Credit Cards

Apply for the Capital One Venture X Business: The Easy Way!

Create more opportunities to earn miles with employee cards! We'll tell you how to apply for the Capital One Venture X Business card to maximize your rewards!

Advertisement

Complete Your Application in Three Simple Steps!

Do you want to discover -the easiest and most complete way to apply for the Capital One Venture X Business? Here you go!

We’ve divided the application forms into three parts so you can be sure to include all the important details. Keep reading to learn more!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The Capital One Venture X Business credit card offers up to 10 miles on travel purchases, making your trips more affordable.

To apply for the Capital One Venture X Business, visit Capital One’s website and fill out the application form on the official page for the card.

Here are the parts of the application you can expect:

1. Personal Information

Make sure to provide:

- Email address;

- Primary phone number;

- Legal first name;

- Ml;

- Legal Last Name;

- Date of birth;

- SSN;

- Residential Address.

Advertisement

2. Business Information

Then, fill out the business information. To start, select the business role. After that, insert the annual income and monthly rent/mortgage value.

Capital One also asks you whether you use your credit card for cash advances. Furthermore, provide:

- Business legal structure;

- Legal Business Name;

- Business name to appear on the card;

- Business Address;

- Business Phone number.

Additional Business Information

The form also requires the ownership type, Employer Identification Number, the business is age, and the business industry.

Still, you need to inform the business revenue and spend per month and if your business is headquartered in the U.S.

Advertisement

3. Mailing Information

Then, select where you’d like your card mailed. Finally, read and agree to the terms and continue to submit your application.

Apply using the app

Capital One’s mobile app is a great way to manage your account. However, for new credit card applications, you must visit their website.

Capital One Venture X Business vs. American Express Blue Business Cash™ Card

Choosing a credit card that matches your business style is paramount if you’re a business owner.

The Capital One Venture X Business card and the American Express Blue Business Cash™ card are two popular options.

Both offer rewards and benefits, but they have different features to consider.

So, to decide which card is best for your businessconsider each card’s main featuresch.

Capital One Venture X Business

- Credit Score: Excellent;

- Annual Fee: $395;

- Purchase APR: 0% if you pay your balance in full every month, or 2,99% on outstanding statement;

- Cash Advance APR: Not disclosed; Cash advance fee is Either $5 or 5% of the amount of each cash advance, whichever is greater.

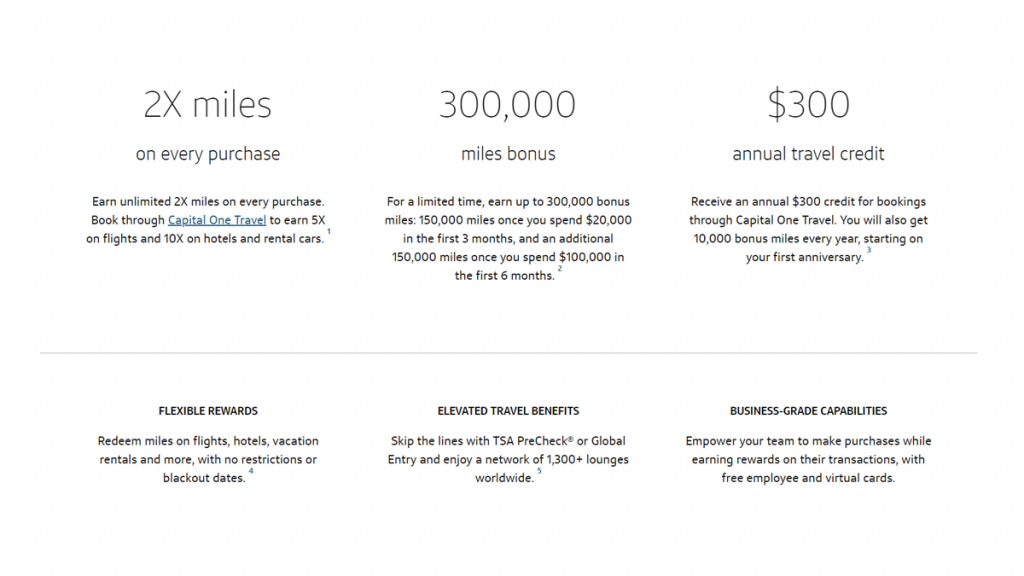

- Welcome Bonus: For a limited time, earn up to 300,000 bonus miles: 150,000 miles once you spend $20,000 in the first 3 months, and an additional 150,000 miles once you spend $100,000 in the first 6 months;

- Rewards: 2 miles on all purchases, 5 miles on flights booked through Capital One Travel, and 10 miles on hotels and car rentals through Capital One Travel.

American Express Blue Business Cash™ Card

- Credit Score: Good-excellent;

- Annual Fee: $0;

- Purchase APR: 0% intro APR on purchases for 12 months of account opening, then 18.49% – 26.49%;

- Cash Advance APR: N/A;

- Welcome Bonus: Earn a $250 statement credit after spending $3,000 in purchases during the first 3 months of account opening;

- Rewards: 2% cash back on eligible business purchases (up to $50k per calendar year), 1% on all other eligible purchases after the first $50k spent on your credit card.

Keep reading to learn how to apply for the American Express Blue Business Cash™ Card.

Apply for The American Express Blue Business Cash™

Follow this guide to apply for The American Express Blue Business Cash™ Card, and make the most out of your business expenses. Read on!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Trending Topics

Southwest Rapid Rewards: a complete guide

Get reward flight information, know how to earn maximum points, details of the new changes, and more. Learn about Southwest Rapid Rewards!

Keep Reading

Apply for First Citizens Bank Cash Rewards Card: Earn back

Earn 1.5% on every swipe! Learn how to apply for the First Citizens Bank Cash Rewards Credit Card now and secure cash back on all purchases!

Keep Reading

Get financial fitness with 7 steps: put your finances in shape!

If you don't know how to manage your money, you need to learn these steps to financial fitness. Your future self will thank you later.

Keep ReadingYou may also like

$0 annual fee: Apply for Navy Federal Platinum Credit Card

If you have questions on how to apply for the Navy Federal Platinum Credit Card, know that it is not rocket science - no hidden fees!

Keep Reading

How to buy cheap Southwest Airlines flights

Get the scoop on how you buy cheap Southwest Airlines the next time you travel. Find where to look and how to save your cash. Read on!

Keep Reading

Colorfy App review: Unlock your creativity and release stress!

Looking for a creative and relaxing way to spend your free time? See this Colorfy App review. Keep reading!

Keep Reading