See a card that can help you earn cashback and manage your crypto!

Juno Card, receive part of your paychecks in crypto!

Advertisement

If you’re like most people, you’re always looking for ways to save money. That’s where Juno Card comes in – a new debit card application that promises to make your life easier and your wallet thicker with the 5% cash back you’ll earn on eligible purchases. Also, you won’t have to worry about annual fees with it!

If you’re like most people, you’re always looking for ways to save money. That’s where Juno Card comes in – a new debit card application that promises to make your life easier and your wallet thicker with the 5% cash back you’ll earn on eligible purchases. Also, you won’t have to worry about annual fees with it!

You will remain in the same website

Check out the main advantages of having a Juno Debit Card!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Embark on an innovative financial journey with the Juno Debit Card, blending traditional spending with the fascinating world of cryptocurrency.

Enjoy 5% cashback on eligible purchases and the perk of managing and earning crypto seamlessly, all with zero annual fees.

Strengths and Special Offerings

- 5% Cashback: Rewarding financial management with notable savings on every transaction.

- Crypto Affinity: Manage and earn crypto, welcoming financial future readiness.

- No Annual Fees: A cost-free experience in annual card management.

- Inclusive Financial Management: Widespread acceptability across numerous platforms.

- Secure App Usage: Ensuring your financial management is both user-friendly and secure.

- Paycheck in Crypto: Opportunity to receive a portion of your salary in cryptocurrency.

- Real-Time Notifications: Stay updated with instant alerts for all card activities.

- Savvy Spending Management: In-app tools to monitor and manage your spending efficiently.

- Easy Card Lock/Unlock: Ensuring security is at your fingertips in case of card misplacement.

- Global Usability: Use your Juno card worldwide for all kinds of transactions.

Limitations to Consider

- Crypto Volatility: Your assets may be subject to the notorious fluctuations of the crypto market.

- App-Dependent: Necessity to manage your assets via the Juno app.

- Geographic Limitations: Certain features may not be available to all global users.

- Cashback Terms: Conditions apply to the eligibility of 5% cashback, limiting its universality.

- Limited Physical Outlets: Potential restrictions in usage at certain offline stores.

- Cybersecurity Risks: Managing finances online always comes with a risk of cyber threats.

- Learning Curve: Understanding crypto management might be challenging for some.

Navigating through the realms of the financial future is an exhilarating adventure with the Juno Debit Card.

Experience a confluence of traditional and crypto financial management, ensuring your journey through expenditures, savings, and asset management is as contemporary and lucrative as it can be.

Juno is not a bank but rather a fintech startup. Evolve Bank & Trust is an FDIC-insured institution that you can trust. Our banking partner, Evolve Bank and Trust, will insure your cash deposits up to the FDIC limit. Therefore, you can be sure that your money will be safe.

If you love to buy crypto and are looking for a debit card to manage your finances and get cashback, the Juno Debit Card can be a perfect choice! So, you'll be able to earn a high cashback rate for your purchase and spend it at your favorite brands. Also, the OnJuno bank features can be great to help you improve your finances!

There are no transaction fees associated with the Juno debit card. There are no fees for overdrafts or currency conversions. A Basic account user is allowed one free out-of-network ATM withdrawal every calendar month. Therefore, you'll be able to enjoy the features of this card for a few fees.

Juno Debit Card application

Apply for a Juno Debit Card and get all the benefits of a traditional banking account without visiting a physical branch. Read on!

Are you not so sure about getting the Juno Debit Card? Are you looking for a debit card with more simple options? If so, you can try applying for the Sable Card!

With this credit card, you'll be able to earn cashback and pay no fees! Therefore, read our post below to learn how to apply for this card!

Sable Card application

Applying for a Sable card is an excellent idea. Open your account online and get your debit card with no fees. This article will show you how to get a Sable card.

Trending Topics

Choose the best mortgage for your finances

Need help determining which mortgage is best for you? Check out our guide to help you choose your mortgage. Keep reading!

Keep Reading

Certificates of Deposit: what is and how does it work?

Do you have money in a savings account? You should think about certificates of deposit. This content will show you its pros and cons.

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card review: is it legit and worth it?

Petal® 1 "No Annual Fee" Visa® Credit Card will help boost your score. In this post, we'll take a closer look at its benefits!

Keep ReadingYou may also like

100 Lenders personal loan review: how does it work and is it good?

Do you need a personal loan for an emergency or to pay off debt? If so, read our 100 Lenders personal loan review and learn more about it!

Keep Reading

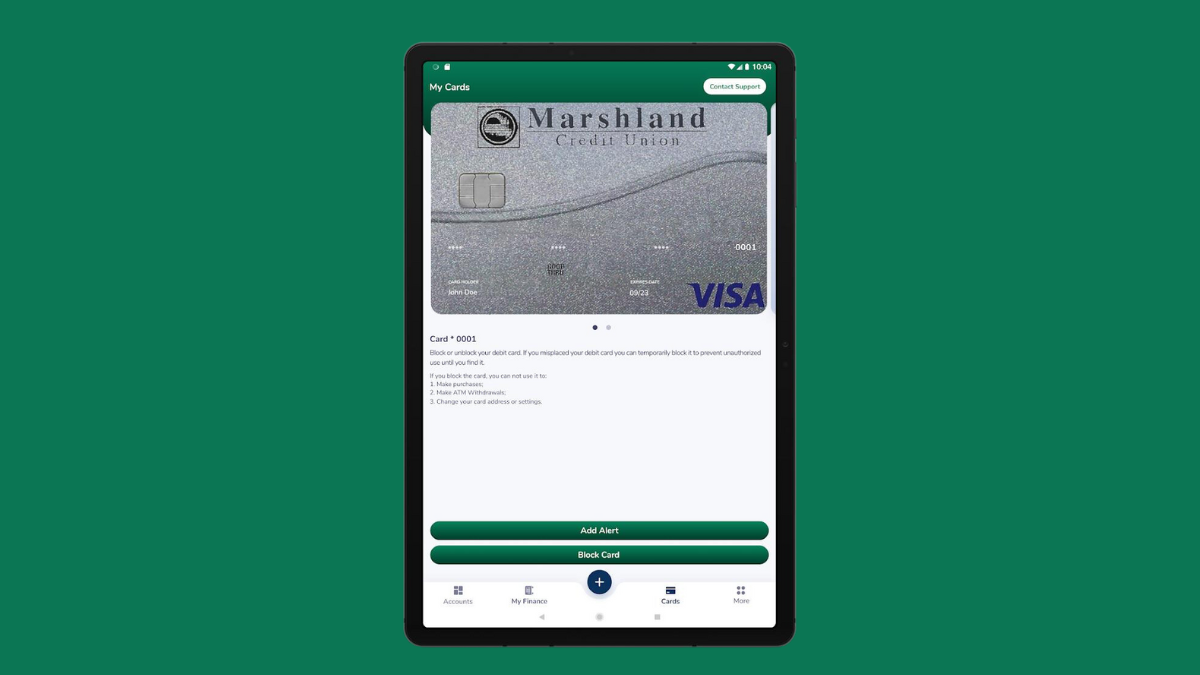

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading

Debt consolidation loan: an uncomplicated guide

A debt consolidation loan may be suitable if you're struggling to cope with the monthly minimums on your credit cards. Find out more here!

Keep Reading