Credit Cards

Apply for the Navy Federal nRewards® Secured Card: $0 annual fee

No credit history? No problem! Apply for the nRewards® Secured and join thousands who have successfully built their credit scores with Navy Federal.

Advertisement

Make your application online with this guide

Ready to transform your credit? Apply for Navy Federal nRewards® Secured now with our help!

Earn 1 point per dollar spent, and enjoy a journey towards better credit and exclusive rewards. Keep reading to understand the application process!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Navy Federal nRewards® Secured is a solid option to boost credit and rewards. So, if you want to apply for the Navy Federal nRewards® Secured, follow this guide.

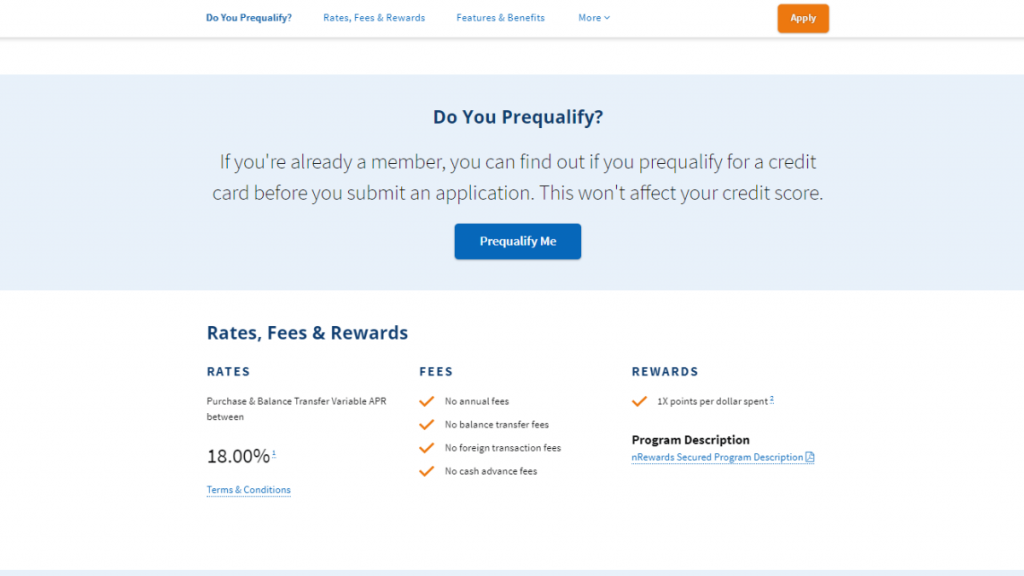

1. Navy Federal website

Applying for the nRewards® Secured card is quick and easy!

All you have to do is visit the card’s website and fill out the application form. It’s that simple!

Advertisement

2. Provide your personal information

Then, you can fill out the application form with accurate details, including:

- Name;

- Address;

- Phone number;

- Email address;

- Social Security number;

- Date of birth;

- Employment information;

- Income information.

3. Choose your security deposit

Lastly, you’ll be required to pay a security deposit, which will vary depending on your budget, but it can start from as low as $200.

Then, this deposit will serve as your credit limit, which means you can only spend up to that amount on your credit card.

Advertisement

4. Review and submit your application

Before submitting your application, it’s important to double-check all the information you’ve provided for accuracy.

So, take your time and review everything carefully.

Once you’re confident that everything is correct, submit your application.

Apply using the app

If you were planning to apply for the nRewards® Secured card using the Navy Federal app, you won’t be able to do that now.

However, there’s no need to worry because you can still get the nRewards® Secured card and start building your credit.

All you need to do is follow some easy steps and then be on your way to enjoying this card’s awesome benefits.

Navy Federal nRewards® Secured vs. Navy Federal Visa Signature® Flagship Rewards

You can consider getting a secured credit card to build your credit score. Then the Navy Federal nRewards® Secured card is a good choice among the options available.

On the other hand, if you have a good credit score and want to earn more rewards and benefits, you can go for the Visa Signature® Flagship Rewards card.

To sum it up, if you need a credit card, you can choose either based on your needs and preferences.

Finally, you can compare their features to make an informed decision.

Navy Federal nRewards® Secured

- Credit Score: 300-689 (Poor – Average);

- Annual Fee: $0;

- Purchase APR: 18.00% (variable);

- Cash Advance APR: 2% above the purchase APR;

- Welcome Bonus: N/A;

- Rewards: 1x point per dollar on all purchases.

Navy Federal Visa Signature® Flagship Rewards

- Credit Score: Good-Excellent;

- Annual Fee: $0 annual fee for the first year, then $49;

- Purchase APR: 15.24% to 18.00% ( Variable);

- Cash Advance APR: 2% above the purchase APR;

- Welcome Bonus: Earn 30,000 bonus points after spending $3,000 within 90 days of account opening and a free year of Amazon Prime;

- Rewards: 3 points on travel, 2 points on everything else, and statement credits for Global Entry or TSA Pre✓® ( up to $100).

Stay tuned for our upcoming post on how to apply for the Navy Federal Visa Signature® Flagship Rewards.

Apply for the Navy Federal Flagship Rewards

Apply for the Navy Federal Visa Signature® Flagship Rewards today – earn up to 3X points on purchases + amazing benefits! Keep reading!

Trending Topics

Luxury Black credit card review: is it worth it?

Some people want to know if the Luxury Black credit card is worth getting. Here's a detailed review to help you decide if you should get one.

Keep Reading

Ally Bank increased its APY rates to 0,90%

Ally Bank has been increasing its APY rates for customers. Check out the latest increase and see just how much you can earn.

Keep Reading

How to use anxiety apps: regain your peace of mind

If your mind is not helping you, learn how to deal with your anxiety with one of these apps. It's easier than you think!

Keep ReadingYou may also like

Facts about credit cards: 7 important things you didn’t know

Some facts about credit cards are unknown to many users. We recommend you to read this article with some tips to master your cards.

Keep Reading

QuickLoanLink review: how does it work and is it good?

Read the QuickLoanLink review and find out how you can get a loan even if you have a bad score. Check it out!

Keep Reading

Holy Bible App: Listen online, download now!

Get the best Christian experience with a Holy Bible app! Read or listen to the scripture on your phone anytime, anywhere.

Keep Reading