Reviews

United℠ Explorer Card review

Read out this United℠ Explorer Card review to familiarize yourself with this travel card that offers great rewards for frequent travelers, including a 50,000-mile sign-up bonus. Plus, there's no annual fee for the first year. Read on!

Advertisement

United℠ Explorer Card: The Ultimate Travel Companion

Are you ready to travel with ease? In today’s United℠ Explorer Card review, you’ll understand how to earn miles that make your travels more enjoyable.

How to apply for the United℠ Explorer Card

This guide will show you exactly how to apply for the United℠ Explorer Card and earn its amazing travel rewards. Let's get started!

From checked bags and discounts on food and beverages, the United℠ Explorer Card can help you get the most out of your travels. Let’s look at what this card has to offer. Read on!

- Credit Score: Good to excellent;

- Annual Fee: $0 for the first year, $95 after that;

- Regular APR: 21.99% – 28.99% variable APR for purchases and balance transfers; 29.99% variable APR for cash advances;

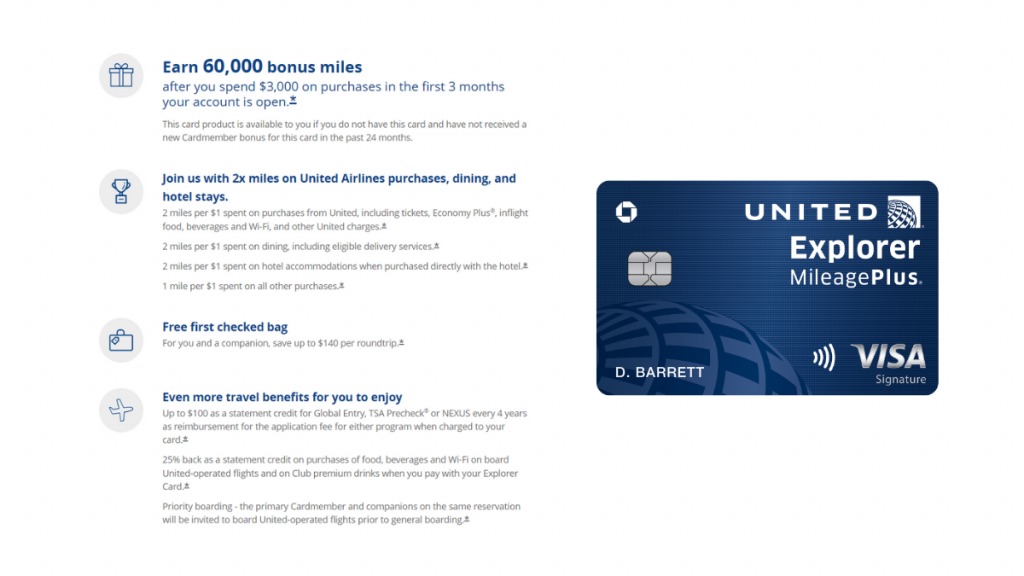

- Welcome Bonus: Earn 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

- Rewards: 2 miles for each dollar spent on purchases from United, including tickets, Economy Plus®, inflight food, beverages, Wi-Fi, and others; 2 miles per $1 spent on dining, including qualifying delivery services;

- Other Rewards: 2 miles per $1 spent on hotel accommodations (valid for when you purchase directly with the hotel); and 1 mile per $1 spent on all other purchases;

- Terms apply.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

United℠ Explorer Card: how does it work?

United℠ Explorer Card offers some great rewards for frequent travelers.

When you sign up for the card, you can earn 60,000 bonus miles after spending $3,000 in purchases within the first three months of opening your account.

Plus, there’s no annual fee for the first year. After that, you’ll pay $95.

You can also earn 2x miles on dining, hotel stays, and United® purchases — so make sure to use your card whenever possible when booking flights or hotels.

The card also offers great savings opportunities, such as up to $100 Global Entry/TSA PreCheck®/NEXUS fee credit.

Get a statement credit of up to 25% when you use your Explorer Card for food, drinks, and Wi-Fi onboard United-operated flights. Plus, indulge in Club premium beverages with the same rewards.

Packing for a trip just got even better – you can now save up to $140 with our free first-checked bag. That’s one less thing off your list, so all that remains is getting ready to soar. (Terms and Conditions apply).

Also, you can upgrade your travel experience with special access to priority boarding and exclusive United Club℠ privileges. Enjoy two one-time passes each year on the anniversary of your card membership.

Fees

- Foreign transaction fee: $0;

- Balance Transfer: $5 or 5%, whichever is greater;

- Cash Advance: $10 or 10%, whichever is greater.

Advertisement

United℠ Explorer Card: should you get one?

United℠ Explorer Card is an excellent choice for anyone looking to access multiple benefits on travels while saving. But is it right for you? Let’s compare this card’s pros and cons to help you decide.

Pros

- Earn 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

- $0 introductory annual fee for the first year, then $95.

- Earn 2 miles per $1 spent on dining, hotel stays, and United® purchases.

- Up to $100 Global Entry, TSA PreCheck® or NEXUS fee credit.

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card.

- Free first checked bag – a savings of up to $140 per roundtrip. Terms Apply.

- Enjoy priority boarding privileges and visit the United Club(SM) with 2 one-time passes each year.

- Member FDIC.

Advertisement

Cons

- There’s an annual fee;

- Rewards are limited.

Credit score required

You’ll want an impressive credit score to get the United℠ Explorer Card. Anything from good to excellent will do (690-850).

United℠ Explorer Card application: how to do it?

Ready to take your travels further? Learn how to apply for the United℠ Explorer Card, and let it help you earn miles for all your purchases – and make every adventure more memorable.

Check out our post below for instructions.

How to apply for the United℠ Explorer Card

This guide will show you exactly how to apply for the United℠ Explorer Card and earn its amazing travel rewards. Let's get started!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Copper – Banking Built For Teens review: fees, rates, and more

Get your teens started in finances with Copper- Banking Built for Teens review! An account specifically tailored towards kids.

Keep Reading

Learn to apply easily for the LightStream Personal Loan

Ready to apply for a Lightstream Personal Loan? Look no further! We've got all the information you need right here! Borrow up to $100K fast!

Keep Reading

Delta SkyMiles® Blue American Express Card Review: Earn big

This card is perfect for periodic travelers who love miles. Dive into Delta SkyMiles® Blue American Express Card review! $0 annual fee!

Keep ReadingYou may also like

Petal 2 “Cash Back, No Fees” Visa Credit Card review

Looking for a no hidden fees, cash-back credit card? Check out this Petal 2 "Cash Back, No Fees" Visa Credit Card review. Read on!

Keep Reading

Federal loans vs Private Loans: which is better?

What do you know about Federal Loans vs Private Loans for students? If you're in college or if you intend to be, this content is for you!

Keep Reading

Learn to apply easily for SpeedyNetLoan

Getting a loan online is easier and faster than you might think. Read this post to understand how to apply for a SpeedyNetLoan. Stay tuned!

Keep Reading