Credit Cards

An Irresistible APR To Smash Debt: PNC Core® Visa® review

Slash your interest rates and eliminate your debts with the card in our review: the PNC Core® Visa® Credit Card! Pay $0 annual fee!

Advertisement

Save Money on Interest and Say Goodbye to Debt

High interest making debt repayment a nightmare? Not anymore! Check out our PNC Core® Visa® Credit Card review.

Apply for the PNC Core® Visa® Credit Card

Apply now for the PNC Core® Visa® Credit Card with our assistance. Learn what is required, where, and how to get it – $0 annual fee!

Discover a credit card to tame your debts with a tempting and long 0% APR period. Read on to learn more benefits and features!

- Credit Score: 750 or higher;

- Annual Fee: $0;

- Purchase APR: 0% intro APR for 15 billing cycles, then 15.99% to 27.99% (variable);

- Cash Advance APR: 29.99% (variable);

- Welcome Bonus: N/A;

- Rewards: N/A.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

PNC Core® Visa® Credit Card: how does it work?

If you have a substantial balance to pay off or plan a significant purchase, the PNC Core® Visa® Credit Card is an excellent pick to save on interest.

For example, suppose you are looking forward to buying a new laptop. Then you can pay using this card without interest for a period.

Also, suppose you have excessive debt on other credit cards. In that case, you can transfer that debt to the PNC Core® Visa® without incurring additional interest charges.

0% APR promotion

The PNC Core® Visa® Credit Card offers an amazing promotional rate of 0% APR on purchases and balance transfers the first 15 billing cycles after opening the account.

So, during this time, you won’t pay interest on any purchases you make. Also, it will not rack up interest if you transfer a large balance from other cards.

Advertisement

Security Features

This credit card has three security features that help protect you from fraud:

1. Zero Liability Fraud Protection

It guarantees that you will not be accountable for any unauthorized charges made on your card.

Advertisement

2. PNC Easy Lock® and alert

It lets you lock your card with a few clicks, helping keep your account secure.

3. Alerts

Lastly, alerts help you keep track of your account activity so that you can spot any suspicious transactions quickly.

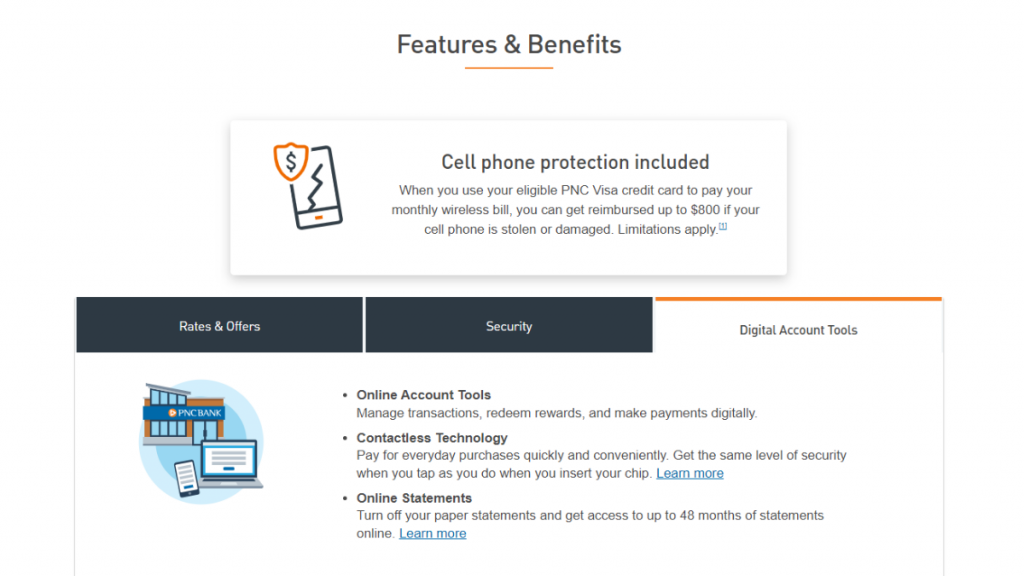

Digital Account Tools

The PNC Core® Visa® Credit Card also comes with an array of digital account tools that make it easy to manage your card online:

- View your transactions;

- Make payments;

- Access statements;

- Contactless technology.

PNC Core® Visa® Credit Card: should you get one?

Consider this credit card to save on interest to purchase or transfer balances without an annual fee.

Further, review the PNC Core® Visa® Credit Card drawbacks and benefits below to determine its worth for your finances.

Pros

- 0% introductory APR promotion;

- No annual fee;

- Zero Fraud Liability;

- Online Management.

Cons

- No rewards;

- No welcome bonus.

Credit score required

You need a credit score of at least 750 to apply for this card.

PNC Core® Visa® Credit Card application: how to do it?

Want a PNC Core® Visa® Credit Card? So read on for step-by-step instructions.

Apply for the PNC Core® Visa® Credit Card

Apply now for the PNC Core® Visa® Credit Card with our assistance. Learn what is required, where, and how to get it – $0 annual fee!

Trending Topics

MaxCarLoan Review: Quick Loans, Dream Cars!

Need car financing? MaxCarLoan loan broker, in this review, helps you find the best broker on the market. Learn more!

Keep Reading

How do travel credit cards work?

How do travel credit cards work? Find the answer here, and learn how to take advantage of them in your next adventure. Read on!

Keep Reading

Child and Adult Care Food Program (CACFP): see how to apply

Learn how to apply for CACFP Child and Adult Care Food Program (CACFP) and ensure access to nutritious food! Keep reading and understand how!

Keep ReadingYou may also like

Capital One Platinum Secured Credit Card review: is it worth it?

Read this Capital One Platinum Secured Credit Card review and learn all about its perks, such as flexible security deposit and no annual fee!

Keep Reading

Petal 2 “Cash Back, No Fees” Visa Credit Card review

Looking for a no hidden fees, cash-back credit card? Check out this Petal 2 "Cash Back, No Fees" Visa Credit Card review. Read on!

Keep Reading

Learn to apply easily for the Best Egg Personal Loans

We'll show you how easy it is to apply for Best Egg Personal Loans. Plus, learn about the benefits of borrowing with them. Check it out!

Keep Reading