Credit Cards

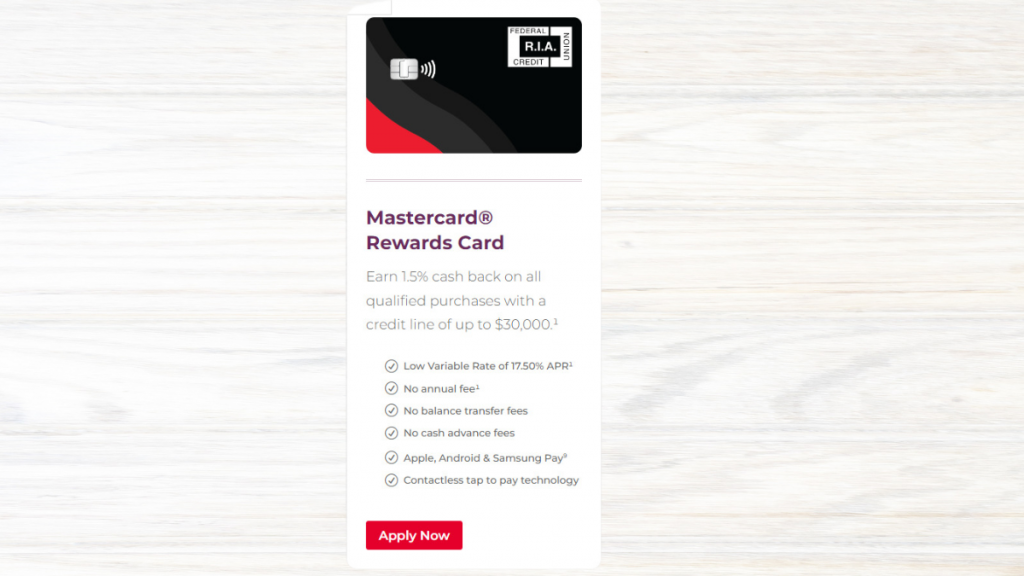

R.I.A. Federal Credit Union Mastercard® Rewards Card Review

Get the low down on how you can save and earn rewards with the R.I.A. Federal Credit Union's Mastercard® Rewards Card!

Advertisement

Cashback on all purchases and no annual fees

Looking for a credit card that lets you earn rewards on every purchase? The R.I.A. Federal Credit Union Mastercard® Rewards Card of this review might be just what you need.

R.I.A.F.C.U. Mastercard® Rewards

Unlock the potential of shopping with the R.I.A. Federal Credit Union Mastercard® Rewards Card! Apply today and start saving big!

With this card, you can earn rewards on everything from groceries and gas to travel and dining out. So check out!

- Credit Score: 680 or higher (good to excellent);

- Annual Fee: $0;

- Purchase APR: 17.50% – variable;

- Cash Advance APR: Not disclosed;

- Welcome Bonus: None;

- Rewards: 1.5% of cashback on selected purchases.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

R.I.A. Federal Credit Union Mastercard® Rewards Card: how does it work?

The R.I.A. Federal Credit Union Mastercard® Rewards Card is a credit card that offers a straightforward and easy-to-understand rewards program.

Thus, cardholders can earn 1.5% cashback on selected purchases.

To qualify for the R.I.A. Federal Credit Union Mastercard® Rewards Card, applicants need a credit score of 680 or higher, which is considered good to excellent.

Once approved, cardholders can enjoy a low purchase APR of 17.50%, which is variable and subject to change based on market conditions.

Additionally, there is no annual fee, making this card an affordable option.

R.I.A. Federal Credit Union Mastercard® Rewards Card: should you get one?

If you are looking for a rewards credit card with no annual fee and a low purchase APR, this card could be a good option for you.

However, it’s important to note that the card is only available to members of R.I.A. Federal Credit Union.

Additionally, the 1.5% cashback reward on selected purchases may not be as high as some other reward cards on the market. Further, check the pros and cons:

Advertisement

Pros

- No annual fee;

- Earn rewards on every purchase;

- No Cash Advance Fees;

- Manage your account online or through the mobile app.

Cons

- Requires a good to excellent credit score.

Advertisement

Credit score required

To qualify for the R.I.A. Federal Credit Union Mastercard® Rewards Card, you’ll typically need a good to excellent credit score. This means a score of 670 or higher.

R.I.A. Federal Credit Union Mastercard® Rewards Card application: how to do it?

Overall, the R.I.A. Federal Credit Union Mastercard® Rewards Card is an excellent choice for those who want to earn rewards on everyday purchases.

Thus, to apply for the R.I.A. Federal Credit Union Mastercard® Rewards Card, simply visit their website and complete the online application.

Also, you will need to provide some basic personal and financial information, including your annual income and housing status.

So, learn more about the process with the post below.

R.I.A.F.C.U. Mastercard® Rewards

Unlock the potential of shopping with the R.I.A. Federal Credit Union Mastercard® Rewards Card! Apply today and start saving big!

Trending Topics

Surge® Platinum Mastercard® credit card review: credit limit even for the lowest scores

Read the Surge® Platinum Mastercard® credit card review. This card comes with zero fraud liability and the ability to repair your credit score

Keep Reading

Total Visa® Credit Card review: Visa card for people with poor credit

The Total Visa® Credit Card targets your bad score. Rebuild credit. Get it right now with an online application. Check it out!

Keep Reading

Learn how to download the Colorfy App and manage your anxiety and stress

Discover how to download the Colorfy app to have a little more anxiety control with painting. Keep reading!

Keep ReadingYou may also like

Learn to apply easily for Sallie Mae Student Loan

Are you looking to apply for the Sallie Mae Student Loan but don’t know where to start? We are going to help you get your loan today!

Keep Reading

Apply for Delta SkyMiles® Blue American Express Card easily

Learn how to apply for the Delta SkyMiles® Blue American Express Card - earn 10K bonus miles and pay $0 annual fee! Read on and learn!

Keep Reading

Apply for the Verizon Visa® Card: enjoy no annual fee

You can apply for a Verizon Visa® Card easily! Earn up to 4% cash back with no annual fee! Read on and learn more!

Keep Reading