Accounts

6 Best Online Checking Accounts: Maximize Your Money Management

Feeling overwhelmed by online checking options? Our guide simplifies your search! Compare features, rates, and fees to find the best online checking accounts for your finances. Start saving now!

Advertisement

Access your funds anytime, anywhere with an online account

Are you fed up with bank lines and hidden fees? Open the door to convenience with online checking accounts- we’ll show you the best picks of 2023.

Upgrade Rewards Checking application

Get ready to take advantage of our Upgrade Rewards Checking! Apply now and enjoy no hidden fees and cash back on expenses! Read on!

With 24/7 access from anywhere, online checking accounts offer many perks over traditional ones. See the key benefits of online checking accounts and tips for choosing. Read on!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Best Online Checking Accounts

Do you want to access your money anytime, anywhere, without unfriendly bank tellers and high fees? With online checking accounts, it’s possible!

However, with so many options, it can be overwhelming to figure out which is the best fit for you. It’s like trying to navigate a maze.

So, here is our list of the best online checking accounts for 2023. Have a look!

1. Capital One 360 Checking

This checking account charges no monthly fees, minimum balance, or overdraft fees, making it ideal for budget-conscious folks.

Advertisement

Pros

- Earn interest

- Free ATM access at thousands of locations

- Access direct deposit paycheck two days earlier

- FDIC insured

Cons

- Lower APY compared to some competitors (0.10%)

- No bonus

Advertisement

Fees

- None, except for out-of-network ATM charges

2. SoFi Checking & Savings

Sofi Checking & Savings is a mixed account in our list of the best online checking accounts.

It offers up to 15% cash back and a bonus between $50 and $300, depending on your direct deposit during the first 30 days.

Pros

- Boasts a high APY on both checking (0,50%) and savings (4.60% )

- No monthly fee

- Send seamless integration with their investing platform

- Bonus of up to $250

- FDIC insured

- No overdraft fees

Cons

- Requires direct deposit to earn interest on checking

Fees

- None, except for out-of-network ATM charges

3. Axos Bank Rewards Checking

With this account, you can earn a $300 welcome bonus and up to 3,30% APY.

Pros

- Earn cash back on debit card purchases

- Unlimited reimbursement for ATM fees

- No monthly fees

- FDIC insured

Cons

- Requires a minimum deposit to earn rewards

Fees

- None, except for out-of-network ATM charges and insufficient funds fees

Apply for Axos Bank Rewards Checking Account

Looking for easy checking account application? Discover how Axos Bank Rewards Checking Account process works, and start earning today.

4. LendingClub Rewards Checking

These checking account sellings include a cashback rate (1% on all qualified purchases) and unlimited ATM fee reimbursement. The APY is 0.10%.

Pros

- Earn up to 1% cash back on eligible purchases

- No monthly fees, minimum balance, or overdraft fees

- Get early access to your paycheck with direct deposit

Cons

- Lower APY than some competitors (0.10%)

- No bonus offers

Fees

- Opening fee: $100

5. American Express® Reward Checking

Amex customers can get a decent interest rate and access a wide free ATM network. Also, there’s no monthly fee. The APY is 1.00%.

Pros

- Earn Membership Rewards® points on eligible purchases, redeemable for travel, shopping, and more

- No monthly fees or minimum balance requirements

- Get access to Amex benefits and perks

Cons

- Requires an Amex card for full benefits

- No overdraft protection

- No bonus

Fees

- Out-of-network ATM charges

- Foreign transaction fees

6. Ally Bank Interest Checking

With the Ally Bank Interest Checking, you’ll earn interest, access a good app, and make transfers.

About the APY, the interest rate is 0.10% for account balances less than $15,000 and 0.25% for balances greater than $15,000.

Pros

- No monthly fees, minimum balance, or overdraft fees

- Free ATM access at Allpoint ATMs

- Extensive online banking features

- Get paid earlier

- FDIC insured

Cons

- No bonus offers

- Limited physical branch network

Fees

- None, except for out-of-network ATM charges and foreign transaction fees

Overall, the best online checking account is the one that aligns with your specific needs and financial goals.

So, carefully compare features, fees, and benefits before deciding.

Pros of having an online checking account

Here are some pros of online checking accounts that’ll make your wallet sing.

1. Convenience

Firstly, you can access your money anytime, anywhere, with just a click or tap.

2. Almost no fees

Secondly, many online accounts offer zero monthly fees and even reimburse ATM fees.

3. More bang for your buck

Earn higher interest rates than traditional banks, so your money grows while you sleep.

4. Tech-powered tools

Finally, budgeting apps, bill pay, and even investment options are just a tap away, making managing your money a breeze.

Cons of having an online checking account

Here are some cons that you might need to consider.

1. Tech dependence

Firstly, some online checkings are from online banks, which do not have physical branches for those who prefer a face-to-face chat.

However, online chat and phone support are just a click away.

2. Security savvy

Secondly, you must be vigilant about online security and fraud protection.

Strong passwords and as well as a healthy dose of skepticism are your best friends.

Choose your 0% APR card

Select an option below and we will recommend you the best 0% APR card based on your preferences.

