Loans

Hassle-free experience: Apply for LendKey Student Loans

This guide will show you how to apply for LendKey Student Loans. Ensure up to 100% financing and flexible loan conditions! Read on!

Advertisement

Find out the steps of the online application and requirements

Ready to fund your education? Learn how to apply for LendKey Student Loans and embark on your academic journey with confidence.

See an overview of the application process and requirements for LendKey Student Loans, ensuring you have all the information you need to apply. Keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

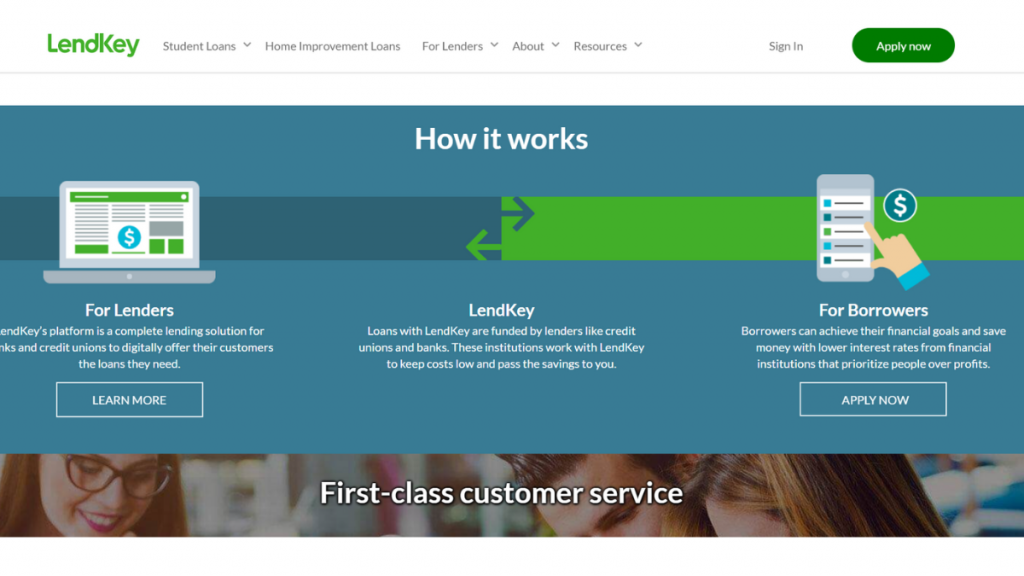

The application process through LendKey is convenient, allowing you to complete it entirely online.

Step 1: Getting Started

Head to LendKey’s website to apply. Choose either to refinance your current loans or finance your education.

Advertisement

Step 2: Filling Out the Application

During the application process, you’ll likely need to submit several documents, including your government-issued ID, Social Security number, and proof of income.

If you’re seeking a private student loan, you’ll also need information about your school, and if you’re refinancing, you’ll need your current loan statements.

Step 03: Compare and Select

LendKey’s marketplace will present you with multiple loan offers. You can compare the terms and conditions before choosing the one.

Advertisement

Requirements

To ensure you meet the eligibility criteria for LendKey Student Loans, let’s break down the requirements for both private student loans and refinancing:

Private Student Loan

- You must be enrolled at least half-time in an approved, degree-granting school.

- Maintain a credit score of at least 660.

- Have a steady source of income or a cosigner.

- Be a U.S. citizen or a permanent resident.

- Meet the age of majority in your state.

Refinancing Student Loan

- Be a U.S. citizen or a permanent resident.

- Have already graduated with at least one of the required degrees.

- Demonstrate a positive credit history.

- Provide proof of income.

Apply using the app

At the moment, LendKey does not offer an app that is specifically tailored to their services.

Nevertheless, you can still access their website easily on your phone, as it is mobile-friendly.

Other options for students: Discover It® Student Cash Back Card

Are you a student looking for your first credit card? Consider the Discover It® Student Cash Back Card – a rewarding option to kickstart your credit journey.

With this card, you can earn up to 5% cash back, and there are no annual fees to worry about.

Plus, the card has helpful tools to help you better manage your credit. So, it’s worth checking out if you’re a student looking for your first credit card.

- Credit Score: No credit score is required;

- Annual Fee: $0;

- Purchase APR: 0% intro APR for 6 months, then 18.24% – 27.74% Variable APR;

- Cash Advance APR: 29,74% Variable APR;

- Welcome Bonus: Unlimited Cashback Match: you’ll have your cash back match earned at the end of the first year to turn $50 into $100, for example;

- Rewards: Earn 5% cash back on rotating categories (up to $1,500/quarter) when activated and 1% on other purchases.

Why not give this card a try and start building your credit history while enjoying cashback rewards?

Stay tuned for our upcoming post, where we’ll guide you on how to apply for the Discover It® Student Cash Back Card.

Apply for Discover It® Student Cash Back Card

Looking to apply for the Discover It® Student Cash Back Card? Discover all the steps in this guide – earn up to 5% cash back on purchases!

Trending Topics

Get creative: 8 apps that turn photos into awesome caricatures

Take your photo editing skills to the next level with these top-rated apps to turn your photos into caricatures. Find out more!

Keep Reading

Gemini Credit Card® review: Earn crypto on your purchases

Love crypto? Get a Gemini Credit Card® review with pros and cons! Pay no annual fee and earn crypto on every purchase!

Keep Reading

Sable bank account review: how does it work and is it good?

Are you looking for a better way to manage money? So, read this Sable bank account review to learn about its benefits - with a $0 annual fee!

Keep ReadingYou may also like

Federal Pell Grant: see how to apply

Find out if you're eligible to apply for the Federal Pell Grant. Ensure up to $7,395 to cover educational costs!

Keep Reading

Surge® Platinum Mastercard® credit card application: how does it work?

A credit card can be the best choice to build your score. Read on to learn how to apply for the Surge® Platinum Mastercard® credit card!

Keep Reading

Citi® Diamond Preferred® Card review: Have a break on interest!

Discover how you can save money on interest for 21 months for balance transfers with the Citi® Diamond Preferred® Card review. Read on!

Keep Reading