Credit Cards

Apply for the Chase Slate Edge℠ and Improve your Finances!

Need to consolidate your credit card balances or make a big purchase without paying interest? If so, you might want to apply for the Chase Slate Edge℠!

Advertisement

From Application to Approval: How to Apply for the Chase Slate Edge℠ in Minutes

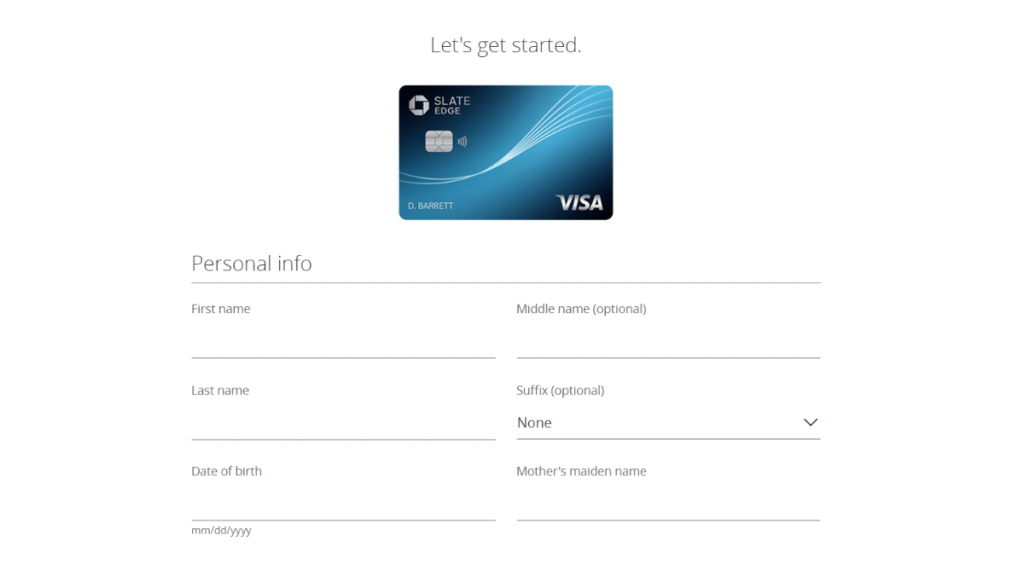

How to apply for the Chase Slate Edge℠? Here are the instructions covering each step.

It will include completing the application by submitting personal and financial information and then waiting for a decision on your application. Read on for details!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

You can easily apply for the Chase Slate Edge℠ by following the instructions below.

First, go to the Chase Slate Edge℠ page on the Chase website.

Then enter your personal information, such as your name, address, date of birth, and Social Security number.

Next, provide your financial information, including your income, employment status, and monthly housing payment.

After that, review the terms and conditions of the card, including the APR, fees, and rewards program.

Then, check the box to indicate that you have read and agreed to the terms and conditions. Finally, submit your application and wait for a decision.

You may receive an instant decision, or Chase may need to review your application further and contact you later.

If you are approved for the Chase Slate Edge℠, you should receive your card in the mail within 7-10 business days.

Apply using the app

It is not currently possible to apply for Chase cards using the Apply Chase app.

The app was developed to allow card members to manage their existing credit accounts and view details about their existing accounts, such as:

- Account Summary

- Transaction History

- Payment Options

- Personal Information

- Additional Services & Benefits

Advertisement

Chase Slate Edge℠ vs. Chase Freedom Unlimited®

The Chase Slate Edge℠ offers 0% intro APR on purchases and balance transfers without fees or penalties.

On the other hand, Chase Freedom Unlimited® offers 0% intro APR on purchases and balance transfers for 15 months! And there is much more with no annual fee!

You should consider your spending habits to make the right decision between these two cards. Take a look at their features and compare them.

Chase Slate Edge℠

- Credit Score: Good-Excellent.

- Annual Fee: $0.

- Purchase APR: 0% intro APR during the first 18 months on purchases and balance transfers, then after that, 20.49% – 29.24% variable APR.

- Penalty APR: Up to 29.99%.

- Cash Advance APR: 29.99% variable.

- Welcome Bonus: None.

- Rewards: None.

- Balance Transfer Fee: Intro BT fee of $5 or 3% of the amount of each transfer, whichever is greater in the first 60 days. After the intro period, either $5 or 5% of the amount of each transfer, whichever is greater.

- Other fees: 3% foreign transaction fee, and either $10 or 5% of the amount of each transaction, whichever is greater, for cash advances.

Advertisement

Chase Freedom Unlimited®

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Regular APR: 0% Intro APR for purchases and balance transfers for 15 months (from account opening). Then, 20.49% – 29.24% variable APR; 29.99% variable APR for cash advances;

- Rewards: After your first year or $20,000 spent: 5% cash back on travel you purchase through Chase Ultimate Rewards®; 3% cash back on dining and takeout; 3% back on drugstore; 1.5% cash back on all other purchases;

- Terms apply.

If you’re interested in applying for the Chase® Slate Edge℠ , please continue reading our post below for instructions.

Application for the Chase Freedom Unlimited®

Looking to get more out of your credit card? Chase Freedom Unlimited® offers cash back, perks, and benefits that can help you make the most of your spending. Read on!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Apply for Hawaiian Airlines® World Elite Mastercard® easily

Apply for the Hawaiian Airlines® World Elite Mastercard® following this step-by-step. Earn 60K bonus miles in no time! Read on!

Keep Reading

5 best credit cards to build credit

Want to establish or rebuild your credit history? Check out our list of the best credit cards to build credit. Read on!

Keep Reading

Citi Simplicity® Card application: how does it work?

Do you need a credit card to help you pay your debts? Discover if you are eligible and how to apply for a Citi Simplicity® Card. Read on!

Keep ReadingYou may also like

Ally Bank Mortgage review: how does it work, and is it good?

Don't get a loan before reading this Ally Bank Mortgage review. We'll cover everything from interest rates to customer service. Keep reading!

Keep Reading

Avant Personal Loan review: how does it work, and is it good?

Learn how to get fast cash for any purpose in the Avant Personal Loan Review. Keep reading to find out more!

Keep Reading

Build Credit and Save Money: How to Download Super+

Download Super+ on your smartphone to save on gas, shopping, and more. Read on to learn how to have it on your device!

Keep Reading