CA

BMO CashBack® Business Mastercard®* Review

Discover the benefits of the BMO CashBack® Business Mastercard®*, tailored for business owners. Enjoy cash back on purchases, exclusive offers, and financial flexibility to boost your business success.

Advertisement

Enjoy valuable cash back rewards on the things you spend most money on!

The BMO CashBack® Business Mastercard®* is designed for small business owners. It gives you cash back rewards on all your day-to-day business spending.

With a generous welcome bonus and a fantastic rewards rate, you can make the most of your expenses without the annual fee! Check out our full review below.

| Credit Score | Good – Excellent |

| Annual Fee | $0 |

| Regular APR | 0% intro rate for 9 months (with a 3% transfer fee) on balance transfers. 19.99% on purchases; 22.99% on cash advances. |

| Welcome bonus | 10% cash back on the first 3 months for selected purchases. |

| Rewards | 1.5% on gas, internet bills, phone bills and office supplies; 1.75% back at any Shell location; 0.75% on everything else. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

BMO CashBack® Business Mastercard®*: is it legit?

Experience the advantage of no annual fees with the BMO CashBack® Business Mastercard®*. It’s a cost-effective choice for savvy business owners.

You can maximize your earnings with significant cash back on every purchase. This card not only simplifies expenses but also rewards your business spending.

The BMO CashBack® Business offers competitive interest rates, making it a smart choice for managing business finances and optimizing cash flow.

Benefit from top-tier security features. The card ensures safe transactions and protects your business’s financial data, providing peace of mind in every transaction.

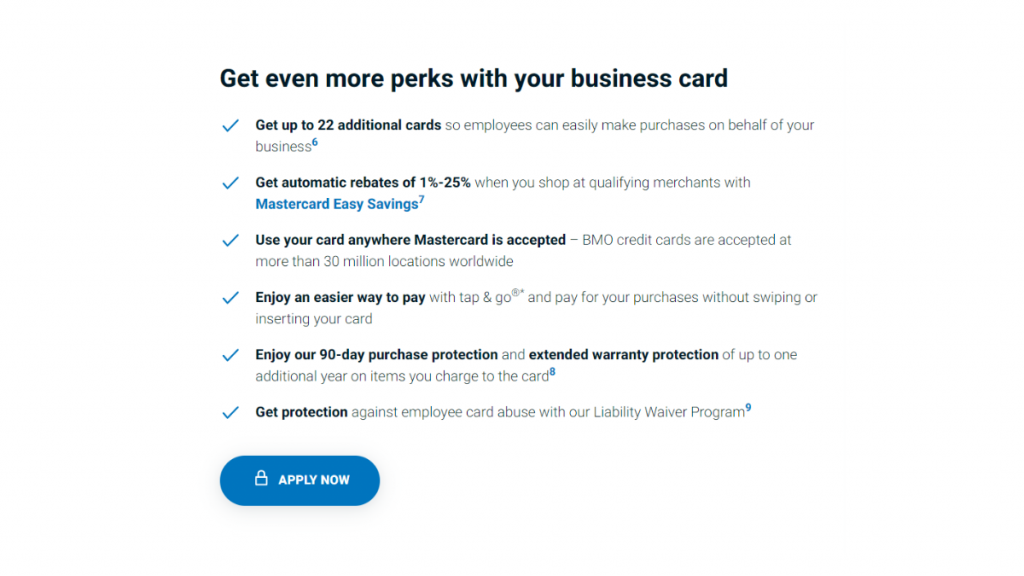

Enjoy exclusive cardholder benefits, including travel insurance and extended warranties. These added perks bring additional value to your business.

BMO CashBack® Business Mastercard®*: should you get one?

Advertisement

Pros

- Cost-effective for business owners.

- Earn cash back on all purchases.

- Competitive interest rates to help manage finances effectively.

- Protects against fraud and theft.

- Access to travel insurance, extended warranties, etc.

- Useful for managing cash flow and expenses.

Cons

- Cash back might be restricted to certain purchase types.

- Interest rates can be high if the balance is not paid in full.

- Additional costs for international transactions.

- Requires a good credit score for approval.

- Perks like travel insurance may have specific terms and conditions.

