Apps

Super+ Review: Your Key to Everyday Savings

Learn how Super+ can assist you in cutting down daily expenses by reading our comprehensive review. Ensure cash back + exclusive benefits! Read on!

Advertisement

Cash Back, Discounts, and More for $15/Month

Want to save money on your everyday purchases, travel, and gas? Super+ is an app that can help you do just that, and we’re here to give you a detailed review of how it works.

How to Download Super+

Download Super+ on your smartphone to save on gas, shopping, and more. Read on to learn how to have it on your device!

We’ll explain all the app’s benefits, features, and potential downsides so you can decide if it’s right for you. Read on to see how Super+ can boost your savings!

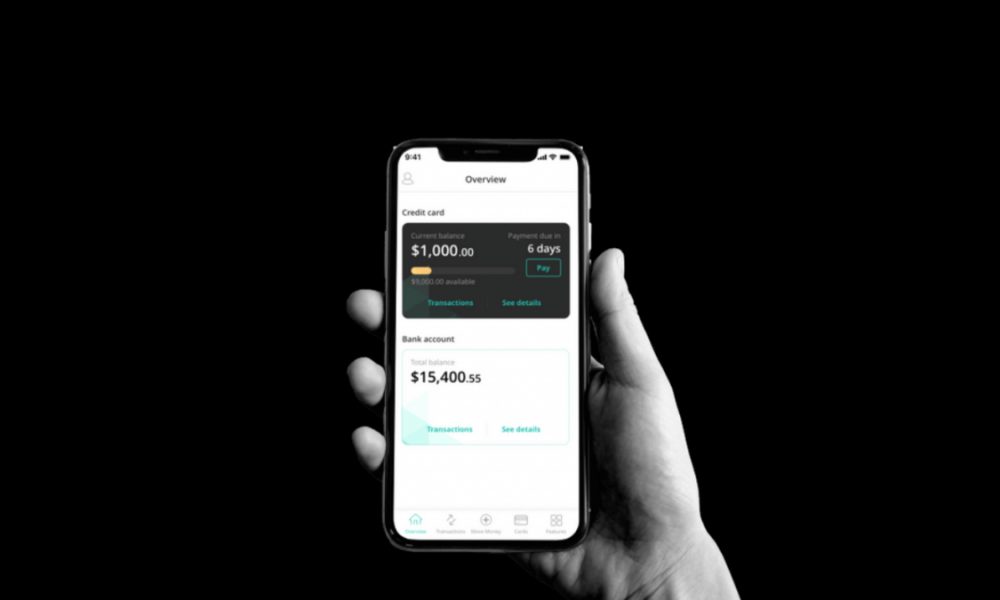

Super+: how does it work?

Super+ is a subscription service offered by the Super.com app. Using it, users can save on their everyday purchases with discounts and exclusive deals.

For a monthly fee of $15, Super+ members can enjoy many things, such as cashback rewards on all their purchases, credit-building opportunities, and discounts.

Still, you can earn even more through surveys and games.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Link it to a Debit Card

One unique aspect of Super+ is its integration with your existing funds, linked to a debit card.

So, it means you can use your money while still enjoying the benefits of Super+.

As a Super+ member, you’ll receive an impressive 10% cashback on Super Travel bookings, along with exclusive perks and up to 10% cashback on everyday purchases.

Credit Building

Super+ reports your purchases to the three main credit bureaus. Then it helps you establish or improve your credit history.

So you pay in debit and enjoy credit perks.

Super Travel

For budget-conscious travelers, Super Travel is a standout feature of the Super+ subscription.

It offers up to 50% savings on over 500,000 hotels worldwide and also provides 24/7 customer service support, ensuring your travel experiences are more affordable.

Super Pay

Super+ also offers the convenience of Super Pay, allowing you to access cash advances of up to $250 with no credit check, interest, or hidden fees.

It can be a valuable lifeline during unexpected financial situations.

Super+: should you get it?

Super+ is a compelling option for individuals looking to maximize their savings and enjoy various financial perks. Here are the key pros and cons to consider:

Pros

- Members have seen their credit scores increase 28 points on average in 2 weeks by reporting their rent payments through Super+

- Get a cash advance up to $250 or your money back guaranteed – with no interest or credit check

- Credit building suite with bureau reporting, monitoring, and credit report access

- Super Card with 0% APR

- Unlimited 1-10% Cashback

- $15/month for Super+

- Money Back Guarantee*

- *Not all users will qualify. Advances range from $20 to $250. Express transfer fee may apply. Terms apply.

Cons

- Monthly Fee;

- No Upgrade Options.

Super™ Secured Mastercard® main features

This credit card is issued by MRV Banks, with no credit check. It’s like a secured card but doesn’t require a secured deposit.

So, the limit is the same amount you have in a linked debit account. Check out its features.

- Credit Score: Poor- excellent;

- Annual Fee: $0;

- Purchase APR: None;

- Cash Advance APR: None;

- Welcome Bonus: None;

- Rewards: 1% cash back on all purchases, 5% cash back on Super Shop and online, and 10% cash back on bookings through Super Travel.

Super+: how to download it?

If you want to get the Super.com app and join the Super+ subscription, review how to apply in our upcoming post. Stay tuned!

How to Download Super+

Download Super+ on your smartphone to save on gas, shopping, and more. Read on to learn how to have it on your device!

Trending Topics

Learn to apply easily for 100 Lenders personal loan

If you need a loan that accepts all scores and can help you in times of need, read on to learn how to apply for 100 Lenders personal loan!

Keep Reading

How to apply for the Sable bank account easily

If you're tired of old-fashioned banks, learn how to apply for a Sable bank account and enjoy your online account with a $0 annual fee.

Keep Reading

Discover it® Secured credit card review: is it worth it?

The Discover it® Secured credit card is the first step on your journey to a healthy credit score. Read this review to learn how!

Keep ReadingYou may also like

An Irresistible APR To Smash Debt: PNC Core® Visa® review

Save money on high-interest debts with the PNC Core® Visa® Credit Card - Our review encompasses it all! Enjoy 0% intro APR for 15 months!

Keep Reading

Delta SkyMiles® Blue American Express Card Review: Earn big

This card is perfect for periodic travelers who love miles. Dive into Delta SkyMiles® Blue American Express Card review! $0 annual fee!

Keep Reading

Savings vs. checking accounts: Understand the difference

Unclear on the difference between savings vs checking accounts? This quick guide has you covered! Learn how to utilize both accounts best!

Keep Reading