Credit Cards

Upgrade Triple Cash Rewards Visa® review: is it legit and worth it?

If you're looking for a new credit card with cash back rewards, the Upgrade Triple Cash Rewards Visa® is an interesting option. We are going to show you its pros and cons on this full review.

Advertisement

Upgrade Triple Cash Rewards Visa® review: earn 3% cash back on selected purchases

Are you wondering why the Upgrade Triple Cash Rewards Visa® has this name? It is because you can get 3 times more cashback buying some important items for your house, your car, or your health.

You don’t need a perfect credit score to get this card, and the credit limits are higher than other credit cards. It works like a personal loan, making it a good choice for big purchases.

Learn everything this card has to offer by reading this full review.

- Credit Score: Excellent, Good, Fair, Average.

- Annual Fee: Pay a $0 annual fee to enjoy this card.

- Regular APR: Variable 14.99% to 29.99% variable APR.

- Welcome bonus: $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions.

- Rewards: Earn 3% cash back on selected categories and 1% cash back on everything else.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Upgrade Triple Cash Rewards Visa®: is it legit?

This card is a mixture of a credit card and a personal loan. So the maximum limit you can get is much higher than other cards in the same category.

Another advantage is the rewards. In addition to 1% cash back on all purchases, you can earn a 3% bonus in the following categories:

- Health: take care of your health with gym memberships, spas, fitness equipment, etc.

- Auto: everything related to your car can give you extra cashback: car washes, automotive parts, repair and maintenance services, etc.

- Home: If you love making a trip to IKEA, you know what this category is all about. Your home repair and gardening can also give you rewards.

Upgrade Triple Cash Rewards Visa®: should you get one?

With competitive price offers and a high credit limit, this card might be a good deal if you need to make a big purchase. It works like a loan, but loans do not give rewards, while the Upgrade Triple Cash Rewards Visa® does.

Advertisement

From Upgrade:

- $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions*.

- 3% unlimited cash back on every purchase in Home, Health, and Auto categories.

- No annual fee.

- Enjoy Visa Signature benefits, like Roadside Dispatch, Price Protection, Extended Warranty and more.

- Shop smarter with Upgrade Shopping! Get exclusive savings at stores, restaurants, and more.

- No touch payments with contactless technology built in.

- See if you qualify in seconds with no impact to your credit score.

- Great for large purchases with predictable payments you can budget for.

- Mobile app to access your account anytime, anywhere.

- Use your card anywhere Visa is accepted.

- Relax knowing that you are protected in case of unauthorized transactions with Visa’s Zero Liability Policy.

Pros

- This credit card works like a personal loan too. You can split your balance into monthly installments at a fixed rate.

- You don’t need an excellent credit score to apply. However, it will impact your credit limit and interest rates.

- The credit lines start at $500 and go up to $25,000.

- The bonus categories to earn 3% cash back are very useful. In every other purchase, you still get 1% cash back. You receive it when you pay your bill.

- You will pay a $0 annual fee to use this credit card and receive rewards for it.

- Get a $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions.

Advertisement

Cons

- The APR can be very high.

- Some experts consider it as a loan or a line of credit, and not as a credit card, and claim that the laws that regulate both are different. However, you can use it like a regular credit card. Just make sure to carefully read the terms and conditions before you apply for it.

- This card is not available in DC, IA, WV, WI, GA and MA.

Credit score required

It doesn’t have to be great, but it can’t be that bad either. You can give it a try if your credit score is at least 630 or higher. Remember that the better your score, the better the offer and the APR, as well as your credit limit.

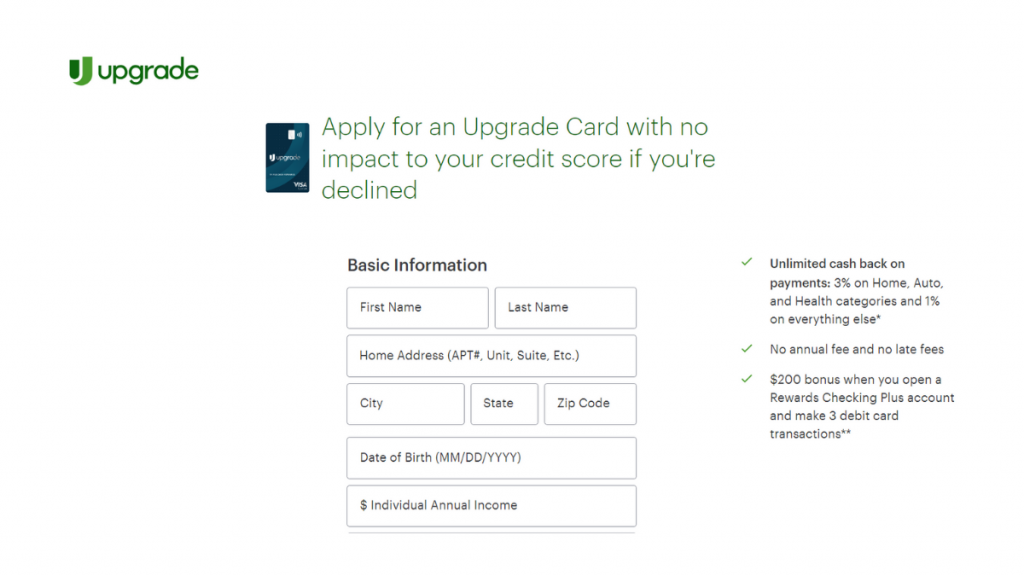

Upgrade Triple Cash Rewards credit card application: how to do it?

