Credit Cards

Apply for Ally Everyday Cash Back Mastercard®: 3% cash back

Ready to turn groceries, gas, and pharmacy trips into cash back gold? Apply for the Ally Everyday Cash Back Mastercard® today! It is easier than grabbing your morning coffee.

Advertisement

Follow these steps to make your application from home!

Earning cash back shouldn’t feel like a chore. So, if you apply for The Ally Everyday Cash Back Mastercard®, it makes it simple and seamless.

Enjoy automatic 3% cash back on grocery store, drugstore, and gas station purchases, and watch the rewards add up effortlessly. Learn how to make your application!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

If you want to apply for the Ally Everyday Cash Back Mastercard® or any other Ally card, then you must receive an offer.

So, if you have your offer by email and want to apply, here are the steps:

Step 01- Receive an Offer

Firstly, check for an email offer with a specific reservation number and access code.

Then, follow the instructions provided in the email and access the link.

Advertisement

Step 02- Application

After that, enter the access code and reservation number on the linked page.

Then fill out the application form with your personal information, documents, and employment status.

Step 03- Submit

Finally, review all terms and conditions carefully before applying.

And don’t forget to contact Ally customer service if you have any questions or concerns about the application.

Advertisement

Apply using the app

You can’t get Ally cards through the app right now.

However, if you have an Ally card, you can enjoy many useful features and benefits of mobile banking and payments, such as:

- Manage your account while on the move.

- Pay bills.

- Check your transactions.

- Keep track of your balance from anywhere.

Ally Everyday Cash Back Mastercard® vs. Blue Cash Everyday® Card from American Express

These credit card options are good for people who want credit cards for everyday spending.

Both have a similar rewards rate, but the Blue Cash Everyday® Card from American Express has a welcome bonus.

On the other hand, Ally Everyday Cash Back Mastercard® may be an option for lower credit scores, while the Amex card requires excellent credit.

So, your choice should depend on your spending patterns. Have a look at these cards below.

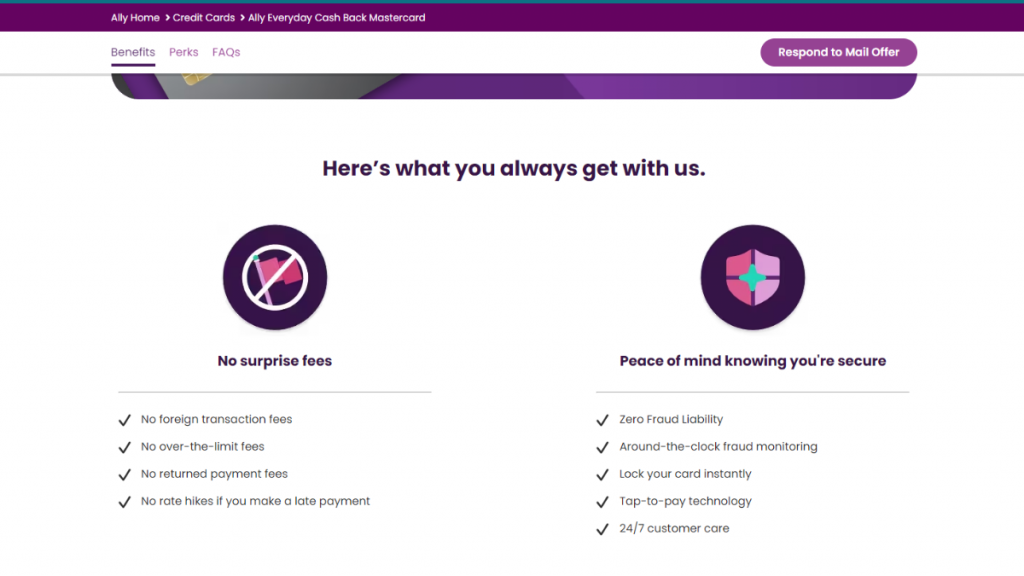

Ally Everyday Cash Back Mastercard®

- Credit Score: N/A;

- Annual Fee: $0-$39 (depending on creditworthiness);

- Purchase APR: 19.99% – 29.99%, variable;

- Cash Advance APR: 5% or $10, whichever is greater;

- Welcome Bonus: None;

- Rewards: 3% cash back at gas stations, grocery stores, and drugstores, plus 1% cash back on everything else.

Blue Cash Everyday® Card from American Express

- Credit Score: Good-Excellent;

- Annual Fee: $0;

- Purchase APR: Get 15 months of 0% intro APR on then a variable rate of 18.99% to 29.99%;

- Cash Advance APR: 29.99% (Variable);

- Welcome Bonus: $200 statement credit after spending $2K in the first 6 months;

- Rewards: 3% cash back on groceries, U.S online retail purchases, and gas, Plus 1% cash back on other eligible purchases.

Keep reading to learn about the Blue Cash Everyday® Card from the American Express application process.

Apply for the Blue Cash Everyday® Card

Get your Blue Cash Everyday® Card from American Express easily with our guide – Read now to learn how to apply! 0% intro APR for 15 months!

Trending Topics

The best free offline GPS: Never get lost again with these apps!

Check out our guide to the best free offline GPS apps to help you in any situation when an internet connection is not available.

Keep Reading

Federal Pell Grant: see how to apply

Find out if you're eligible to apply for the Federal Pell Grant. Ensure up to $7,395 to cover educational costs!

Keep Reading

Student credit cards for no credit: top 4 options

Don't have a credit history? Check out our list of the best student credit cards for no credit, and start building your credit today.

Keep ReadingYou may also like

LendingPoint Personal Loan review: how does it work and is it good?

If you want a LendingPoint Personal Loan review, you've come to the right place. Keep reading to learn more about it!

Keep Reading

The American Express Blue Business Cash™ Card review

Learn how to earn cash back and improve your business' workflow with our The American Express Blue Business Cash™ Card review!

Keep Reading

Discover it® Balance Transfer Credit Card application: how does it work?

Get the lowdown on how to apply for Discover it® Balance Transfer Credit Card! Enjoy 0% intro APR and more! Keep reading!

Keep Reading