that, take the time to review the terms and conditions associated with the card and submit your application.

After that, Capital One will undertake a review process, and you can expect to receive a decision within a few days.

Capital One will send your new credit card to your mailing address within a few weeks if approved.

Apply using the app

If you have a Capital One account, their mobile app is a great way to manage it. You can check your balance, make payments, and get alerts about your account.

However, to apply for a new credit card, you must visit their website instead of using the app.

Advertisement

Capital One VentureOne Rewards Credit Card vs. Bank of America® Travel Rewards

The Capital One VentureOne card offers a higher initial bonus of 20K and 1,25 miles on all purchases.

In Contrast, the Bank of America® Travel Rewards card offers a higher earning rate of 1.5 points per dollar spent on all purchases.

So, consider which rewards program aligns better with your travel goals and how you plan to use your rewards.

Capital One VentureOne Rewards Credit Card

- Credit Score: Good-excellent;

- Annual Fee: $0;

- Purchase APR: 0% intro APR for the first 15 months, then 19.99%, 26.24%, or 29.99%, depending on your creditworthiness;

- Balance Transfer Fee: 3% for the first 15 months; 4% at a promotional APR that Capital One may offer you at any other time.

- Cash Advance APR: 29.99% (variable);

- Cash Advance Fee: Either $5 or 5% of the amount of each cash advance, whichever is greater;

- Welcome Bonus: Earn 20K bonus miles after spending $500 on purchases during the first 3 months of account opening;

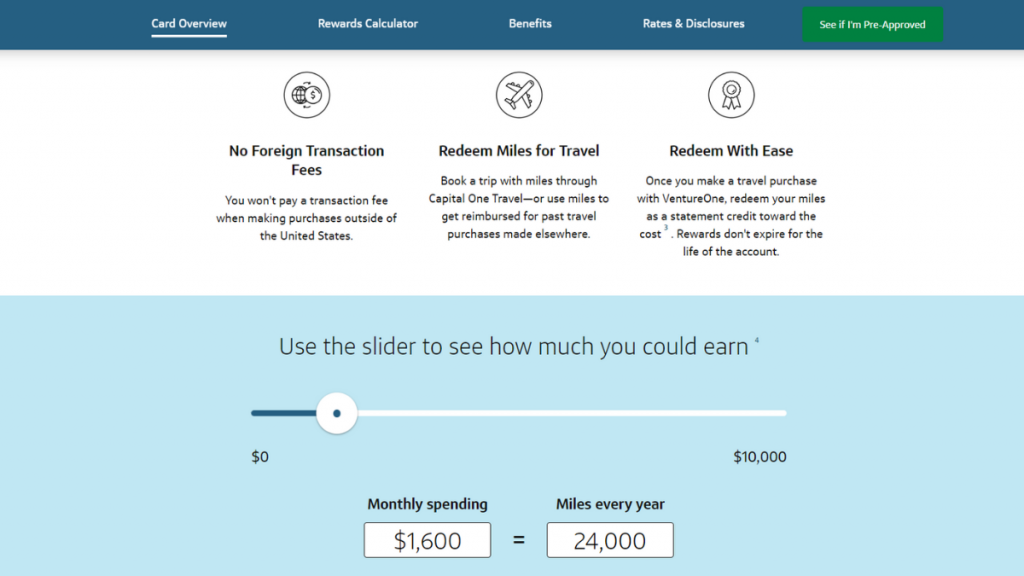

- Rewards: Earn 1,25 miles on every purchase and 5 miles on hotels and car rentals booked through Capital One Travel;

- Terms apply.

Bank of America® Travel Rewards

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Purchase APR: 0% intro APR for the first 18 billing cycles ( then 18.24% to 28.24% variable APR), and any balance transfers made during the first 60 days of account opening ( then a 3% fee applies);

- Cash Advance APR:

- Welcome Bonus: 25K online bonus points after you make more than $1.000 on purchases during the first 90 days of account opening;

- Rewards: Earn 1.5 points on all purchases.

In our upcoming post, we’ll explore the process of applying for the Bank of America® Travel Rewards card. Stay tuned for all the details!

Apply for Bank of America® Travel Rewards

Apply for the Bank of America® Travel Rewards credit card and earn points on travel purchases. Follow our step-by-step guide!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Trending Topics

Learn to apply easily for the Avant Personal Loan

Do you want to apply for the Avant Loan? It's fast, easy, and secure. Stay here to learn more about this loan.

Keep Reading

Mogo Prepaid Card application: how does it work?

Do you want an eco-friendly card that will help you manage your spending? Then read this Mogo Prepaid Card application to learn how to get it.

Keep Reading

Aeroplan® Credit Card application: how does it work?

Get the latest info to apply for an Aeroplan® Credit Card! Earn up to 3x points on all purchases! Keep reading and learn more!

Keep ReadingYou may also like

How to start planning your retirement

Wondering how to plan for retirement? Check out our top tips on how to save enough money and create a plan that's just right for you.

Keep Reading

Upgrade credit card review: a credit card that works like a personal loan

If you're looking for a good card to rebuild your score, you've just found the Upgrade credit card. It will give you excellent benefits.

Keep Reading

Blue Cash Everyday® Card from American Express: easily apply

Get your Blue Cash Everyday® Card from American Express easily with our guide - Read now to learn how to apply! 0% intro APR for 15 months!

Keep Reading