Reviews

GO2bank™ review: is it the best choice for you?

Are you looking for a better banking experience? Look no further than GO2bank™. Read our GO2bank™ review!

Advertisement

GO2bank™: FDIC-insured online bank to protect your money

Do you like online banking? Then you can’t miss the GO2bank™ review we’ve prepared for you. With this mobile app, you can bank from anywhere your smartphone goes.

And since it’s always password-protected, your finances are safe and secure. So you can have peace of mind and enjoy all its features.

How to apply to GO2bank™

GO2bank™ came to make your life easier. Find out about the application process, and have access 24/7 to your account on your phone. Read on!

In addition, with GO2bank™, there are no hidden fees, so you won’t be fooled.

If you want to discover all of this online bank’s advantages, how it works and much more, keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

GO2bank™: the ultimate banking app?

GO2bank™ is an online bank that aims to simplify banking and ease the processes for its clients.

On the bright side, the GO2bank™ app is available for free. Also, you can get up to 7% cash back on gift cards.

This online bank is safe because it’s FDIC-insured. So you can make transactions and move and control your money without worries.

It comes with a fraud alert, and also you can choose to lock and unlock your account anytime.

Still, it charges no monthly fee if you make a direct deposit or $5 monthly if you prefer.

You can also pay your bills and get a free ATM right from the app.

And the direct deposit might prevent you from paying overdraft fees if you opt for it. Still, you can get your pay up to two days early. Just make sure you set it in the app.

On the other hand, as with any bank, you’ll have to pay some fees. Then, you might be charged a 3% foreign transaction fee and a $3 per transaction in teller cash withdrawal.

GO2bank™: should you start banking with it?

GO2bank™ is a new online banking service that promises to be convenient, easy to use, and secure.

But is it really worth signing up for? Let’s take a closer look at the pros and cons of GO2bank™ to help you make a decision.

Advertisement

Pros

- Overdraft protection up to $200 with opt-in and eligible direct deposit*

- No monthly fees with eligible direct deposit, otherwise $5 per month

- Earn up to 7% cash back when you buy eGift Cards in the app

- Get your pay up to 2 days early – Get your government benefits up to 4 days early.*

- High-yield savings account, 4.50% APY paid quarterly on savings up to $5,000.*

- Terms apply.

Cons

- $3 teller cash withdrawal fee;

- 3% foreign transaction fee;

Advertisement

Credit scores required for the GO2bank™ products

If you’re looking for an online bank that’s available to everyone, regardless of credit score, GO2bank™ is a great option.

Their secured card can be used for everyday purchases, so it’s perfect for those who want to build up their credit or establish financial independence.

Plus, there are no hidden fees, and you can do everything online so that you can use it without worry.

GO2bank™ application: how to do it?

If you’re interested in the GO2bank™ review, make sure to check out the post about its applications.

You’ll learn all about how this innovative tool can help you manage your finances better. Below, you’ll find our post. Check it out!

How to apply to GO2bank™

GO2bank™ came to make your life easier. Find out about the application process, and have access 24/7 to your account on your phone. Read on!

Trending Topics

Can you get a credit card with no job?

Need a credit card but don't have an income? Find out if you can get a credit card with no job, and explore your possibilities. Read on!

Keep Reading

Student credit cards for no credit: top 4 options

Don't have a credit history? Check out our list of the best student credit cards for no credit, and start building your credit today.

Keep Reading

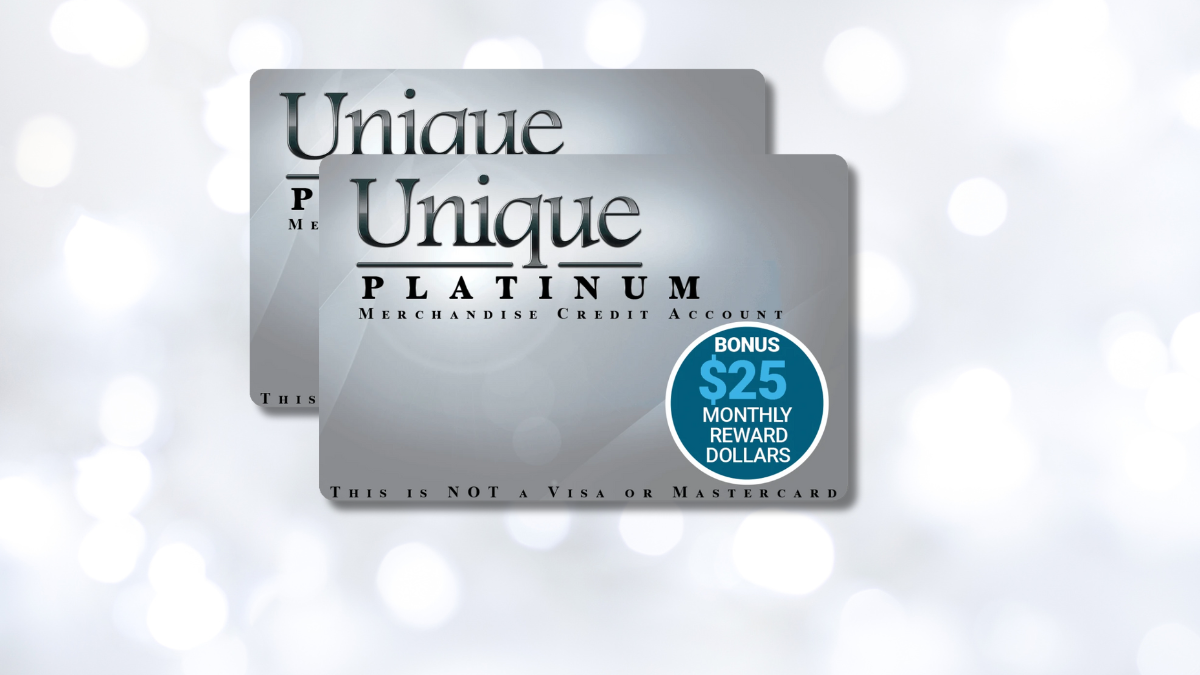

Unique Platinum Card review: Elevate your spending power

Looking to elevate your spending power? Then don't miss our Unique Platinum Card review! 0% APR and amazing benefits! Read on!

Keep ReadingYou may also like

Southwest Rapid Rewards® Premier Credit Card review

Want affordable travel? Our Southwest Rapid Rewards® Premier Credit Card review reveals how to earn points and travel more for less!

Keep Reading

6 Best Online Checking Accounts: Maximize Your Money Management

Discover our top picks for the best online checking accounts of 2023. Read on to learn how to select the best one for you!

Keep Reading

Bull vs bear market explained: understand how they affect you

In this article, we explore the bull vs. bear market, how they can impact your investments and the current state of the markets in the USA.

Keep Reading