Reviews

Buy On Trust Lending review: how does it work and is it good?

Read our Buy On Trust Lending review to know how you can get up to $5,000 in credit limits to buy your favorite electronic brands – even if you have a limited credit history!

Advertisement

Buy On Trust Lending: Shop now, pay later!

A lease-to-buy program is a great way to get the latest and greatest electronics from your favorite brands without having to pay full price upfront. With it, you make monthly payments on the item until you own it outright. In this Buy on Trust Lending Review, we’ll look over one of the top electronics stores in the game for those looking for this line of credit.

There are many lease-to-own electronics programs out there. But, Buy On Trust stands out among the competition because of two crucial factors. One: it reports all payments to TransUnion, Equifax, and Experian – the three major credit bureau companies. Two, it provides 24/7 excellent customer service.

So, are you looking to get high-quality electronics and appliances but don’t have the cash on hand to buy them? Read on to see how the Buy On Trust Lending can help you!

| Credit Limits | $5000 |

| Reports to Credit Bureaus | Yes |

| Customer Support | 24/7 customer services |

How to apply for Buy On Trust Account?

Learn how to apply for a Buy on Trust account and get the producs you want today!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is Buy On Trust Lending?

Buy On Trust Lending is a merchandising credit account with a lease-to-own program that offers up to $5000 in credit limits for new account holders. The company provides top-of-the-line electronic products from prominent brand names like Apple and Samsung with Best Buy.

The company accepts all kinds of applications, no matter how low your credit score is. However, you have to meet their criteria to get the credit. That said, Buy On Trust requires proof of income history, a checking account, checking activity, and a monthly income of at least $1000 deposited in the said checking account.

To purchase the items you want, you must first apply for a pre-qualification process. Once your request is approved, you get a credit line according to your financial profile. You can then make the purchases from your favorite branded products with the credit given to you. To check out your items, you’ll have to pay a $50 fee to Buy On Trust.

The payment terms are highly flexible, with monthly installments that stretch over 12 months. Once you’re done with the payment, you can own the products you leased if you want to. If you don’t want to commit your budget to monthly installments, you can pay off all items within 90 days and close your account with a $10 fee.

Buy On Trust also lets their customers pay off the merchandise anytime between 90 days and 12 with a 25% discount on future payments.

Is Buy On Trust good?

The company offers excellent accessibility for people with bad or no credit history to shop from over 80,000 branded name items at Best Buy. However, every credit line has its disadvantages. So, let’s look at the primary perks and drawbacks this service has to provide next in our Buy On Trust Lending review.

Advertisement

Pros

- Buy today, pay later

- Up to $5000 line of credit

- Brand name products

- Accepts applicants with low or no credit history

- Flexible payment schedule

- Excellent 24/7 customer services

- Helps to increase credit score by reporting payments to all 3 credit bureaus

Cons

- More expensive than paying cash

- Not available in all US states

Advertisement

Does Buy On Trust check credit scores?

The Buy On Trust account doesn’t require a good credit history to approve new requests. However, the company does perform a soft inquiry before providing a line of credit. It is important to note that not all applications are approved. Even if you have damaged credit, you need to abide by their terms & conditions and minimum income requirements.

Want to get verified on Buy On Trust Lending? We will help you!

So, now you’ve seen everything this loan can do for you in our Buy On Trust Lending review! If you’re interested in requesting a loan to upgrade your electronics, we can help. Follow the link below for an easy guide on how to get verified at Buy on Trust today!

How to apply for Buy On Trust Account?

Learn how to apply for a Buy on Trust account and get the producs you want today!

Trending Topics

HSBC Premier Checking application: how does it work?

Find out how to apply for the HSBC Premier Checking in less than five minutes. Enjoy free ATMs and more. Read on!

