Credit Cards

Torrid Credit Card Review: Big Discounts on all Purchases

Find out how to get fashion discounts with the Torrid Credit Card in our review! Discover rewards for cardholders now. Keep reading!

Advertisement

Pay less every time you shop at Torrid and Save more!

If you’re a fan of Torrid, you might have heard of its store credit card. But is it worth your while? In this blog post, we’ll review the Torrid Credit Card and see if it fits you well.

Up to 40% off Now: How to Apply for Torrid Card

Are you a Torrid lover? Learn to apply for the Torrid Credit Card now and score a 5% discount on all your purchases. Keep reading!

We’ve got you covered, from how it works to its rewards, fees, and credit score requirements. So, let’s dive in.

- Credit Score: 630 or higher;

- Annual Fee: $0;

- Purchase APR: 25.99% Variable;

- Cash Advance APR: N/A;

- Welcome Bonus: 40% off on your first purchase after opening and using the Torrid Credit Card online, plus $15 off $50 purchase once your Torrid card arrives;

- Rewards: 5% off on all purchases using the card.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Torrid Credit Card: how does it work?

The Torrid Credit Card is store-branded, allowing you to purchase at Torrid stores and online.

It offers discounts and rewards without an annual fee.

However, it’s important to note that the card also comes with a high APR and fees. Further, let’s break down its features:

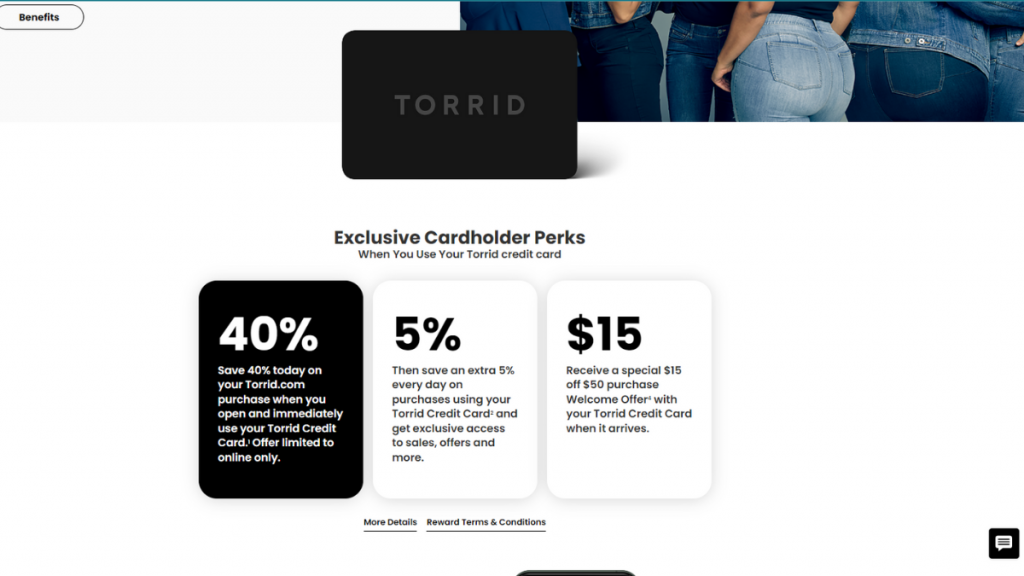

Welcome Bonus

When you open and use the Torrid Credit Card online, you’ll receive 40% off your first purchase, and once your card arrives, you’ll get $15 off a $50 purchase.

Advertisement

Rewards

With the Torrid Credit Card, you’ll enjoy 5% off on all purchases made with the card.

Additionally, you’ll gain access to exclusive sales and offers unavailable to non-cardholders.

Loyalty Program

The Torrid Credit Card’s loyalty program has three tiers: Insider, Loyalist, and VIP.

Your tier will depend on your spending.

You’ll earn rewards for every 250 points collected and a birthday gift for members.

Advertisement

Credit Reports

Indeed, it’s worth noting that your account activity is reported to credit bureaus, allowing you to improve your credit by making regular, on-time payments.

Torrid Credit Card: should you get one?

If you’re a frequent Torrid shopper who plans to make big purchases, the Torrid Credit Card might be worth considering.

However, it’s not the best option for people who carry a balance or have less than great credit scores.

Pros

- No Annual fees;

- High rewards and bonuses;

- Exclusive discounts and perks;

- Loyalty program.

Cons

- High APR;

- Late payment and returned payment fees.

Credit score required

To qualify for the Torrid Credit Card, you must review your score and see if it’s 630 or higher.

Torrid Credit Card application: how to do it?

Ready to apply for the Torrid Credit Card and earn a 5% discount on all your purchases? Then keep reading to get started!

Up to 40% off Now: How to Apply for Torrid Card

Are you a Torrid lover? Learn to apply for the Torrid Credit Card now and score a 5% discount on all your purchases. Keep reading!

Trending Topics

Western Union® Netspend® Prepaid Mastercard® review

Manage your finances with ease using the Western Union® Netspend® Prepaid Mastercard® of this review. No credit check required!

Keep Reading

Upgrade Cash Rewards Visa® review

The Upgrade Cash Rewards Visa® is perfect for you who need a higher credit limit. Enjoy a card with no annual fee and cash back!

Keep Reading

Delta SkyMiles® Reserve Business American Express Card review

Find out how this credit card works and its pros and cons here in the Delta SkyMiles® Reserve Business American Express Card review. Read on!

Keep ReadingYou may also like

Citi® / AAdvantage® Executive World Elite Mastercard® review

The Citi® / AAdvantage® Executive World Elite Mastercard® review will show you how to earn miles on American Airlines. Read on!

Keep Reading

Aer Lingus Visa Signature® Card application: how does it work?

Earn points, enjoy Premium travel protections, early boarding, and more! Find out how to apply for the Aer Lingus Visa Signature® Card.

Keep Reading

Marriott Bonvoy Bevy™ American Express® Card Review: Earn more

Check out our full review of the Marriott Bonvoy Bevy™ American Express® Card - earn 155,000 bonus points + elite benefits! Read on!

Keep Reading