Advertisement

Credit scores required

This card requires that its applicants have a credit score of at least 660. So if you have a fair credit score, you may get approved for this card without any restriction.

Application for the BMO CashBack® Business Mastercard®*: how to do it?

If after analyzing the information we have provided here you have decided to apply, this is very easy to do. The process takes just a few minutes and you can do it all online.

If you wish there were a step-by-step guide to applying for this product, wish no longer. We got it:

Apply online

To apply for the BMO CashBack® Business Mastercard®*, start by visiting BMO’s official website. Then navigate to the credit card section.

Review the cash back rewards, interest rates, and additional perks. This knowledge ensures the card meets your specific business requirements.

Click ‘Apply Now’ to begin filling out the application form. You’ll need to provide some essential business and personal information.

Double-check all entered details for accuracy. BMO evaluates your application based on the provided information and your business’s credit history.

Once your application is approved, you’ll receive a confirmation. The card, along with details on how to activate and use it, will be sent to you.

Apply using the app

While you can’t directly apply for the BMO CashBack® Business through the mobile app, managing your account post-application is seamless with the app.

The mobile app offers a range of features for existing cardholders. Track your spending and make payments conveniently from your smartphone.

For new applications, the BMO website is your go-to. It’s mobile-friendly, ensuring a smooth application process even when you’re on the move.

After obtaining your card, download the BMO mobile app. It’s designed to make managing your card’s finances effortless.

BMO CashBack® Business Mastercard®* or BMO Ascend World Elite®* Mastercard®*

The BMO CashBack® Business Mastercard®* is an excellent choice for businesses seeking valuable rewards with no annual fee.

Looking for more? Consider the BMO Ascend World Elite®* Mastercard®*. It offers enhanced rewards and exclusive benefits.

| BMO CashBack® Business Mastercard®* | BMO Ascend World Elite®* Mastercard®* | |

| Credit Score | Good – Excellent | Good – Excellent |

| Annual Fee | $0 | $150 (waived in the first year as a member) |

| Regular APR | 0% intro rate for 9 months (with a 3% transfer fee) on balance transfers. 19.99% on purchases; 22.99% on cash advances. | 20.99% on purchases; 23.99% for cash advances (21.99% for Quebec residents). |

| Welcome bonus | 10% cash back on the first 3 months for selected purchases. | Earn up 60,000 bonus points. (Minimum spending required) |

| Rewards | 1.5% on gas, internet bills, phone bills and office supplies; 1.75% back at any Shell location; 0.75% on everything else. | 5x points on travel; 3x points on dining, entertainment, and recurring bills; 1x points on every other purchase. |

Discover the perks of the BMO Ascend World Elite®* Mastercard®*. Learn more about its unique offerings and how to apply in the link below.

Apply for the BMO Ascend World Elite®* Mastercard®

Learn how you can easily apply for the BMO Ascend World Elite®* Mastercard®* and start earning more value on your spending.

Trending Topics

Flagstar Bank Mortgage review: how does it work and is it good?

This Flagstar Bank Mortgage review will uncover all this lender's details! Options with 0% to 3% minimum down payment and affordable loans.

Keep Reading

Capital One Walmart Rewards® Mastercard® review: is it worth it?

The Capital One Walmart Rewards® Mastercard® offers both savings and rewards that could make it your top choice for everyday shopping!

Keep Reading

Discover it® Balance Transfer Credit Card review: 0% intro APR

This Discover it® Balance Transfer Credit Card review will cover this product's perks! Pay no annual fee and earn up to 5% cashback.

Keep ReadingYou may also like

Apply for Axos Bank Rewards Checking Account: simple and quick

Looking for easy checking account application? Discover how Axos Bank Rewards Checking Account process works, and start earning today.

Keep Reading

Electro Finance Lease review: how does it work and is it trustworthy?

Check our Electro Finance Lease review to learn a new and improved way to get the products you want with the financing you need!

Keep Reading

Apply for the Navy Federal Visa Signature® Flagship Rewards

Apply for the Navy Federal Visa Signature® Flagship Rewards today - earn up to 3X points on purchases + amazing benefits! Keep reading!

Keep Reading