Reviews

The Centurion® Card from American Express review: is it worth it?

The Centurion® Card from American Express is famous for its exclusivity and luxurious benefits. The perfect card for the bon vivant - but with a salty price. Learn more about this beautiful metal credit card!

Advertisement

The Centurion® Card: for exclusive clients, with the most VIP benefits

Some decades ago, The Centurion® Card from American Express was almost a myth. Rumors would talk about a “black card”, almost a magic one, that would give access to the most exclusive benefits.

Nobody knew exactly how to get it or the requirements, making it one of the most luxurious credit cards ever.

A lot about The Centurion® Card from American Express is not a secret anymore. But some requirements for approval and offers for new members are still not that clear.

The Centurion® Card from American Express

Do you have what it takes to ask for The Centurion® Card from American Express? Here is the step-by-step to make your requisition. Keep reading!

Also, the concept of the “black cards” is settled, as every bank has one version for the top richest clients. The only way to get one is by invitation – even though you can ask for an invite. Do you have what it takes to dare ask for this invite? Keep reading to find out.

One of the best benefits is access to Amex Centurion® Lounges at airports. But you also got this with the American Express Platinum for a much lower annual fee.

| Credit Score | Excellent |

| Annual Fee | $5,000 (+$10,000 of Initiation Fee) |

| Regular APR | Prime Rate + 21.99% (variable) |

| Welcome bonus | Membership Rewards® Points – variable to each client |

| Rewards | 1X Membership Rewards® Points for each dollar spent on eligible purchases |

See Rates & Fees

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The Centurion® Card from American Express: should you get one?

To get the Amex black card, first, you have to get the invitation.

To get the invitation, you have to be an Amex cardholder already. And on top of that, you’ll need a good spending history with your American Express card. And in this case, a “good spending” is something between $250,000 and $400,000. Some say even above $450,000.

If you add to this condition the desire to live the ultra-exclusive access to the best hotels and airlines with special treatment, that’s a yes.

Maybe your invitation is already on its way. For guarantee, you can ask to be considered for The Centurion® Card from American Express.

Pros

- Membership Rewards® Points program

- A Personal Concierge Service, 24/7 to assist you

- Private Suit Membership at the Los Angeles Airport

- Elite Status at hotels and car rental services

Advertisement

Cons

- Ultra expensive annual fee + initiation fee

- You’ll need a high credit score and credit history with Amex to get an invitation

- The majority of its benefits are directed to travel and VIP access at hotels and rental services

Credit scores required

Your credit score needs to be excellent to be approved. There is an interesting thing to think about in this matter of credit scores.

Remember that your credit score is composed of 5 major factors. One of these factors is to be a responsible user, with no delay in your payments. You also can’t stay too close to your credit limit all the time.

In conclusion, if you expend a lot and make big purchases but don’t seem to be a responsible user, you may not be approved for a more exclusive credit card, like The Centurion® Card from American Express.

Advertisement

The Centurion® Card from American Express application: how to do it?

Even with all these requirements, it is not impossible to be approved. A lot has changed in credit cards in the past few years. So if you feel that this card is the one for you, we’ll show you how to apply it in the following article.

The Centurion® Card from American Express

Do you have what it takes to ask for The Centurion® Card from American Express? Here is the step-by-step to make your requisition. Keep reading!

All information about The Centurion® Card from American Express has been collected independently by The Mad Capitalist.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

CitiBusiness® / AAdvantage® Platinum Select® Mastercard® review

Read our CitiBusiness® / AAdvantage® Platinum Select® Mastercard® review to see how this card can help you save on airfare and baggage fees!

Keep Reading

Learn to easily apply for the Upgrade Personal Loan

Are you looking for personal loans of up to $50,000? If so, read our post to learn how to apply for Upgrade Personal Loan!

