See a credit card that can give you perks to build credit while purchasing at the Horizon Outlet!

BOOST Platinum Card, the smart choice for building credit

Advertisement

Are you looking for a store card to rebuild your credit score? If so, the BOOST Platinum Card may be your best choice. This card provides low-interest rates and no credit check. With a limit of $750 for Horizon Outlet purchases, you’ll love what this product has to offer!

Are you looking for a store card to rebuild your credit score? If so, the BOOST Platinum Card may be your best choice. This card provides low-interest rates and no credit check. With a limit of $750 for Horizon Outlet purchases, you’ll love what this product has to offer!

You will remain in the same website

Check below for some of the main features of the BOOST Platinum Card to help you build a better financial future.

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Embark on a journey of financial empowerment with the BOOST Platinum Card®, your beacon through the retail realm, lighting the path to a frictionless buying experience.

This card isn't just a financial instrument; it's a lifeline to accessible credit, designed to augment your purchasing prowess without complexity.

Strengths and Special Offerings

- Uncomplicated Credit Access: With no credit history checks and an instant approval process, accessing credit is as straightforward as a calm sea voyage.

- Generous Unsecured Credit: Avail yourself of a $750 unsecured credit limit, providing a substantial buffer for your online shopping sprees at the MyHorizonOutlet.

- Zero Impact on Credit Score: Rest easy knowing your card usage doesn't report to credit bureaus, keeping your credit score undisturbed and waters unrippled.

- Introductory Benefits: Dive into a sea of perks with benefits like roadside assistance, legal assistance, and daily discount offerings, enhancing your consumer experience.

- Risk-Free Exploration: Navigate the waters risk-free for 7 days, with the option to cancel if the currents don’t flow your way.

- Predictable Fee Structure: A consistent monthly maintenance fee replaces unpredictable interest charges, keeping your financial journey on a steady course.

Limitations to Consider

- Limited Navigational Range: Your purchasing journey is bound within the MyHorizonOutlet, restricting your exploration to a single trading port.

- No Credit Building: The card doesn't report to credit bureaus, missing the opportunity to build your credit reputation through responsible use.

- Monthly Maintenance Fee: Regular fees can add up, like small waves impacting your voyage over time, necessitating careful budgeting.

- Lack of Traditional Card Perks: Expect no cashback, reward points, or airline miles to sweeten your travels, as this journey sticks to practical routes.

- Initial Enrollment Fees: Early voyage stages might be rocky, with fees for setting up your account impacting your initial credit availability.

The BOOST Platinum Card® offers a unique expedition, simplifying access to credit for those seeking calm seas, away from credit score storms.

While it doesn't chart the traditional credit card course, its straightforward nature eliminates unexpected whirlpools in your financial journey.

Ideal for those who prefer to sail within sight of familiar shores, it’s your vessel for serene, albeit limited, retail exploration.

The BOOST Platinum Card can be worth it if you love to make purchases at the Horizon Outlet. However, if you don't make purchases at the Horizon Outlet, you may not like to use this card to get its benefits and perks.

Those with low credit scores or no credit history are the target audience for BOOST Platinum. You may apply for a $750 credit line to spend on your next purchase in just a few minutes. Also, if you like to make purchases at the Horizon Outlet, you'll love this card!

TheBOOST Platinum Card can only be used to make purchases at the Horizon Outlet, unlike most other credit cards, which may be used everywhere online.

Application for the BOOST Platinum Card

Learn how to apply for the BOOST Platinum Card, perfect for consumers looking to rebuild their credit score. This card offers no interest on purchases, a $750 limit!

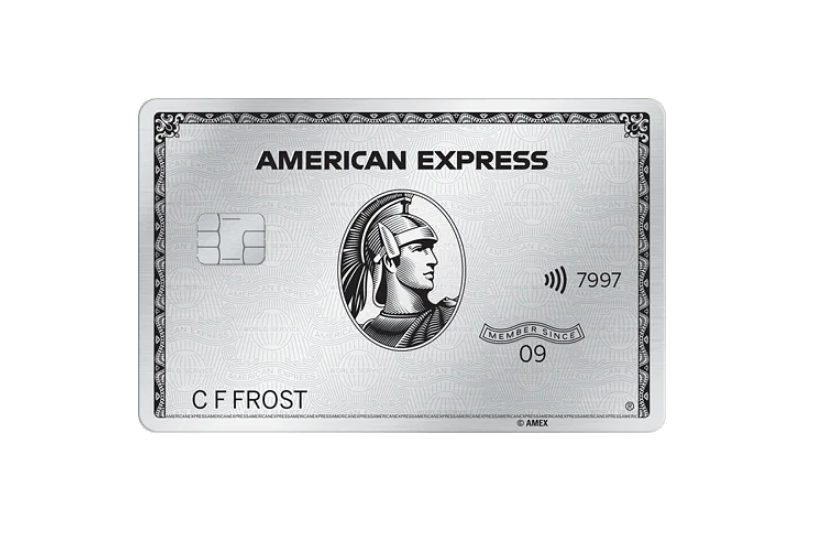

If you're unsure about getting the BOOST Platinum Card, you can try applying for another, such as the Platinum Card® from American Express!

With this Amex card, you'll get even more perks, and you'll be able to make purchases almost anywhere! So, read the post below to learn how to apply!

Apply for the Platinum Card® from American Express

The Platinum Card® from American Express is worth the price if you enjoy its perks. You can count on benefits at airlines, hotels, entertainment, and rental services!

Trending Topics

Capital One Spark Cash Plus application: how does it work?

Capital One Spark Cash Plus is what you need to run your business more easily. Read on to learn how to apply!

Keep Reading

PNC points® Visa® Credit Card review: 100K bonus points

Our review of the PNC points® Visa® Credit Card covers its perks and drawbacks. Read on to learn how you can earn up to 7 points!

Keep Reading

Apply for Axos Bank Rewards Checking Account: simple and quick

Looking for easy checking account application? Discover how Axos Bank Rewards Checking Account process works, and start earning today.

Keep ReadingYou may also like

What is overdraft: the invisible transaction cost

This article will discuss what overdraft fees are, the benefits and risks involved with them, and how to avoid being charged.

Keep Reading

LendingClub Personal Loans review: how does it work and is it good?

This complete LendingClub Personal Loans review will tell you everything you need to know about this online platform. Read on!

Keep Reading

First Progress Platinum Elite Mastercard® Secured Credit Card application

See how to apply for the First Progress Platinum Elite Mastercard® Secured Credit Card, one of the best options to help you build credit.

Keep Reading