Reviews

Walmart MoneyCard® application: how does it work?

Learn how easy and fast it is to apply for the Walmart MoneyCard® and make the most out of your Walmart shopping - online and in-store!

Advertisement

Walmart MoneyCard®: Earn cash back when you shop at Walmart!

Are you looking for a safer way to shop or a better way to manage your finances? We’ve got the answer! Check out how easy the Walmart MoneyCard® application process is below.

This debit card offers cash back for online purchases, in-store or official Walmart fuel stations. So, if you like it, keep reading to find out how to apply for one.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

To apply for a Walmart MoneyCard®, you should be at least 18 years old, have a valid social number, and be an American resident.

If you meet the requirements, you’ll be able to apply for free on their website. It will be necessary to provide some basic information and agree with their electronic service terms.

Once you agree to all terms, you’ll receive a confirmation email from Walmart. And as soon as you have your card in your hands, you can reload it and activate it with a $1.00 fee. Simple, isn’t it?

Apply using the app

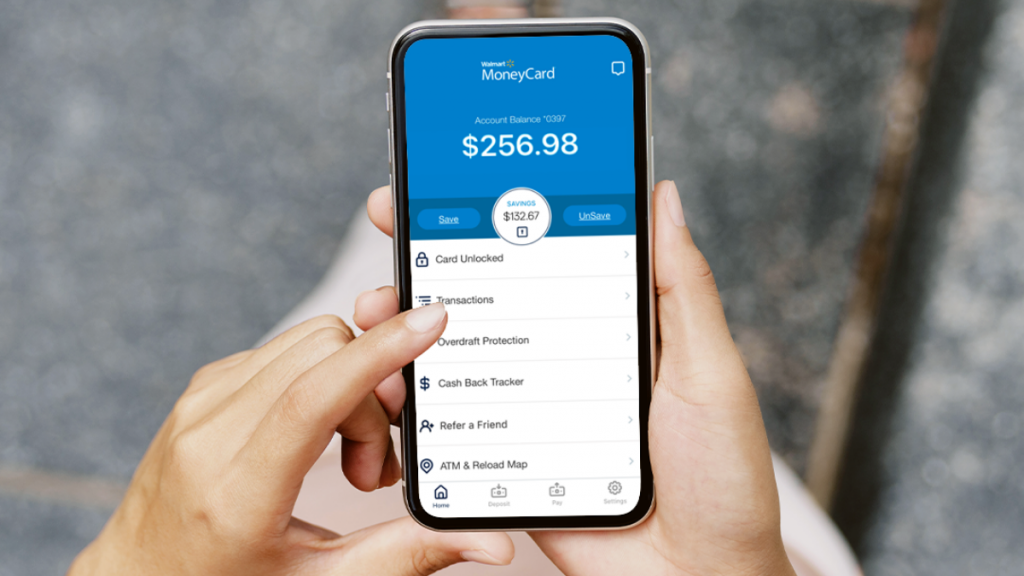

The Walmart MoneyCard® debit card also has a mobile and device app that you can download on Androids, iPhones, and computers.

It makes it easy to check your balance, track your spending, and find ATMs near you. You can also add new family members to your account and reload it free.

However, the app offers no options for new applicants to qualify. You must visit the website.

Advertisement

Walmart MoneyCard® vs. Mission Money card

If the Walmart MoneyCard® doesn’t suit you, we have another recommendation: the Mission Money card.

It is a free-fee debit card and has a mobile app with useful features, such as balance checks, transfers, and much more.

Walmart MoneyCard®

- Credit Score: Available for all credit scores;

- Annual Fee: Monthly fees of $5.94 (waive the fee with a direct deposit – see terms);

- Regular APR: N/A;

- Welcome bonus: None, currently;

- Rewards: 3% cash back at walmart.com; 2% cash back at Walmart fuel stations; 1% cash back at Walmart stores (reward valid for up to $75 each year).

Advertisement

Mission Money card

- Credit Score: no credit score required;

- Annual Fee: $0;

- Regular APR: N/A;

- Welcome bonus: N/A;

- Rewards: N/A.

In case you like the Mission Money Card, don’t forget to read our post about how to apply at the link below!

How to apply for Mission Money Card

Are you looking for a better way to spend your money? If so, take a look at the Mission Money card, and simplify your life. Learn how to apply for it right here.

Trending Topics

Explore the steps to apply for My GM Rewards® Mastercard®

Want to earn rewards on your GM purchases? Apply for My GM Rewards® Mastercard® now and start earning today!

Keep Reading

The Business Platinum Card® from American Express application

Wondering if The Business Platinum Card® from American Express is right for your business? Read on to its eligibility and application.

Keep Reading

Best secured credit cards with no credit check: easiest to get!

Pick one of the best secured credit cards with no credit check to fix your credit score. This will help you in the future for sure!

Keep ReadingYou may also like

Learn 10 great ways to make extra money while staying at home

Are you looking for ways to make extra money at home? Search no more. This article has fantastic suggestions for you. Learn more reading it!

Keep Reading

Solana is releasing a new crypto phone

Find out more about the upcoming Solana crypto phone, including its features and why you should be excited about it.

Keep Reading

A Guide to Mortgage Forbearance: what it is and how it can help

Unsure what mortgage forbearance is? Here's a guide explaining everything, including when to use it and how it works. Read on!

Keep Reading