Debit Cards

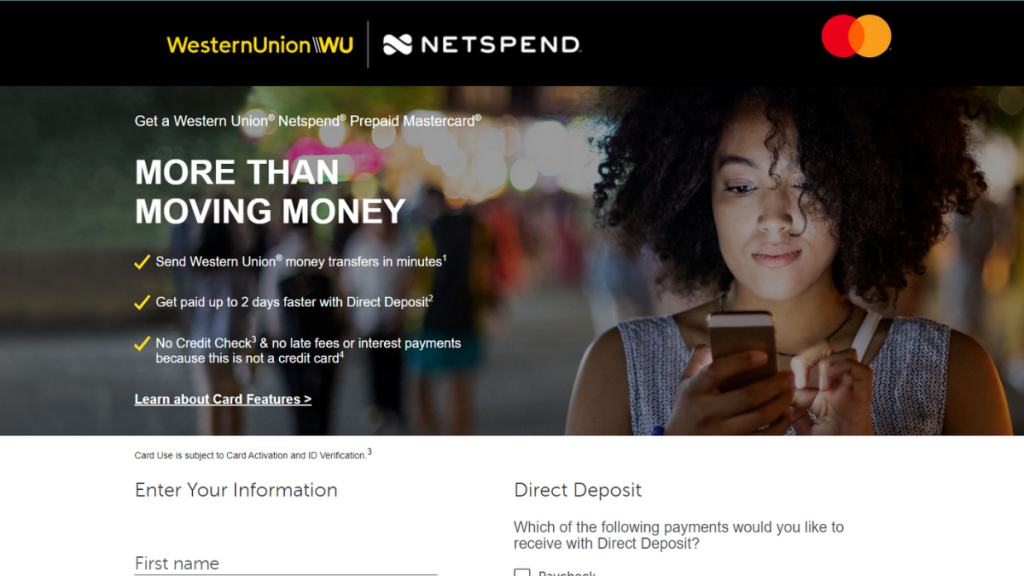

Western Union® Netspend® Prepaid Mastercard® review

Send and receive money, pay bills, and enjoy the benefits of a credit card without the worry of overspending. Discover the Western Union® Netspend® Prepaid Mastercard®!

Advertisement

Enjoy an interesting welcome Bonus

Looking for a way to manage your finances without the burden of traditional cards? Look no further than this Western Union® Netspend® Prepaid Mastercard® review.

Western Union® Netspend® Prepaid application

Simplify your financial management with the Western Union® Netspend® Prepaid Mastercard®. Apply now and enjoy the conveniences.

This prepaid card offers all the benefits of a credit card without worrying about overspending or damaging your credit score. So read on and learn more!

- Credit Score: All types of credit scores are accepted;

- Annual Fee: $0 up to $9.95 monthly, depending on the purchase plan you choose;

- Purchase APR: None;

- Cash Advance APR: None;

- Welcome Bonus: $20 credit when you refer a friend who activates their new card and loads at least $40;

- Rewards: None.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Western Union® Netspend® Prepaid Mastercard®: how does it work?

The Western Union® Netspend® Prepaid Mastercard® is a reloadable-prepaid card that can be used anywhere Mastercard is accepted.

Besides, you must purchase a card and activate it online to start.

Once activated, you can load funds onto the card via direct deposit, online transfer, or at a Western Union location.

Furthermore, the card can be used for purchases online and in-store, and you can withdraw cash from ATMs with the card as well.

You can also use the card to pay bills or send money to other Netspend cardholders.

Western Union® Netspend® Prepaid Mastercard®: should you get one?

The Western Union® Netspend® Prepaid Mastercard® is an excellent option for those looking to simplify their finances and avoid the pitfalls of traditional credit cards.

Here are some of the pros and cons to consider before making your decision:

Advertisement

Pros

- No credit check is required, making the card available to anyone regardless of credit score;

- No purchase or cash advance APR;

- A $20 credit is given to you when you refer a friend who activates their new card and loads at least $40;

- The ability to send and receive money from other Netspend cardholders.

Cons

- Monthly fees of up to $9.95 apply, depending on how much you load onto the card each month;

- No rewards program;

- Some fees may apply for certain transactions, such as out-of-network ATM withdrawals.

Advertisement

Credit score required

One of the major advantages of the Western Union® Net spend® Prepaid Mastercard® is that no credit check is required to get the card.

Thus, anyone can get this prepaid card.

Western Union® Netspend® Prepaid Mastercard® application: how to do it?

Overall, the Western Union® Netspend® Prepaid Mastercard® is an excellent option for those looking to simplify their finances and avoid the pitfalls of traditional cards.

Moreover, with no credit check required and the ability to send and receive money from other Netspend cardholders, it’s a great way to manage your money.

However, before deciding, be aware of the monthly fees and lack of a rewards program.

Ready to simplify your finances with the Western Union® Netspend® Prepaid Mastercard®?

Check out our how-to guide to learn how to apply and start enjoying the benefits of this hassle-free prepaid card today!

Western Union® Netspend® Prepaid application

Simplify your financial management with the Western Union® Netspend® Prepaid Mastercard®. Apply now and enjoy the conveniences.

Trending Topics

Chase Secure Banking℠ application: how does it work?

Discover how to make the Chase Secure Banking℠ application – a convenient way to manage your finances better. No minimum deposit.

Keep Reading

Application for the Sam’s Club Credit Plus Member Mastercard card: how does it work?

Learn how to apply for a Sam’s Club Credit Plus Member Mastercard card and start earning cash back on your purchases today!

Keep Reading

Fortiva® Credit Card review: no security deposit

Looking for a great credit card that doesn't require a high score? Check out the Fortiva® Credit Card, an option for fair credit.

Keep ReadingYou may also like

Delta SkyMiles® Blue American Express Card Review: Earn big

This card is perfect for periodic travelers who love miles. Dive into Delta SkyMiles® Blue American Express Card review! $0 annual fee!

Keep Reading

How to build credit fast from scratch with our tips for beginners!

Learn how to build credit and get the best offers from lenders and credit card issuers. This can make a difference in achieving your plans.

Keep Reading

Avant Personal Loan review: how does it work, and is it good?

Learn how to get fast cash for any purpose in the Avant Personal Loan Review. Keep reading to find out more!

Keep Reading