Reviews

How to request Capital One SavorOne Cash Rewards Credit Card

Applying for the Capital One SavorOne Cash Rewards Credit Card is pretty easy, and you can do it online. Check out how the application process works so that you can enjoy unlimited cash back, bonuses, and more!

Advertisement

Learn how to apply for the Capital One SavorOne Cash Rewards Credit Card

If you love nightlife but hate credit card fees, check out the Capital One SavorOne Cash Rewards Credit Card. Unlike many competitors, Capital One SavourOne Cash Rewards puts dining and entertainment rewards first.

It avoids the annoying trap of typical coupons in the dinner rewards program and instead returns pure and simple money. Plus, there are no annual or foreign transfer fees to worry about.

Plus, you can get a 0% intro APR for 15 months on balance transfers and purchases. Then, 19.99% – 29.99% variable APR! Also, you’ll get access to Complimentary Concierge Service and much more!

Remember though that there is a balance transfer fee as it follows: 3% for the first 15 months; 4% at a promotional APR that Capital One may offer you at any other time.

So if your trash is full of travel containers, the Capital One SavourOne Cash Rewards Credit Card is an obvious choice!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

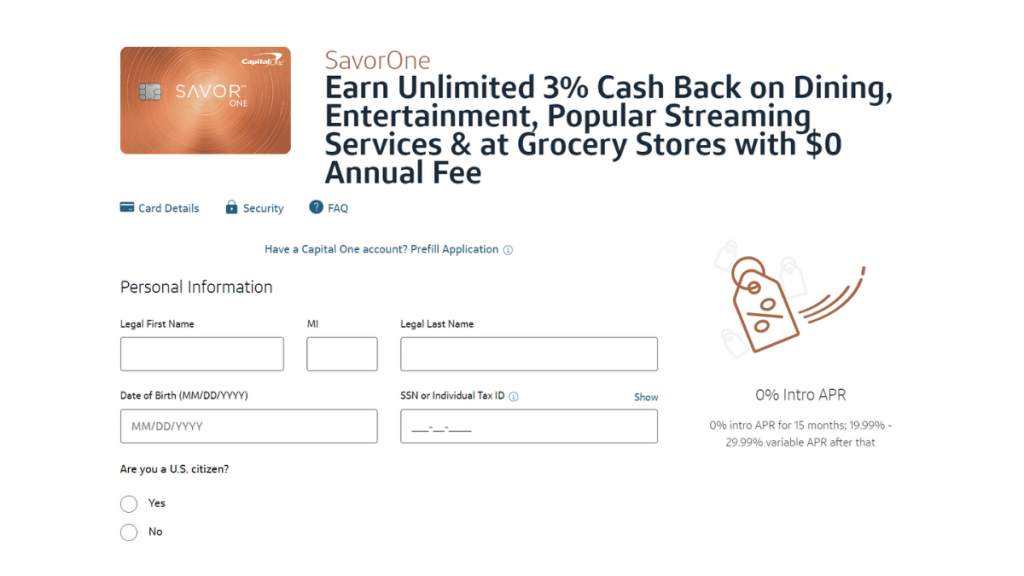

Apply online

Applying for the Capital One SavorOne Cash Rewards is an easy task.

First, go to the Capital One website, select the Credit Cards tab, and choose the Cash Back option.

Select the Capital One SavorOne Cash Rewards Credit Card and click on Apply Now.

After that, fill in the form with your personal information, such as legal name, date of birth, and Social Security Number. You also have to answer whether you are a U.S. Citizen or not.

Then, provide some financial information, such as your estimated gross annual income and checking or savings account.

Now you just need to submit it and wait for approval.

Apply using the app

Although it is not possible to apply using the mobile app, you can download it after approval.

That way, you can use it to manage and control your finances and transaction in a fast and straightforward way, without even leaving your house.

Advertisement

Capital One SavorOne Cash Rewards Credit Card vs. Discover it® Secured credit card

After learning more about the Capital One SavorOne Cash Rewards, are you still wondering if it is the most appropriate option for your financial needs?

So, we have another card for you. Check out the following article to know more about the Discover it® Secured credit card. It is a good alternative if you want to build or rebuild your credit score.

How do you get the Discover it® Secured card?

The Discover it® Secured credit card will amaze you with its benefits, cash back in every purchase, and no annual fee. If that's what you look for, learn how to apply!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Trending Topics

The Centurion® Card from American Express review: is it worth it?

Only 1% of the world can qualify for The Centurion® Card from American Express. Keep reading to know if it's worth the price.

Keep Reading

Is the U.S. headed for a housing crisis?

Could a housing crisis be on the horizon for the United States? Find out what factors could lead to one and how it would impact the economy.

Keep Reading

Application for the HSBC Cash Rewards Mastercard® card: how does it work?

We love a good cashback with no annual fees. That's the case with the HSBC Cash Rewards Mastercard® card. Take a look at how to apply.

Keep ReadingYou may also like

Apply for Marriott Bonvoy Bevy™ American Express® Card easily

Embrace convenience: Apply for the Marriott Bonvoy Bevy™ American Express® Card - up to 6 points on purchases and more! Read on!

Keep Reading

Apply for the Chase Slate Edge℠ and Improve your Finances!

Want to save money on interest charges? Learn how to easily apply for the Chase Slate Edge℠ with our guidance!

Keep Reading

Child and Adult Care Food Program (CACFP): Nutritious food care!

Grant nutrition meals for infants, children, and adults. The Child and Adult Care Food Program will provide the help you need!

Keep Reading