Credit Cards

Ally Everyday Cash Back Mastercard® Review: Higher Cash Back

Do you need a credit card to suit your simplistic lifestyle? Explore the Ally Everyday Cash Back Mastercard® perks and pitfalls in our review. From cash back rewards to fees, we break down the essentials. Stay tuned!

Advertisement

Turn your everyday purchases into cashback rewards

Do you want a credit card that keeps things simple? Meet the Ally Everyday Cash Back Mastercard® in our review.

Apply for Ally Everyday Cash Back Mastercard®

Score 3% cash back on everyday essentials! Cracking the code on how to apply for the Ally Everyday Cash Back Mastercard® in under 5 minutes.

With no annual fee and straightforward cash-back rewards, this card is designed for those who prefer hassle-free spending. So, dive into the key details.

- Credit Score: N/A;

- Annual Fee: $0-$39 (depending on creditworthiness);

- Purchase APR: 19.99% – 29.99%, variable;

- Cash Advance APR: 5% or $10, whichever is greater;

- Welcome Bonus: None;

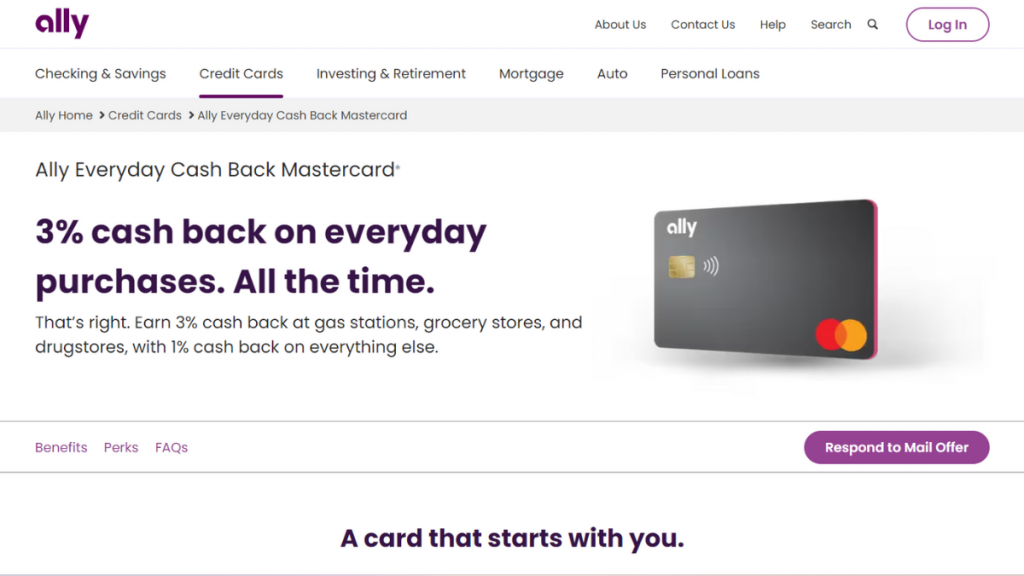

- Rewards: 3% cash back at gas stations, grocery stores, and drugstores, plus 1% cash back on everything else.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Ally Everyday Cash Back Mastercard®: how does it work?

The Ally Everyday Cash Back Mastercard® simplifies your credit card experience.

Then, it is ideal for those seeking a no-frills approach to cash-back rewards.

However, you might want to explore other options if you crave flexibility and additional features.

Rewards

This credit card is great for earning rewards. You can get anywhere from 1-3% cash back on your purchases.

Still, there are no limits on how much you can earn.

You’ll get 3% cash back when you buy gas, groceries, or medicine and 1% back on everything else.

Also, the best part is that you can redeem your rewards whenever you want, no matter how much you have saved up.

So, it’s a simple and flexible way to get some extra cash for the things you buy every day.

Advertisement

Redemption

You simply get more value from your rewards by converting them into statement credit.

Then, it’s a hassle-free process that lets you enjoy the benefits of cash back on your purchases without any complexities.

Annual Fee

The annual fee for the Ally Everyday Cash Back Mastercard® ranges from $0 to $39, depending on your creditworthiness.

Then it is a modest cost for the convenience and perks this card offers.

Advertisement

Other Fees

- Balance Transfer Fee: 4% or $5, whichever is greater;

- Late Payment Fee: Up to $40.

Other Features

This card also comes with some noteworthy features, such as:

- Free FICO credit score access;

- 24/7 customer service;

- Zero Fraud Liability.

Ally Everyday Cash Back Mastercard®: should you get one?

Consider this card if simplicity and cashback are your priority.

Review the advantages and disadvantages below to decide if the Ally Everyday Cash Back Mastercard® aligns with your financial goals.

Pros

- Straightforward cash back rewards;

- No annual fee (or a low fee, depending on creditworthiness);

- Free FICO credit score access;

- 24/7 customer service;

- Zero Fraud Liability.

Cons

- Few redemption options.

Credit score required

No credit score is disclosed.

Ally Everyday Cash Back Mastercard® application: how to do it?

Ready to simplify your spending? Applying for the Ally Everyday Cash Back Mastercard® is a breeze.

So, stay tuned for more details on how to apply.

Apply for Ally Everyday Cash Back Mastercard®

Score 3% cash back on everyday essentials! Cracking the code on how to apply for the Ally Everyday Cash Back Mastercard® in under 5 minutes.

Trending Topics

What to do if I didn’t get my Stimulus Check? [2023]

Here are some tips on what to do if you're one of the millions of Americans who haven't received their stimulus check yet. Read on!

Keep Reading

70K bonus points: Apply for American Express® Business Gold Card

Get an in-depth understanding of the American Express® Business Gold Card and its application process. Earn up to 4 points on purchases!

Keep Reading

BMO Ascend World Elite®* Mastercard®* Review

Maximize travel with BMO Ascend World Elite®* Mastercard®*: top rewards, extensive insurance, luxury perks. Elevate your journeys!"

Keep ReadingYou may also like

Commodity Supplemental Food Program (CSFP): see how to apply

Discover how to apply for The Commodity Supplemental Food Program (CSFP). Learn the eligibility criteria and documents required. Read on!

Keep Reading

Mission Lane Visa® Credit Card review: Improve your score with a $300 limit

Read on to get a full Mission Lane Visa® Credit Card review! This credit card will help you build credit! Enjoy the initial limit of $300!

Keep Reading

Western Union® Netspend® Prepaid Mastercard® review

Manage your finances with ease using the Western Union® Netspend® Prepaid Mastercard® of this review. No credit check required!

Keep Reading