Credit Cards

70K bonus points: Apply for American Express® Business Gold Card

As a business owner, you can apply for the American Express® Business Gold Card. Earn points on purchases and enjoy exclusive travel benefits! Read on!

Advertisement

American Express® Business Gold Card: Here is how to apply

This post will provide a detailed breakdown of the American Express® Business Gold Card application process.

As a preferred choice among business owners, this card provides a range of perks and advantages that can facilitate business growth and financial management. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

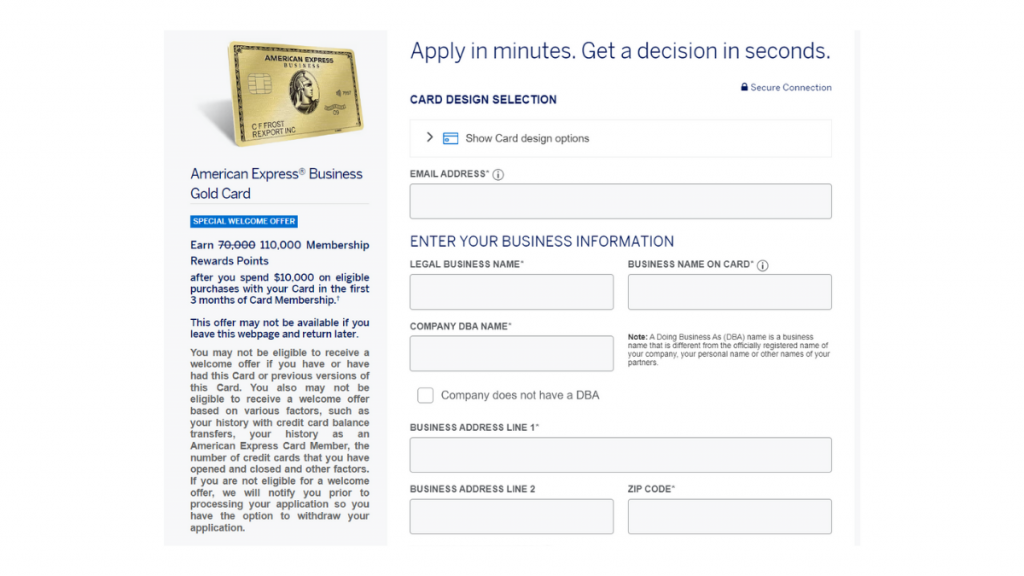

Apply online

To apply for the American Express® Business Gold Card, you can follow these steps:

- First, visit the American Express website and navigate to the Business Gold Card page;

- Then start the application process;

- Fill out the application form with your business and personal information, including your legal business name, Tax ID number, and contact information;

- After that, provide details about your business’s revenue, expenses, and industry;

- Choose the payment and billing options that work best for your business;

- Review the terms and conditions of the card and accept them;

- Finally, submit your application.

Once you submit your application, American Express will review it to determine your eligibility for the Business Gold Card.

Thus, if your application is approved, you will receive your card in the mail within 7-10 business days.

Apply using the app

If you want to apply for a new American Express card, go to their website directly because the app does not allow new card applications.

However, the app is a great tool for managing your current card and exploring its benefits.

Indeed, it is available on Android and iPhone devices and offers balance-checking and payment-making features.

Advertisement

American Express® Business Gold Card vs. U.S. Bank Triple Cash Rewards Visa® Business Card

The U.S. Bank Triple Cash Rewards Visa® Business Card and the American Express® Business Gold Card are both business credit cards, but they have some differences.

The U.S. Bank Triple Cash Rewards Visa® Business Card offers 3% cash back on eligible purchases and 1% cash back on all other eligible purchases.

Check these other features that differentiate these cards to find out which one to choose for your business!

American Express® Business Gold Card

- Credit Score: Good-Excellent;

- Annual Fee: $375;

- Regular APR: 19.49% – 27.49% Variable;

- Welcome bonus: Earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- Rewards: 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap. Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.

- See Rates & Fees

Advertisement

U.S. Bank Triple Cash Rewards Visa® Business Card

- Credit Score: Good- Excellent;

- Annual Fee: $0;

- Regular APR: 0% Intro APR on Purchases and Balance Transfers for 15 billing cycles. 18.99% – 27.99% variable after;

- Welcome bonus: Earn $500 back after spending $4,500 or more in the first 150 days from account opening;

- Rewards: 3% cash back on eligible purchases at EV charging and gas stations, cell phone service providers, restaurants, and office supply stores; 1% cash back on all other eligible purchases; Receive a $100 credit when you subscribe to services such as FreshBooks or QuickBooks on an ongoing basis.

Do you want to get your U.S. Bank Triple Cash Rewards Visa® Business Card? Then check out our application guide post below.

Apply U.S. Bank Triple Cash Rewards

Discover what is necessary to apply for the U.S. Bank Triple Cash Rewards Visa® Business Card. Pay no annual fee! Keep reading and learn!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Fortiva® Cash Back Rewards Mastercard review

Check out the Fortiva® Cash Back Rewards Mastercard review, and see if this card deserves a try. Read on to get started!

Keep Reading

How to budget for an apartment

Discover how to make your money stretch! Find out how to budget for an apartment to secure that perfect place easily!

Keep Reading

Learn to apply easily for the Regional Finance Personal Loans

Do you want to apply for the Regional Finance Personal Loans? You can get the best loan options here! So, read on to learn how to apply!

Keep ReadingYou may also like

Reflex® Platinum Mastercard® credit card review: is it worth it?

The Reflex® Platinum Mastercard® credit card is a solid choice for anyone looking to rebuild their credit scores. Learn more in our review!

Keep Reading

Application for the HSBC Cash Rewards Mastercard® card: how does it work?

We love a good cashback with no annual fees. That's the case with the HSBC Cash Rewards Mastercard® card. Take a look at how to apply.

Keep Reading

Home Depot Consumer Credit Card Review: Is it a smart choice?

Considering a credit card for home improvement? Check out our Home Depot Consumer Credit Card review for informed decision-making. Read on!

Keep Reading