Now you can get a car loan in as little as 24 hours – regardless of credit score! Make your dream ride reality without the hassle.

CarLoans.com: You can pick your own terms!

Advertisement

Do you want to get an auto loan, but your score is low? CarLoans.com understands that everyone deserves access to the car of their dreams. That’s why they offer a lending platform with competitive rates and flexible terms, plus a quick application process. Not only this, but CarLoans also commits to helping you rebuild your credit score along the way! Don’t put off your dream car purchase! Explore our post below to understand how this platform works to help you get your loan in less than 24hrs.

Do you want to get an auto loan, but your score is low? CarLoans.com understands that everyone deserves access to the car of their dreams. That’s why they offer a lending platform with competitive rates and flexible terms, plus a quick application process. Not only this, but CarLoans also commits to helping you rebuild your credit score along the way! Don’t put off your dream car purchase! Explore our post below to understand how this platform works to help you get your loan in less than 24hrs.

You will remain in the same website

Are you searching for an auto loan? At CarLoans.com, they offer a variety of unique benefits. Discover the several perks of getting your auto loan through CarLoans.com. Check out below!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Dive into a world where auto financing is streamlined and accessible, with CarLoans.com leading the way!

Serving as a bridge between potential car buyers and lenders, CarLoans.com stands as a beacon of ease and convenience, simplifying the journey to securing that dream set of wheels.

Strengths and Special Offerings

- Wide Network of Lenders: CarLoans.com boasts a diverse and extensive network of lenders, offering borrowers a variety of financing options tailored to different needs and credit profiles.

- Quick and Easy Process: The platform simplifies the application process, enabling users to apply for a car loan in minutes and receive loan offers swiftly.

- Competitive Rates: By connecting borrowers to multiple lenders, CarLoans.com facilitates the possibility of securing competitive interest rates and loan terms.

- All Credit Types Welcome: Whether you have stellar credit, or you’re working to improve it, CarLoans.com accommodates a spectrum of credit histories.

- Educational Resources: The platform offers valuable insights and resources on car financing, empowering users with knowledge to make informed decisions.

Limitations to Consider

- Not a Direct Lender: CarLoans.com is not a direct lender, but a middleman, which might lead to receiving communications from various lenders.

- Varied Terms: Since the terms of the loan depend on the individual lender, users might find discrepancies in loan terms, fees, and conditions.

- Privacy Concerns: Sharing personal information on the platform may lead to receiving marketing communications from third-party companies.

- Lender Specifics: Some users might find the multitude of lenders overwhelming, with varied specifics making the final decision more challenging.

CarLoans.com emerges as a facilitator of smooth and accessible auto financing, opening doors to a variety of lending options and competitive rates.

Despite the challenges of navigating through varied lender specifics and managing communications from multiple entities, the platform stands out for its convenience and inclusivity.

For those stepping into the auto financing landscape, CarLoans.com can be a valuable starting point, weaving a path through the complexities of car loans.

It depends on the lender. Some lenders might require an origination fee, late fee, or early payment fee. Borrowers can visualize their conditions before closing the deal. Each contract varies according to your creditworthiness and financial information. So you must apply to access further information!

It's really fast. If you have all documents on hand, it will take about 2 to 3 minutes to complete the application form. After that, you can finish your application directly to the lender of your choice. So it is a hassle-free process! Please, access their official website for further information!

CarLoans.com only offers auto loans for its applicants. They are an online lending platform, therefore, applicants can apply and connect with several lenders at once. This way, they can compare offers and choose the best one for their financial needs! CarLoans.com is what you're looking for if you want to count on your options and flexibility!

Learn to apply easily for CarLoans.com

Have you been thinking of buying a new car? Then learn how to apply for CarLoans.com! Get approved in 2 minutes! Keep reading!

Looking for other fast loan options? Access quick and competitively-priced personal loans ranging from $100 to $15,000.

Plus, no credit score check is required. Find out what more this service offers by reading our upcoming post today - the perfect resource for any loan-related questions or concerns!

