See how you can repair your credit with this secured card!

GO2bank™ Secured Visa® Card: an excellent choice to rebuild your credit!

Advertisement

If you want a secured card with a $0 annual fee, you’ve hitten the gold pot! The GO2bank™ Secured Visa® Card is the perfect choice to rebuild your credit and make purchases online and in-store. Plus, you can get cash back by using the mobile app. And you can manage your card online!

If you want a secured card with a $0 annual fee, you’ve hitten the gold pot! The GO2bank™ Secured Visa® Card is the perfect choice to rebuild your credit and make purchases online and in-store. Plus, you can get cash back by using the mobile app. And you can manage your card online!

You will remain in the same website

That's right, and you won't have to pay an annual fee with GO2bank™ Secured Visa® Card. Check the other benefits of this Visa that are waiting for you.

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Explore financial empowerment and progress with the GO2bank™ Secured Visa® Card, where your journey towards robust credit building is not only encouraged but also nurtured through accessible, user-friendly features and an inclusive financial approach.

Strengths and Special Offerings

- Inclusive Accessibility: Dive into a credit offering that doesn’t discriminate but welcomes various financial profiles, ensuring that credit building is accessible to many.

- Catalyst for Credit Enhancement: Embark on a fruitful path to enhancing your credit score, with responsible usage being reported to the three major credit bureaus.

- Security Deposit as Credit Line: Enjoy a credit line equivalent to your security deposit, ensuring your spending limit is within a manageable spectrum and adapting to your financial capacity.

- User-Friendly App Interface: Manage your account with ease through an intuitive app interface, ensuring that card management is a breeze and not a chore.

- Viable for Everyday Use: Utilize the card for everyday purchases, online shopping, or bill payments, incorporating it seamlessly into your daily financial activities.

Limitations to Consider

- Potential for Fees: Keep an eye out for applicable fees, such as annual charges or other service fees, that might sneak into your credit usage and management.

- Limited Reward Structure: Navigate through a potentially restrictive rewards ecosystem, which might not be as lucrative or diverse as some other credit offerings in the market.

- Initial Deposit Requirement: Be prepared to set aside funds for the initial security deposit, which while establishing your credit line, also necessitates upfront financial allocation.

- Restrictions on Qualifications: The potential for constraints regarding who qualifies, based on their financial and credit history, which might restrict accessibility for certain users.

Straddle the realms of financial security and growth with the GO2bank™ Secured Visa® Card, wherein lies a balanced blend of credit-building efficacy and user-oriented functionality.

Let each transaction be a stepping stone towards stable financial future, navigating through the facets of its offerings and limitations, crafting a credit journey that is reflective and resonant with your financial ambitions.

If you want to qualify for the GO2bank™ Secured Visa® Card, you won't need to meet too many strict requirements. Also, you'll be able to apply for the card even with no credit score because there is no credit check to open your GO2bank™ account. So, you'll need to open your account to apply for the card.

As with many other secured credit cards, the GO2bank™ Secured Visa® Card only requires you to make the minimum security deposit amount to establish your credit limit. Therefore, you'll need to deposit at least $100 to your GO2bank™ account, which will be the same as your credit limit.

When you use a GO2bank™ Secured Visa® Card, you can improve your credit score by making on-time payments and using your card responsibly. This way, GO2bank™ will send your monthly payment reports to the three major credit bureaus!

GO2bank™ Secured Visa® Credit Card application

Find out if you are eligible for GO2bank™ Secured Visa® Card and learn the step-by-step to make your application today and have access to your account anytime!

Do you think you still need to search for different cards other than the GO2bank™ Secured Visa® Card? If so, we can help you understand more about the Total Visa® Card!

With this credit card, you can build or rebuild your credit and easily apply with quick approval! Plus, you can choose your card design and check your credit score for free to keep track of your finances!

So, read our post below to learn more about this card and how to apply for it!