Keep Reading

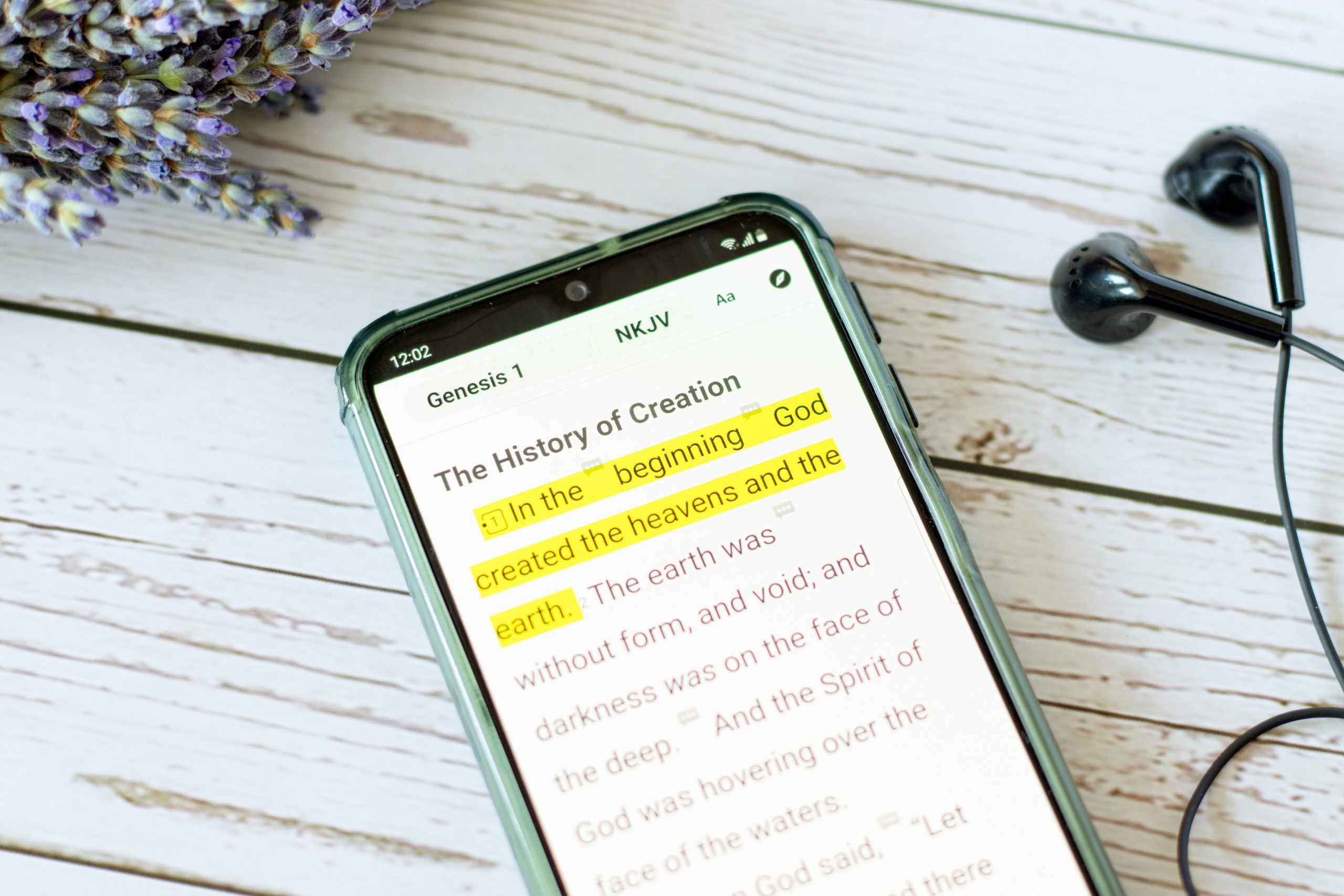

Holy Bible App: Listen online, download now!

Get the best Christian experience with a Holy Bible app! Read or listen to the scripture on your phone anytime, anywhere.

Keep ReadingYou may also like

Child and Adult Care Food Program (CACFP): Nutritious food care!

Grant nutrition meals for infants, children, and adults. The Child and Adult Care Food Program will provide the help you need!

Keep Reading

What is an emergency fund and why do you need one?

Learn how to build an emergency fund and be prepared for everything. Your future self will be thankful. Read this article to build yours.

Keep Reading

Wells Fargo Autograph℠ Card application: how does it work?

Learn how to apply for the Wells Fargo Autograph℠ Card. Enjoy cash back reward and welcome bonus! Read on for more!

Keep Reading