Reviews

Application for the GO2bank™: how does it work?

Here is a full review about the GO2bank™ application process. Learn who is eligible for an account, and how you can apply online today. Read on!

Advertisement

GO2bank™: free and quick application in the app

GO2bank™ promises to be the ultimate banking app that will make your life easier. Its free application aims to facilitate your money management.

If you’re trying to stay on top of your bills or just want an easy way to see where your cash is going, GO2bank™ is the app for you!

With features like budgeting and bill tracking, GO2bank™ can help make your financial planning easier than ever.

So, if you want to know how to apply for this online banking service, stay with us. In this post, you’ll find everything you need to know.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

The first thing you need to know is that if you want to apply for the GO2bank™, you should be at least 18 years old and a resident of the US.

The application can be made online or through the GO2bank™ app, which you’ll find available for download and compatible with both Android and iPhone.

Once you meet the requirements, you can follow the steps of their app to apply. There, you’ll need to share personal and financial information.

After you submit your application, if you are approved for this bank, you’ll receive a confirmation email.

After that, you can start using the account, make direct deposits, and require a secured credit card in the app or online. Easy, right?

Apply on the app

The online banking account application can be made online or on your smartphone. You only need to follow the guide above.

The GO2bank™ app is available for free on the Playstore and Apple Store. Just download the app and go through the application process, following the steps recommended.

Advertisement

GO2bank™ product recommendation: GO2bank™ Secured Visa® Credit Card

The GO2bank™banking app offers GO2bank™ Secured Visa® Credit Card. It comes with no annual fee.

Also, it’s available for everyone, even if you have bad credit. So you can apply on the app and still enjoy the security and convenience of a credit card without worrying about the costs.

If you feel like applying for one, make sure you read the table with the information on its main features, fees, and overall costs.

| GO2bank™ Secured Visa® Credit Card | |

| Credit Score | Available to all credit scores |

| Annual Fee | $0 |

| Regular APR | 22.99% variable APR for purchases and 26.99% variable APR for cash advance |

| Welcome bonus | None |

| Rewards | Up to 7% cash back if you buy the gift cards recommended on the app |

Below, you will find a link to the application process for this secured card. Make sure you check it out!

How to apply to GO2bank™ Secured Visa® card?

The GO2bank™ Secured Visa® Card is available for rebuilding your credit. Learn about the application requirements and how to apply online!

Trending Topics

Learn how to download the Dare App and manage your anxiety and stress

Find out how to download the Dare app to manage your anxiety issues and panic attacks. Keep reading to start!

Keep Reading

HSBC Premier Checking review: Is the 75,000 minimum balance worth it?

This HSBC Premier Checking review brings a scoop on account details, benefits, drawbacks, and more. Open your account for free. Read on!

Keep Reading

OpenSky® Secured Visa® Credit Card review

Learn about the OpenSky® Secured Visa® Credit Card in this review: start a path to a better financial future and build your credit history.

Keep ReadingYou may also like

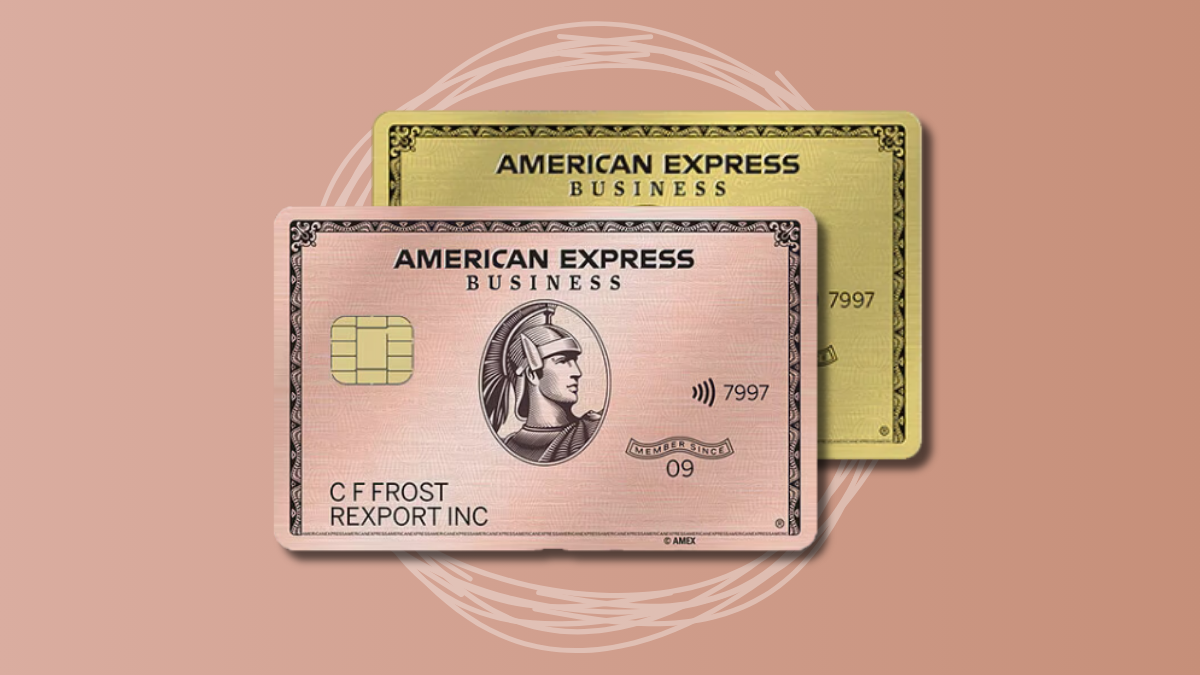

Gold benefits: American Express® Business Gold Card review

Read our American Express® Business Gold Card review and discover why this card is a must-have! Earn 70k bonus points and more!

Keep Reading

Learn to apply easily for CashUSA.com

Ensure you know how to apply for the CashUSA.com personal loan and get the best rates for your needs. Find out more! Up to $10k!

Keep Reading

Refinancing a car: learn the pros and cons

Are you wondering what are the pros and cons of refinancing a car? Wonder no longer! Read our full article and learn more!

Keep Reading