Keep Reading

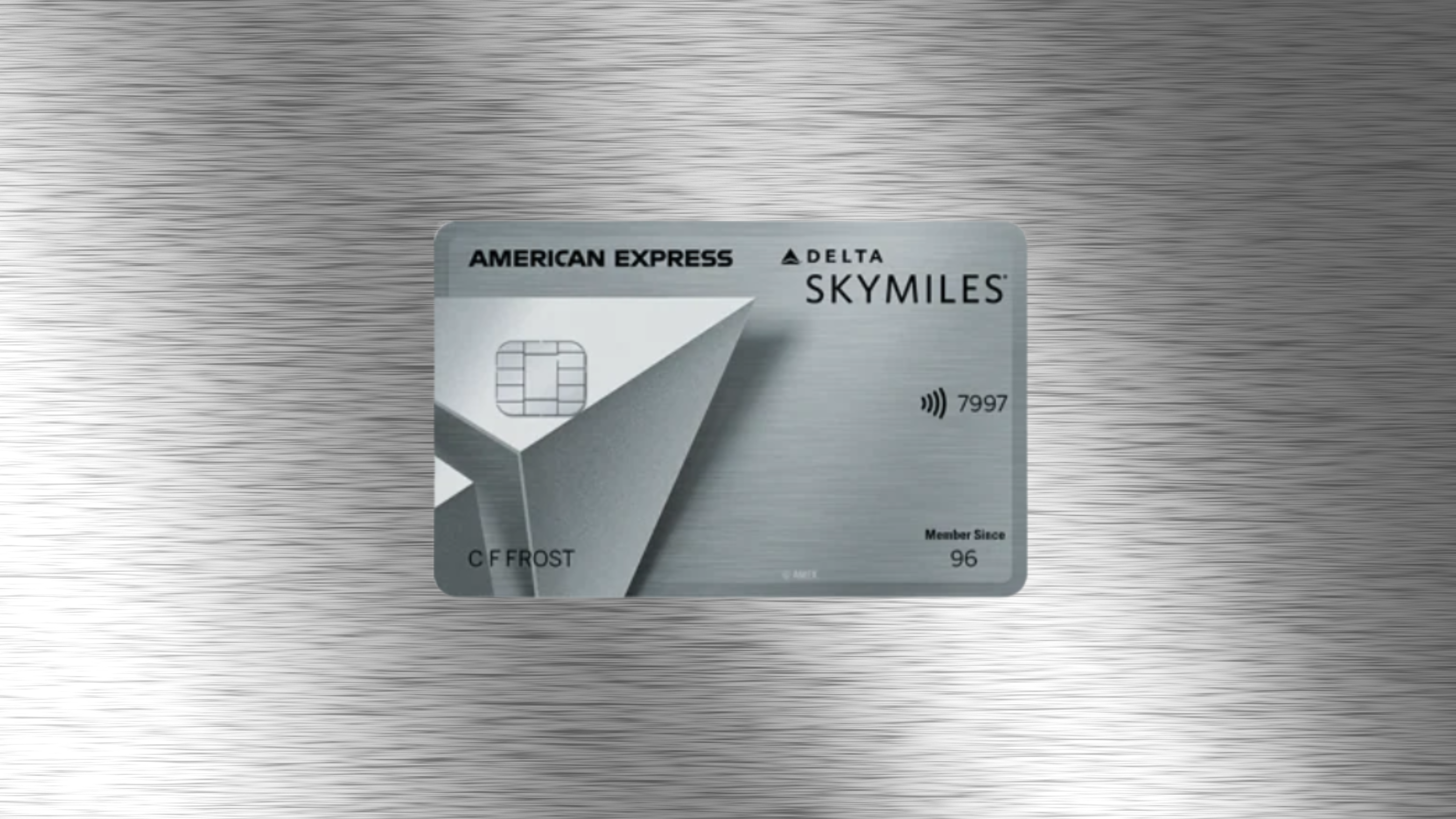

Delta SkyMiles® Platinum American Express Card review

See the Delta SkyMiles® Platinum American Express Card review to take advantage of premium travel benefits. Keep reading!

Keep Reading

Apply for the Delta SkyMiles® Gold American Express Card

Applying for The Delta SkyMiles® Gold American Express Card is easy! Find out if you're eligible, and apply online today!

Keep ReadingYou may also like

Revvi Card: credit card for bad credit with cashback

The Revvi Card saves your bad credit while you get 1% cash back on all purchases. Read our review to learn more. Check it out!

Keep Reading

BMO CashBack® Business Mastercard®* Review

Maximize business spending with the BMO CashBack® Business Mastercard®*, offering valuable perks for savvy entrepreneurs.

Keep Reading

Merrick Bank Personal Loan review: how does it work and is it good?

In this Merrick Bank Personal Loan review, you will learn about how it works, and the pros and cons of their personal loan products.

Keep Reading