Credit Cards

Apply for the Navy Federal Visa Signature® Flagship Rewards

Ready to apply and access the benefits of the Navy Federal Visa Signature® Flagship Rewards? Apply today and earn up to 3X points on purchases!

Advertisement

$0 annual fee in the first year – earn rewards on every purchase!

If you’re eager to apply and experience the perks of the Navy Federal Visa Signature® Flagship Rewards, then you’re in the right spot.

Uncover the application requirements and initiate the process to seize the advantages of this premium credit card. So, keep reading to learn more!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

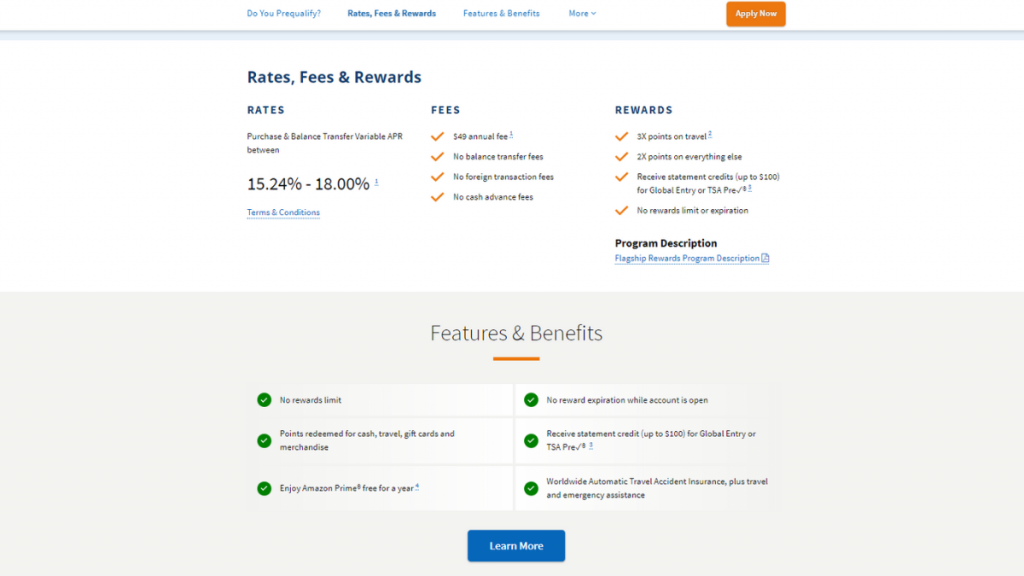

The Navy Federal Visa Signature® Flagship Rewards has an appealing rewards structure:

- 3 points on travel;

- 2 points on everything else;

- Statement credits for Global Entry or TSA Pre✓®.

Eligibility

This credit card is rewarding. However, only members can apply. The inclusive group includes active-duty and retired veterans.

Also, DoD civilian personnel, along with their immediate family members or household, including parents, grandparents, or guardians of minors.

There are three convenient ways to apply for the Navy Federal Visa Signature® Flagship Rewards. Check them out!

Advertisement

1. Online Application

Firstly, this is the fastest way to apply for a Navy Federal card.

To start, visit the website, log into your account, and then follow the application steps.

2. Phone Call

Secondly, applying over the phone is a viable option for those who prefer a more personalized touch.

Simply dial (888) 842-6328, and then a representative will guide the process with questions.

Advertisement

3. In-Person Application

Finally, if face-to-face interactions are more your style, consider applying by visiting one of the Navy Federal branches nearby.

This option allows you to speak directly with a representative so you can receive more assistance with your application.

Apply using the app

The application through the app is not available.

Navy Federal Visa Signature® Flagship Rewards vs. Navy Federal cashRewards

These Navy Federal cards fit different needs.

So, if you choose the Navy Federal cashRewards, you invest in a daily expenses card that gives you points on all purchases.

However, if you prefer a travel card, then the Navy Federal Visa Signature® Flagship Rewards can be more interesting.

It offers points on travel and some luxury perks, such as priority boarding access. Compare the offers below.

Navy Federal Visa Signature® Flagship Rewards

- Credit Score: Good-Excellent;

- Annual Fee: $0 annual fee for the first year, then $49;

- Purchase APR: 15.24% to 18.00% (Variable);

- Cash Advance APR: 2% above the purchase APR;

- Welcome Bonus: Earn 30,000 bonus points after spending $3,000 within 90 days of account opening and a free year of Amazon Prime;

- Rewards: 3 points on travel, 2 points on everything else, and statement credits for Global Entry or TSA Pre✓® ( up to $100).

Navy Federal cashRewards Credit Card

- Credit Score: Good to excellent;

- Annual Fee: $0;

- Purchase APR: 14.90% – 18.00% (variable);

- Cash Advance APR: 2% above the purchase APR;

- Welcome Bonus: Get a $250 bonus cash back after spending $2,500 after 90 days of account opening, also a One-time $98 statement credit for an annual Walmart+ membership;

- Rewards: Get up to 1.75% cash back on all purchases.

If you want to apply for a Navy Federal cashRewards, read the post below!

Apply for Navy Federal cashRewards Credit Card

How to apply for the Navy Federal cashRewards Credit Card – everything you need! Earn cash back on purchases! Read on!

Trending Topics

How to open an Axos High Yield Savings Account easily

With competitive APY, this account is perfect for your savings needs. Learn how to apply for an Axos High Yield Savings Account today!

Keep Reading

Commodity Supplemental Food Program (CSFP): Monthly Food

Learn how this program works in our Commodity Supplemental Food Program (CSFP) review! Access nutritious food and support in times of need.

Keep Reading

Learn to apply easily for the PNC Bank Mortgage

Are you looking to apply for a PNC Bank Mortgage? Check out our easy online application process – find out how to get started here.

Keep ReadingYou may also like

Learn to apply easily for the Honest Loans

Do you want to know how to apply for Honest Loans? Keep reading to find out, and understand the requirements.

Keep Reading

Up to $15,000: VivaLoan review

Thinking of taking out a loan? Check out our VivaLoan review to discover if this product is for you! Enjoy personalized rates and terms!

Keep Reading

Medicaid: get the health care you deserve

Learn about who can benefit from Medicaid and how to apply for this important government healthcare program. Keep reading!

Keep Reading