See a card that can give you great perks for shopping at Old Navy!

Old Navy card: for fashion enthusiasts, make the best out of your shopping with reward points and discounts

Advertisement

The Old Navy card gives you exclusive access to sales and discounts. The GAP Inc. brands are constantly bringing you new tendencies in fashion, and you’ll receive reward points every time you shop at any of these stores. You can turn your points into a gift card for your loved ones or even for yourself. You deserve it!

The Old Navy card gives you exclusive access to sales and discounts. The GAP Inc. brands are constantly bringing you new tendencies in fashion, and you’ll receive reward points every time you shop at any of these stores. You can turn your points into a gift card for your loved ones or even for yourself. You deserve it!

You will remain in the same website

These are some of the exclusive benefits for the Old Navy cardholders:

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Transform your fashion shopping spree into a rewarding experience with the Old Navy Card.

Perfect for those who love staying on-trend without breaking the bank, this card integrates style, savings, and exclusive benefits into your everyday purchases at Old Navy and its affiliated brands.

Strengths and Special Offerings

- Reward Points on Purchases: For every dollar spent at Old Navy and its sister brands, earn points that convert into reward dollars, ensuring your shopping is full of savings.

- Welcome Bonus: Jumpstart your rewards journey with a lucrative one-time discount on your first purchase, making your initial shopping spree even more satisfying.

- Exclusive Offers and Discounts: Cardmembers are treated like VIPs, enjoying special shopping hours, exclusive offers, and bonus point shopping days.

- Birthday Bonus: Celebrate with style! Enjoy a birthday treat each year, adding joy to your special day.

- Easy Online Account Management: Track your rewards, view statements, and make payments through a convenient online account, accessible anytime, anywhere.

- No Annual Fee: Indulge in your fashion favorites without the burden of an annual fee, making shopping a more enjoyable experience.

- Bonus Points Shopping Days: Multiply your rewards with special shopping days where you can earn additional points on your purchases, accelerating your rewards.

Limitations to Consider

- High APR: The card comes with a relatively high APR, indicating that carrying a balance could lead to substantial interest charges, potentially offsetting any discounts or rewards.

- Limited Usability: Rewards and benefits are primarily confined to Old Navy and its partner brands, which might limit your spending flexibility compared to other cards.

- Credit Score Impact: Too many retail store cards might negatively affect your credit score, and the temptation to spend for rewards could lead to unwanted debt.

- Rewards Expiration: The reward points expire, requiring you to stay active and redeem your points within the specified period to avoid losing them.

- Late Payment Fee: There's a fee for late payments, which, aside from additional costs, could also impact your credit history if not managed properly.

Embrace a world where fashion and rewards merge with the Old Navy Card. While catering specifically to fans of Old Navy and its affiliates, the card turns shopping trips into opportunities for exclusive perks, making it a chic addition to your wallet.

However, the key is responsible spending; the high APR demands prompt payments to truly reap the benefits without the sting of interest. Fashion aficionados, this might just be your perfect shopping partner!

You may need to have a very high credit score to get the Old Navy card. Therefore, before you start applying for this credit card, you'll need to check if you have a good credit score.

You'll be able to use your Old Navy card at any place that belongs to the Gap brand, such as Old Navy, Gap, Banana Republic, Hill City, Athleta, and others! Therefore, if you love to shop at these places, this can be an incredible card for yout finances!

You won't need to pay an annual fee to use the Old Navy card. However, you may need to pay some common credit card fees, and you'll need to pay APR fees and others.

Application for the Old Navy card

It is easy to apply for the Old Navy credit card. If you want to make the best out of your purchases at GAP Inc. brand stores, keep reading to learn how to get your card.

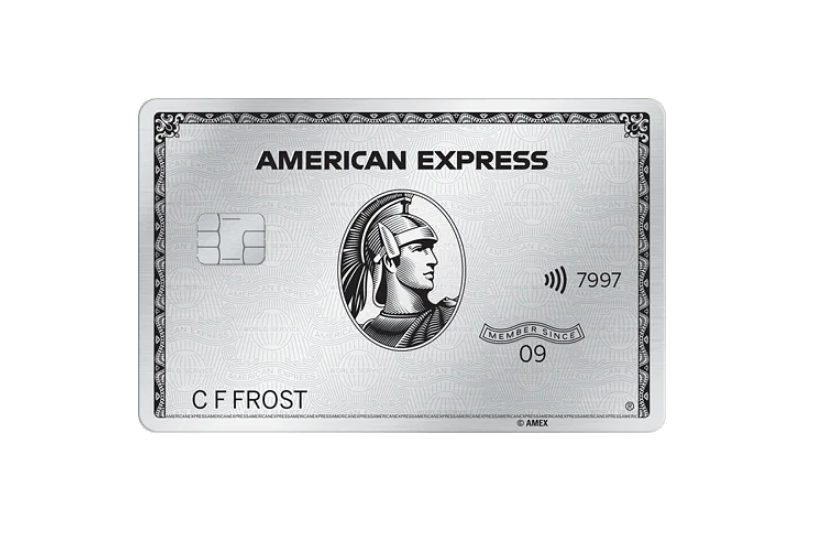

If you're not looking for the features of the Old Navy card, you can try applying for the Platinum Card® from American Express!

With this card, you'll get some of the best perks related to travel and more! Therefore, you can read our post below to learn more about this card and see how to apply!

Application for The Platinum Card® from Amex

The Platinum Card® from American Express is worth the price if you enjoy its perks. You can count on benefits at airlines, hotels, entertainment, and rental services!

Trending Topics

Southwest Rapid Rewards® Priority Credit Card review

Get an in-depth Southwest Rapid Rewards® Priority Credit Card review to drop the hammer about this card. Read on!

Keep Reading

Crafty in Minutes: 6 Incredible Apps to Learn Crochet

Master the art of crocheting with ease! Learn to crochet with the best apps and create unique projects. Start your exciting journey now.

Keep Reading

Learn 10 great ways to make extra money while staying at home

Are you looking for ways to make extra money at home? Search no more. This article has fantastic suggestions for you. Learn more reading it!

Keep ReadingYou may also like

750 credit score: what does it mean?

Your credit score is essentially your financial identity. Discover the advantages of a 750 credit score and how to achieve it!

Keep Reading

Upgrade Cash Rewards Visa® review

The Upgrade Cash Rewards Visa® is perfect for you who need a higher credit limit. Enjoy a card with no annual fee and cash back!

Keep Reading

Capital One Guaranteed Mastercard® Credit Card Review

Explore our in-depth Capital One Guaranteed Mastercard® review to discover its features, benefits, and suitability for your financial needs.

Keep Reading