Attain a higher credit score by reporting your payments to the major credit bureaus!

Establish and Strengthen Your Credit with Blaze Mastercard® Credit Card

Advertisement

Get a helping hand to mend or establish your credit score with the Blaze Mastercard® credit card. With no collateral required, this unsecured option is ideal for struggling borrowers. What’s more? Your timely payments reflect on all three major credit bureaus, putting you on the path to a better credit rating!

Get a helping hand to mend or establish your credit score with the Blaze Mastercard® credit card. With no collateral required, this unsecured option is ideal for struggling borrowers. What’s more? Your timely payments reflect on all three major credit bureaus, putting you on the path to a better credit rating!

You will remain in the same website

If you're trying to boost your credit score, the Blaze Mastercard® Credit Card might be just what you need. Take a closer look at its advantages to see if it's right for you.

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

In the bustling marketplace of credit cards, the Blaze Mastercard® Credit Card emerges as a beacon for individuals looking to ignite their credit journey.

Designed specifically with rebuilding and establishing credit in mind, this card packs a punch for those who prioritize credit growth. Let's deep dive into the facets of this card to determine if it lights up your financial path.

Strengths and Special Offerings

- Credit Building Potential: Blaze Mastercard® offers an opportunity for individuals with limited or tarnished credit to build or rebuild their credit history. A golden ticket for those on the mend!

- Acceptance Across the Board: Being a Mastercard®, it boasts almost universal acceptance. Whether you're dining out or shopping online, Blaze ensures seamless transactions.

- Fast Application Process: Don't fancy lengthy waits? Blaze offers a swift online application process, enabling you to know where you stand in a matter of minutes.

- Transparent Fee Structure: With clarity in its annual fee and other charges, there are no hidden surprises to catch you off-guard.

Limitations to Consider

- Annual Fee: The card comes with an annual fee, which might be a deterrent for those looking for cost-free credit solutions.

- High APR: Compared to some other cards, the Blaze Mastercard® carries a relatively high APR, making it vital to manage balances effectively.

- Limited Rewards: If you're hunting for cashback or reward points, this might not be the card for you. It's more about credit building than perks.

The Blaze Mastercard® Credit Card is akin to a torchlight for those navigating the dark tunnels of credit repair.

While it may not dazzle with rewards or cashback, its true strength lies in its potential to boost credit profiles.

It's a card that demands careful balance management, but for those committed to their credit journey, Blaze could indeed light the way.

Yes, you can use the app to manage your account and make payments from your phone. There you can make payments, view transactions, track your credit score and more. You can download it through Apple Store or Google Play Store, it is simple and quick!

The credit line you receive with Blaze Mastercard® Credit Card will depend on various factors such as your credit history, income, and other financial factors.

You can contact Blaze Mastercard® Credit Card customer service by phone or email. Their contact information is available on their website.

Using Blaze Mastercard® Credit Card responsibly and making timely payments can gradually improve your credit score over time. So make sure to make responsible use of your credit card and you'll improve your credit soon! Applicants with prior bankruptcy may still qualify for Blaze Mastercard® Credit Card. However, the specific requirements vary and are subject to change.

The Definitive Guide to Apply for Blaze Mastercard

Get your credit back on track with the unsecured Blaze Mastercard® Credit Card- Learn how to apply now. Read on!

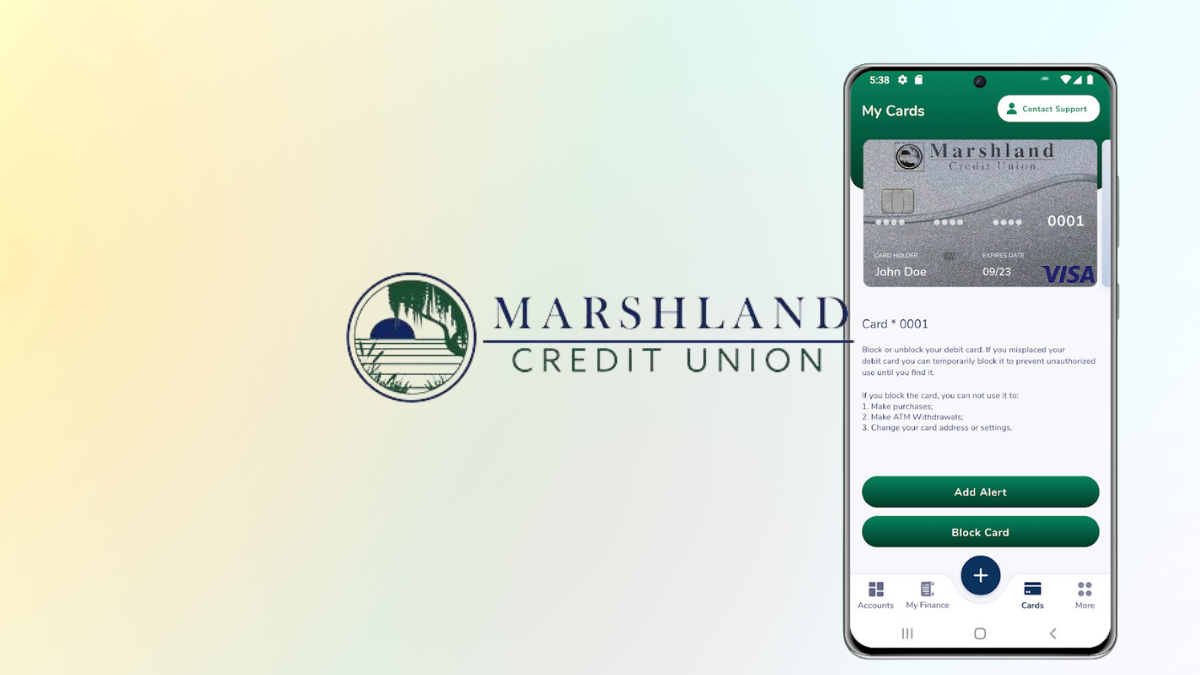

If you have been rejected for a secured card in the past and want to improve your credit, you may want to consider applying for the Marshland Visa® Credit Card.

Check out our post below for more information on how to apply.

Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Trending Topics

Commodity Supplemental Food Program (CSFP): see how to apply

Discover how to apply for The Commodity Supplemental Food Program (CSFP). Learn the eligibility criteria and documents required. Read on!

Keep Reading

Avant Personal Loan review: how does it work, and is it good?

Learn how to get fast cash for any purpose in the Avant Personal Loan Review. Keep reading to find out more!

Keep Reading

Self Visa® Credit Card review: start building credit today!

Looking for a credit card to help you build your credit history? Check out our Self Visa® Credit Card review. Qualify with poor credit!

Keep ReadingYou may also like

10 best credit cards with cashback rewards: reviews and offers 2022

Here you'll find a list of the best credit cards with cashback rewards for 2022. Check their benefits and choose yours to earn cashback.

Keep Reading

Learn to apply easily for Home Depot Project Loan

Apply for the Home Depot Project Loan and take your renovations to the next level. Borrow up to $55,000 fast! Read on!

Keep Reading

How to build an investment portfolio: a simple guide for beginners

A simple guide on how to create an investment portfolio for beginners. Learn how to start now with these steps. Check it out!

Keep Reading