Would you like to have an Upgrade Triple Cash Rewards? If so, you can do it online – if you’re at least 18 years old and have U.S. citizenship and address.

And the best part is that you can pre-qualify with a soft pull to check your offer. If you like it, then you can proceed with the application process.

To enjoy all these benefits, keep reading and follow these steps to apply for your new credit card.

Apply online

First, let’s not make any credit score hard inquiry if you don’t even know if you like the offer, right? Upgrade will make a soft pull with no harm to your score to present you with an offer. If you agree with the rates you got, you can proceed with the application process.

To pre-qualify, it’s very simple. Access the Upgrade website, and find the Upgrade Triple Cash Rewards Visa®. To get started, fill out the form with some basic information, like your full name, address, date of birth, and income.

Create your account with an email and a password. To submit it, you have to read some terms and agree with them. Once you hit the “apply now”, Upgrade will analyze your application and answer with an offer.

Plus, before you apply, you should know that this card is unavailable in DC, IA, WV, WI, GA and MA.

Upgrade Triple Cash Rewards Visa® vs. Upgrade Bitcoin Rewards Visa®

If you’re not sure about this card, Upgrade has more than one credit card option. You can choose to get cash back as a reward with the Upgrade Triple Cash Rewards Visa®, or you can get bitcoins with the Upgrade Bitcoin Rewards Visa®.

Both have outstanding payment options with a high credit limit available (according to your creditworthiness, you can get up to a $25,000 credit limit).

Upgrade Triple Cash Rewards Visa®

- Credit Score: Excellent, Good, Fair, Average.

- Annual Fee: $0 annual fee.

- Regular APR: Variable 14.99% to 29.99 APR.

- Welcome bonus: $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions.

- Rewards: Earn 3% cash back on selected categories and 1% cash back on everything else.

Upgrade Bitcoin Rewards Visa®

- Credit Score: Fair to excellent.

- Annual Fee: $0.

- Regular APR: 14.99% to 29.99% variable APR.

- Welcome bonus: $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions.

- Rewards: Earn 1.5% back as Bitcoins in every purchase.

Are you interested in cryptocurrencies? This card can be your entry into the crypto market. You have nothing to lose, and you might enjoy dealing with crypto. The following article will show you how to apply for the Upgrade Bitcoin Rewards Visa®.

How to apply for an Upgrade Bitcoin Rewards Visa®?

Applying for an Upgrade Bitcoin Rewards Visa® is an excellent way to get your first Bitcoins or get more of them to your wallet. Learn how to apply for it.

Welcome Bonus Disclosure: *To qualify for the welcome bonus, you must open and fund a new Rewards Checking Preferred account through Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Preferred account within 60 days of the date the Rewards Checking Preferred account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Preferred account as part of this application process, you are not eligible for this welcome bonus offer. Your Upgrade Card and Rewards Checking Preferred account must be open and in good standing to receive a bonus. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade Visa® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Preferred account as a one-time payout credit within 60 days after meeting the conditions. This one-time bonus is available through this Upgrade Card offer and may not be available for other Upgrade Card offers.

Trending Topics

Breathwrk App review: A Breath of Fresh Air at the palm of your hands

Have you been looking for a fresh and new way to improve your breathing? Look no further than this Breathwork app review.

Keep Reading

Veterans United Home Loans review: how does it work and is it good?

Check out this Veterans United Home Loans review to see how it works. This #1 VA Lender will help you buy your dream home! Read on!

Keep Reading

Accepted Account application: how does it work?

Learn how to apply to the Accepted Account, a membership that allows you to purchase at Distinct Card Services with discounts. Read on!

Keep ReadingYou may also like

How to make $5000 a month: 10 simple strategies anyone can use

Discover how to make $5000 a month with these simple strategies and secrets that anyone can use. Keep reading!

Keep Reading

Explore the steps to apply for My GM Rewards® Mastercard®

Want to earn rewards on your GM purchases? Apply for My GM Rewards® Mastercard® now and start earning today!

Keep Reading

A small glossary of investment terms: a guide for starters!

We've made this glossary of investment terms to help you understand them better and start investing with confidence. Check this article.

Keep Reading