Credit Cards

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Ready to level up your buying power? Apply for Marshland Visa® Credit Card and get rewarded for every purchase you make with cash back. Keep reading!

Advertisement

Unlock Your Purchasing Power and Earn Rewards by Applying for Marshland Visa® Credit Card Today

Apply for the Marshland Visa® Credit Card in four easy steps and boost your purchasing power with 1 point per dollar spent on all your purchases!

Our guide makes the whole application a breeze so anyone can do it. Then keep reading to learn how to apply now.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

Here are the steps to apply for a Marshland Visa® Credit Card.

1. Application Process

First, visit the Marshland Federal Credit Union website and locate the Marshland Visa® Credit Card.

After that, hit the “Apply Now” button to begin the application process.

Advertisement

2. Application Form

Then you’ll be directed to a PDF application form. Print the form and fill it out with your personal and financial information.

Make sure you double-check all the details to ensure accuracy.

3. Submitting the Application

After filling out the form, fold the paper and secure it in an envelope.

Send the envelope containing your application to the following address: Marshland Federal Credit Union, Brunswick, GA 31520 F.

PS: You can find this address in the PDF form.

Advertisement

4. Application Review

Once Marshland receives your application, they will review it to determine if you qualify for the Marshland Visa® Credit Card.

If approved, you will receive your Marshland Visa® Credit Card in the mail within a few weeks.

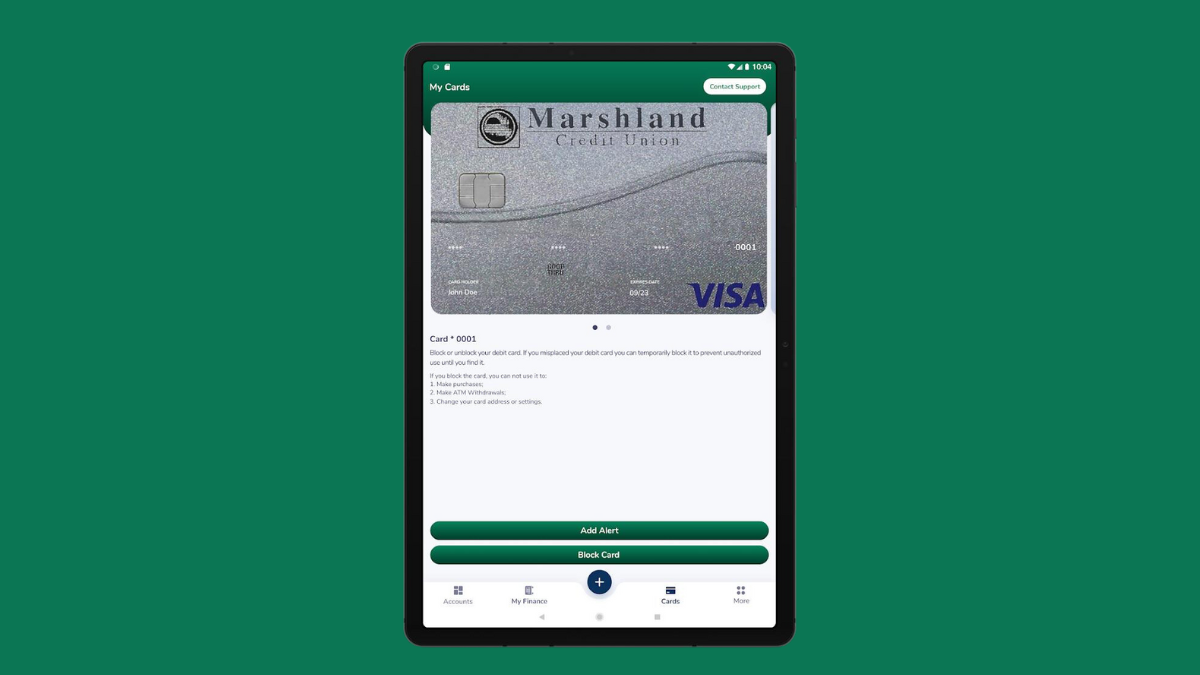

Apply using the app

The app does not have an option for applying. So you must complete your application through their official website!

Marshland Visa® Credit Card vs. Discover it® Cash Back Credit Card

The Marshland Visa® Credit Card and Discover it® Cash Back Credit Card differ in terms of purchase power.

The first card offers 1 point per dollar spent on all purchases.

Conversely, the second one comes with up to 5% cashback on selected categories, plus 1% cash back on everything else.

Review the features below to determine which card aligns with your financial objectives.

Marshland Visa® Credit Card

- Credit Score: Not disclosed;

- Annual Fee: $0;

- Purchase APR: 25-day grace period, after that 9,90%;

- Cash Advance APR: 9,90%;

- Welcome Bonus: N/A;

- Rewards: Earn 1 point on every dollar spent with your card.

Discover it® Cash Back Credit Card

- Credit Score: Good – Excellent;

- Annual Fee: $0;

- Regular APR: 0% Intro APR for 15 months on purchases and balance transfers, then 16.99% to 27.99%;

- Welcome bonus: Get an automatic unlimited cashback match on all your earnings at the end of your first year;

- Rewards: 5% cash back on rotating categories each quarter, 1% cash back on all other purchases, and unlimited cashback match with the Marshland Visa® Credit Card.

Apply for the Discover it® Cash Back Credit Card now with our quick and easy tips.

Further, follow our breakdown of the application process and apply online in no time. Don’t miss out – read on!

Discover it® Cash Back Credit Card application

Learn how to apply for the Discover it® Cash Back Credit Card. Earn up to 5% cash back on purchases and double it after the 1st year!

Trending Topics

Costco Anywhere Visa® Card by Citi review: The rewards card for Costco members

Discover how Costco members can earn cash back on purchases with the Costco Anywhere Visa® Card by Citi review. Read on!

Keep Reading

6 Best Online Checking Accounts: Maximize Your Money Management

Discover our top picks for the best online checking accounts of 2023. Read on to learn how to select the best one for you!

Keep Reading

AutoLoanZoom review: how does it work and is it good?

Learn how this online marketplace can help you secure a car loan in minutes. Read our AutoLoanZoom review to see if it's the right choice.

Keep ReadingYou may also like

Capital One Bank review: is it the best choice for you?

Capital One Bank offers a high-interest savings account which won't lock up your money, and you can access it whenever you want.

Keep Reading

Scotiabank Preferred Package Account Review

Explore our in-depth Scotiabank Preferred Package review for insights on its unlimited transactions, savings perks, and fee waiver criteria!

Keep Reading

Student credit cards for no credit: top 4 options

Don't have a credit history? Check out our list of the best student credit cards for no credit, and start building your credit today.

Keep Reading