Application for the Total Visa® Card

Learn how to apply for the Total Visa® credit card and get your credit history restored. It is a good solution if you want to rebuild your credit!

Trending Topics

What is a money market account and how to open one?

Learn what a money market account is and how it can help you save money while earning interest. Keep reading!

Keep Reading

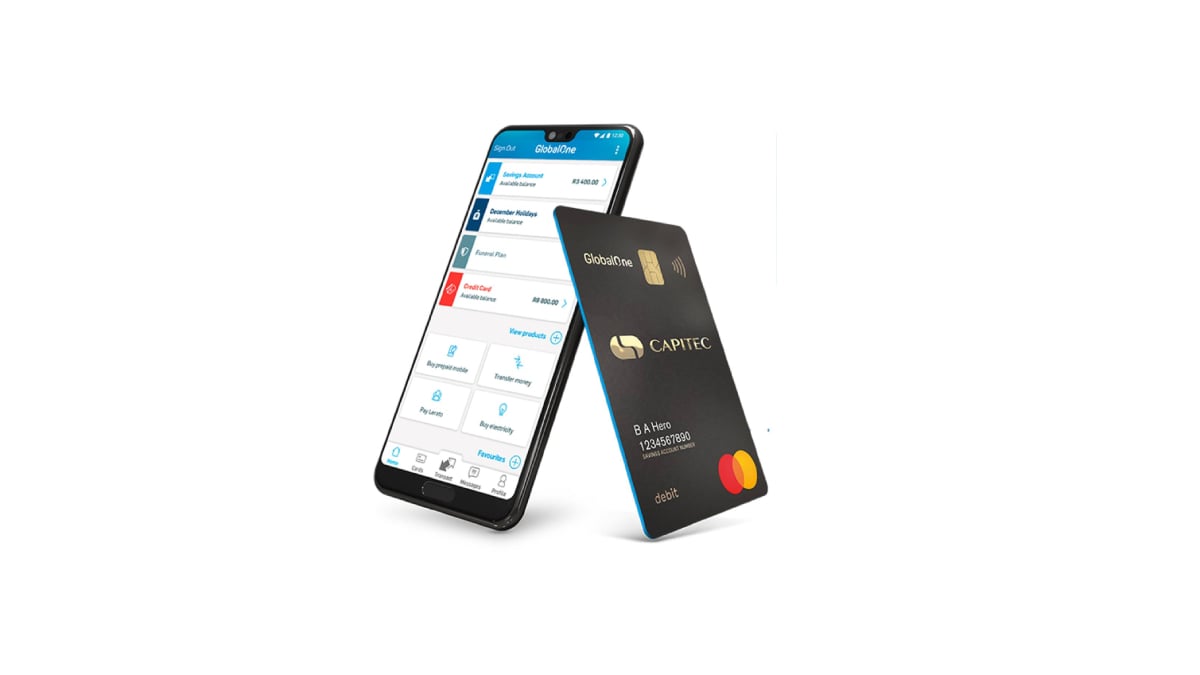

Learn how to download the Capitec Bank App

Find out how to quickly and easily make the Capitec Bank App download. Read on to learn how to enjoy banking online with this app!

Keep Reading

Blaze Mastercard® Credit Card Review: The best tool for building credit

Discover the good and bad of Blaze Mastercard® Credit Card for Building Credit – An honest review to assist in your decision. Read on!

Keep ReadingYou may also like

What can the big 4 of retail business tell us about the average consumer?

The four biggest names in retail have very different outlooks on how and where the average American consumer is spending their money.

Keep Reading

Discover it® Balance Transfer Credit Card application: how does it work?

Get the lowdown on how to apply for Discover it® Balance Transfer Credit Card! Enjoy 0% intro APR and more! Keep reading!

Keep Reading

Apply for Axos Bank Rewards Checking Account: simple and quick

Looking for easy checking account application? Discover how Axos Bank Rewards Checking Account process works, and start earning today.

Keep Reading