3. Limited customer service

Finally, there is no hand-holding at the bank, but most online platforms offer helpful FAQs and 24/7 support.

So it can be harder to solve some issues face to face.

How to choose the best online checking account for you?

Choosing the best online checking account is like finding the perfect pair of jeans – it’s all about fit.

So, picking of the litter, you must consider your needs:

- Budget: Do you prioritize low fees or high APY?

- Spending habits: Do you need rewards or budgeting tools?

- Tech savviness: Are you comfortable with online banking platforms?

Once you’ve answered these questions, then compare the features and fees of the top contenders.

That is how to find a checking account that works for you. Remember, the best online checking account is the one that helps manage your money.

So, shop around, compare options, and choose the perfect financial partner to unlock your potential!

How can you open an online checking account?

Opening an online checking account is easy. Most banks offer simple online applications with quick approvals.

So, you just need to follow the guide below.

- Firstly, gather your documents.

- Then download the app, or visit the bank’s website.

- After that, follow the prompts.

- Finally, confirm your information by email.

Voila! You’re on your way to open an online checking account, and start using it.

Boost your score now: Discover the credit card that fuels your financial freedom in our post below.

5 best credit cards to build credit

If you're looking for the best way to start your credit, look no further than our list of the top credit cards to build credit score.

Trending Topics

How to start investing with Ally Invest?

In this step-by-step guide, we are going to show you how to apply for an Ally Invest account and start investing as soon as possible.

Keep Reading

Is The Mad Capitalist safe?

The Mad Capitalist is a content and education company that provides information about financial products and services - with safety in first!

Keep Reading

First Progress Platinum Elite Mastercard® Secured Credit Card review

Ready to start improving your credit? The First Progress Platinum Elite Mastercard® Secured Credit Card is a good way to get started!

Keep ReadingYou may also like

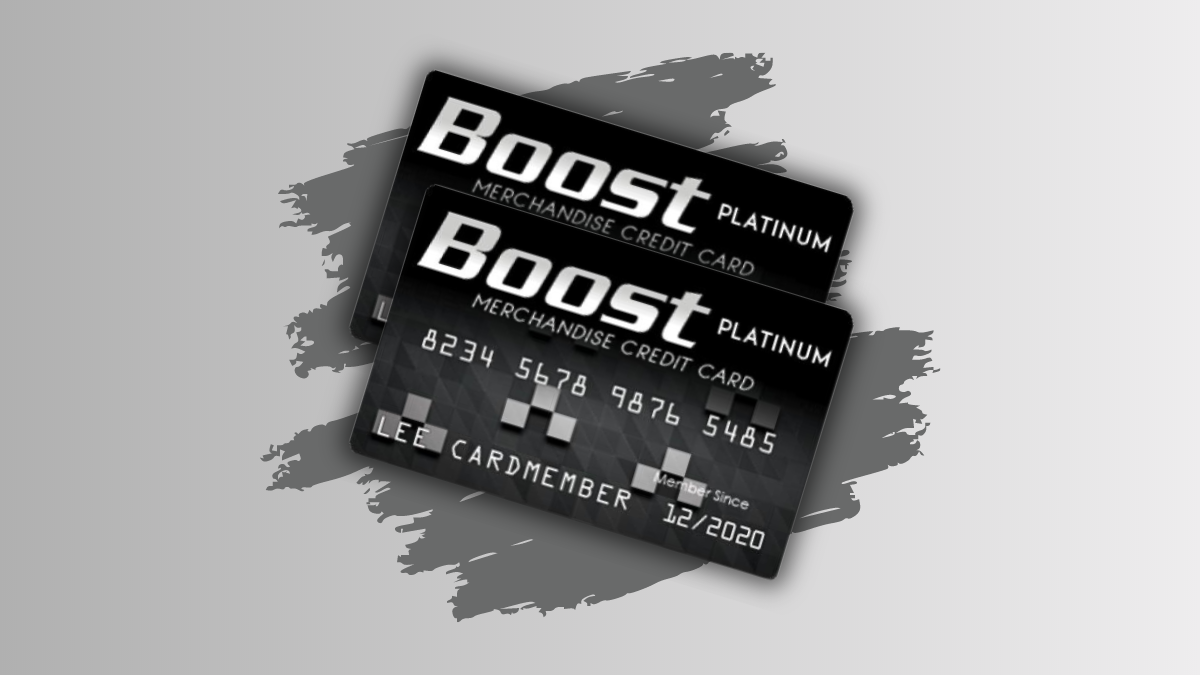

BOOST Platinum Card Review: Is it worth it?

Shop with the BOOST Platinum Card and enjoy $750 merchandise credit. No credit checks, perfect for low scores. Financial flexibility awaits!

Keep Reading

Deserve® EDU Mastercard for Students application: how does it work?

You want a student credit card with no fees and cash back? Learn how to get it with this Deserve® EDU Mastercard for Students application!

Keep Reading

Checklist for moving out of state: your definitive guide

Are you packing up and relocating to another state? Check off all the to-dos with this moving out of state checklist.

Keep Reading