Learn to apply easily for ZippyLoan

Want to apply for a loan with one of ZippyLoan's lenders? Discover how easy it is and make your application today. Get up to $15,000.

Trending Topics

No credit score needed: Apply for Tomo Credit Card

Apply for the Tomo Credit Card today and take advantage of its 0% APR and various discounts and benefits on popular services.

Keep Reading

Learn to apply easily for the Citrus Loans

Are you wondering how to apply for a loan with Citrus Loans? Here are some tips that will help you. Read on!

Keep Reading

Hassle-free experience: Apply for LendKey Student Loans

Learn to apply for LendKey Student Loans and secure your education funding. Plus, discover a student-friendly credit card option!

Keep ReadingYou may also like

Cheap Southwest Airlines flights: Get the best deals on airfare with Southwest Airlines

Find out how to get Southwest Airlines cheap flights. Take advantage of these tips and save big! Keep reading to learn more!

Keep Reading

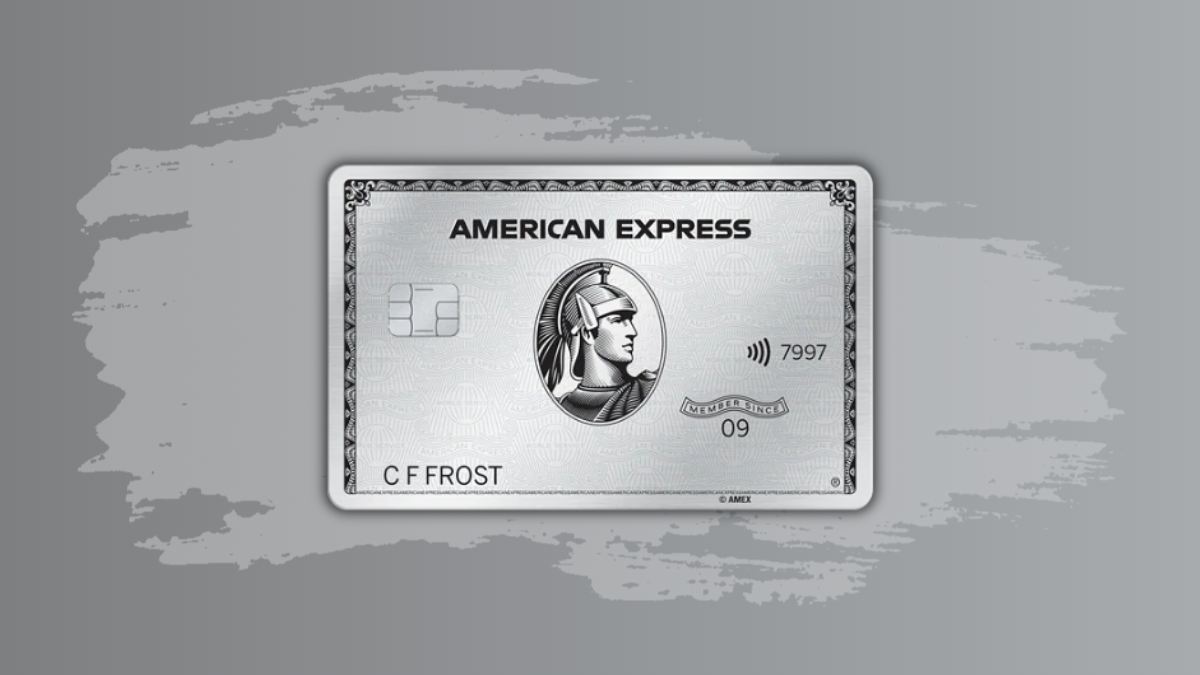

Apply for The Platinum Card® from American Express

It is simple to apply for The Platinum Card® from American Express. If you love getting benefits and traveling the world, apply now for it.

Keep Reading

Apply for the Chase Slate Edge℠ and Improve your Finances!

Want to save money on interest charges? Learn how to easily apply for the Chase Slate Edge℠ with our guidance!

Keep Reading