Apps

Build Credit and Save Money: How to Download Super+

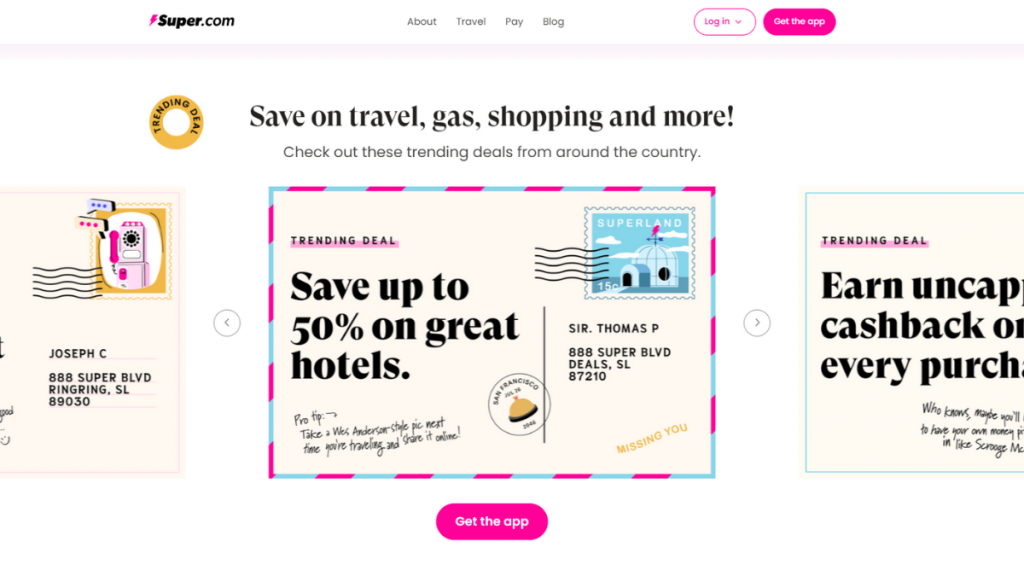

Looking to maximize your purchases and build credit with your debit card? We're here to help! Learn how to download the Super+ app!

Advertisement

Earn money through surveys and games and get cashback!

Looking to boost your credit while saving money? Download The Super+! Earn money by participating in surveys and games while enjoying the benefits of cashback rewards.

Find out the steps to download it on iOS and Android devices, making it easy for users of all backgrounds to start their journey toward financial empowerment. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

How to download and use the Super+ App?

Super.com’s subscription service, Super+, costs $15 per month and requires users to download the app and activate the service.

With this tool at your fingertips, you can earn money through surveys and games and take advantage of cashback rewards.

It’s a simple yet powerful way to improve your credit and save money on everyday needs, such as groceries, gas, and even travel and shopping.

Getting started with Super.com is a breeze. To download the app on iOS or Android, follow these steps:

For iOS Users

- Firstly, open the App Store on your iPhone or iPad.

- In the search bar, type “Super.com” and hit “Search.”

- Then, locate the Super.com app in the search results.

- Tap “Download” to install the app on your device.

- Once the installation is complete, finally open the Super.com app and start using it.

Advertisement

For Android Users

- Open the Google Play Store on your Android device.

- In the search bar, type “Super.com” and then tap the search icon.

- After that, find the Super.com app in the search results.

- Then, select “Install” to download and install the app.

- After installation, open the Super.com app on your Android device.

Looking for other solutions for credit building? Learn more about Mission Lane Visa®

The Mission Lane Visa® Credit Card is a credit card that is offered by Mission Lane LLC.

The card is specifically designed for people with fair or bad credit scores who want to build or rebuild their credit scores.

However, it doesn’t offer any rewards or welcome bonuses. Still, it is a great option for those who want to improve their credit score without any hidden charges or fees.

If you’re interested, check out its main features and information below.

Advertisement

Mission Lane Visa® Credit Card

- Credit Score: Fair, bad credit;

- Annual Fee: $0 to $59;

- Purchase APR: 26.99% – 29.99% (Variable);

- Cash Advance APR:26.99% – 29.99% (Variable);

- Welcome Bonus: No welcome bonus;

- Rewards: No rewards.

Looking for additional credit-building solutions? Consider the Mission Lane Visa® Credit Card, a valuable tool for those with fair or bad credit.

Keep reading to learn more about this credit card’s features and application process. Stay tuned for financial empowerment!

Mission Lane Visa® Credit Card application

Improve your credit score with the Mission Lane Visa® Credit Card! We'll show you to apply in less than 2 minutes! Keep reading!

Trending Topics

Capital One Venture X Rewards Credit Card application: how does it work?

Do you need a travel rewards card with flexibility and miles? Read on and learn to apply for the Capital One Venture X Rewards Credit Card.

Keep Reading

A guide on how to manage your mortgage the right way

Managing your mortgage can be intimidating. Don't worry! We have some tips to help you learn how to easily manage your mortgage.

Keep Reading

Milestone® Mastercard® Review: Boost your credit

Read the Milestone® Mastercard® review to find out if it is right for you. Take a look at its features, benefits, and drawbacks.

Keep ReadingYou may also like

Citrus Loans review: how does it work and is it good?

Do you need a loan for an unexpected expense? Check out our Citrus Loans review to see if this lender is right for you. Read on!

Keep Reading

Bank of America Customized Cash Rewards credit card review: is it worth it?

Is the Bank of America Customized Cash Rewards credit card right for you? See its benefits, such as cashback and $0 annual fee, and find out!

Keep Reading

The 3 best low-risk and safe investments

We have some suggestions for the best low-risk investments if your investment style is more conservative. Keep your money safe.

Keep Reading