Reviews

100 Lenders personal loan review: how does it work and is it good?

Are you in the market for a personal loan that accepts all types of scores? If so, read our 100 Lenders personal loan review to learn more!

Advertisement

100 Lenders personal loan: find the perfect lender for your personal loan

Personal loans can be used for all kinds of things, including debt consolidation, home repairs, and vacations.

In case you need some extra cash, it’s never been easier to get a personal loan, thanks to services like 100 Lenders, which makes it simple as making a pie.

How to apply for 100 Lenders personal loans?

If you need a loan that accepts all scores and can help you in times of need, read on to learn how to apply for 100 Lenders personal loan!

In this post, you’ll have a detailed 100 Lenders personal loan review, and you’ll see how quick it can be to connect to lenders.

We will also help you explore whether or not this marketplace is a good option for you to get cash from. Read our 100 Lenders personal loan review to learn more!

- APR: varies from loan to loan. Take into account the lender, your credit history, applicable legislation, repayment length, and amount of money borrowed;

- Loan Purpose: several borrowing options: debt payoff, vacation, education, etc;

- Loan Amounts: you can borrow any amount from $100 to $40,000;

- Credit Needed: all credit scores are considered (poor to excellent);

- Origination Fee: depends on the loan;

- Late Fee: see terms;

- Early Payoff Penalty: N/A.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is the 100 Lenders personal loan?

100 Lenders is a loan marketplace that connects borrowers with lenders. It’s fast and easy to use, and you can go over the whole process online.

The idea of 100 Lenders is to help people in need of cash by connecting them with willing and able lenders, no matter their credit history.

The platform’s goal is to provide access for all types of borrowers. However, 100 Lenders are not responsible for the money transactions.

They are just intermediaries, providing documents and contracts. So remember that you won’t borrow directly from them but from the financial providers that are registered there.

The short-term loans range from $100 to $40,000. The application process is online, and the loans serve many purposes, such as debt consolidation, home improvement projects, and major purchases.

Likewise, payment options have lower interest fees than banks and are flexible. That’s a good thing. If your requirement is accepted, you can have funds in your hand within 24 business hours.

Is the 100 Lenders personal loan good?

If your situation is challenging and cash isn’t coming soon enough to pay bills or rent with no other options left on the table – consider taking out a personal loan.

We’re here to help you determine if 100 Lenders personal loans are the right lending platform for your needs. So, let’s go over some pros and cons!

Advertisement

Pros

- Applicants for all sorts of credit- from poor to excellent- are welcome to get a loan;

- You may borrow anything from $100 to $40,000 from lenders that serve all kinds of personal purposes;

- The application is simple and can be made anywhere with internet access;

- This short-term solution makes it easy to adjust payments when needed or change other aspects like interest rates without changing insurance policies.

Cons

- Not available in some states;

Advertisement

Does the 100 Lenders personal loan platform check credit scores?

The 100 Lender Personal Loan platform is available to everyone, even if you have bad credit.

You don’t need to worry about your credit score when applying for this loan. It won’t affect your chances of getting one. But you might get higher rates if you have a lower credit score.

Want to get the 100 Lenders personal loan? We will help you!

If you want to get the 100 Lenders personal loan, stay tuned to learn how to apply for a loan, what the requirements are, and more by reading our post below!

How to apply for 100 Lenders personal loans?

If you need a loan that accepts all scores and can help you in times of need, read on to learn how to apply for 100 Lenders personal loan!

Trending Topics

Learn to apply easily for the LightStream Personal Loan

Ready to apply for a Lightstream Personal Loan? Look no further! We've got all the information you need right here! Borrow up to $100K fast!

Keep Reading

Bank of America Platinum Plus® Mastercard® Business Card review

Learn everything you need about the Bank of America Platinum Plus® Mastercard® Business Card with our review! $0 annual fee and more!

Keep Reading

How much should you save to move out: is $5000 enough?

Is $5000 enough to move out? Here are the most important things to consider before and during moving. Read on!

Keep ReadingYou may also like

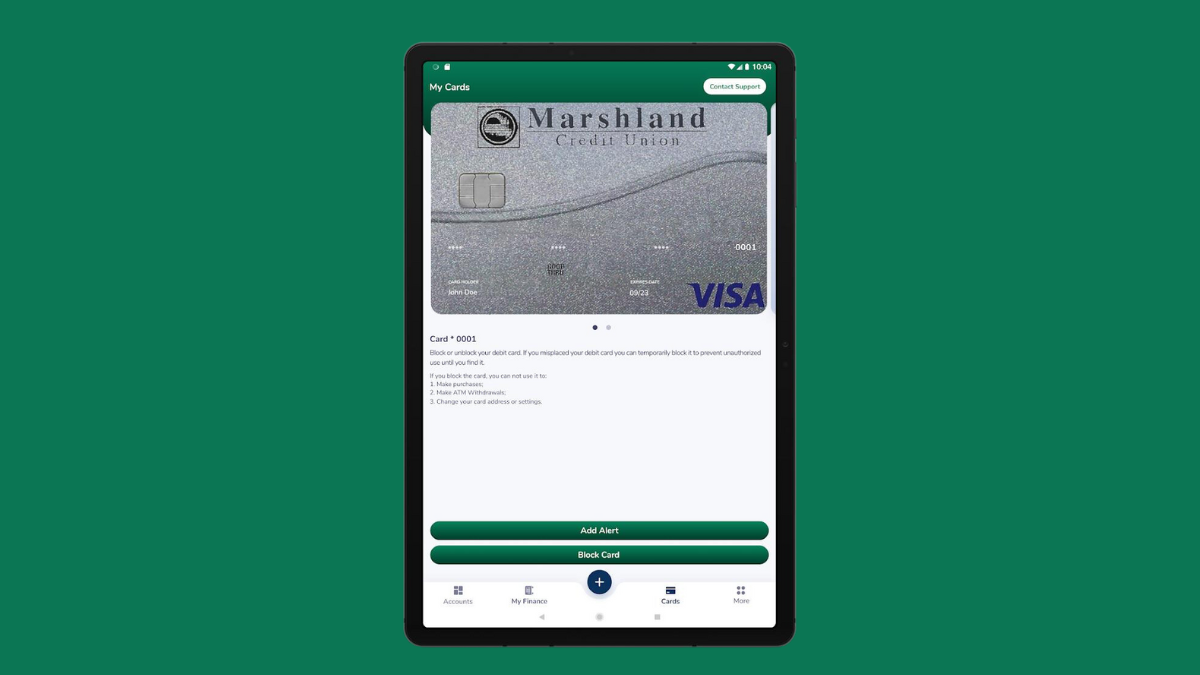

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading

Learn to apply easily for CashUSA.com

Ensure you know how to apply for the CashUSA.com personal loan and get the best rates for your needs. Find out more! Up to $10k!

Keep Reading

Apply for the First Citizens Bank Smart Option Card: fast process

Apply for the First Citizens Bank Smart Option Credit Card easily. Keep reading for all the details you need to know! $0 annual fee!

Keep Reading