Loans

Learn to apply easily for Home Depot Project Loan

Apply for the Home Depot Project Loan and feel confident to make your home improvement! Up to $55,000 with flexible terms! Read on!

Advertisement

Home Depot Project Loan application: pay no hidden fees!

Are you considering to apply for the Home Depot Project Loan? Follow this guide to understand the requirements and make your application easier.

Explore this loan proposal, understand its conditions, and get ready to make that home renovation you have always wanted. So keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Online application

A Home Depot Project Loan is a line of credit designed specifically for home improvement, big or small projects.

The loan is a flexible financing option allowing you to borrow from $2,500 up to $55,000, with up to 84 months to repay.

So, if you need to make larger purchases to make improvements and renovations at your home, you might want to consider this option.

How to Apply for a Home Depot Project Loan?

Home Depot Project Loan applications can only be completed in-store — there’s no online application process.

So, you must visit your local Home Depot and find a to begin the application process at the Customer’s Service Desk.

Advertisement

Understanding the Terms and Conditions

Once you are approved for a Home Depot Project Loan, it’s essential to understand your loan terms and conditions, such as:

- The interest rate;

- The repayment period (up to 84 months);

- The project loan’s credit line can be up to $55,000.

Requirements

To apply for a Home Depot Project Loan, you’ll need to provide some basic information, including:

- Your Social Security number;

- Your date of birth;

- Your gross annual income;

The application may also ask for additional details, such as your employment history and contact information.

Be prepared to provide this information during the in-store application process.

Advertisement

Apply using the app

It’s not possible to apply for this Loan using an app. Visit a local store.

Home Depot Project Loan vs. Rocket Loans: which one is the best?

On the one hand, the Home Depot Project Loan can only be used at Home Depot stores. You can borrow from $2,500 to $55,000.

On the other hand, if you want to use the funds on other stores, then you might consider getting Rocket Loans.

Do you want to learn more? Then compare these loan providers’ features below!

Home Depot Project Loan

- APR: 7.24% to 19.96%;

- Loan Purpose: Purchase at Home Depot;

- Loan Amounts: $2,500 to $55,000;

- Credit Needed: 600;

- Origination Fee: N/A;

- Late Fee: N/A;

- Early Payoff Penalty: None.

Rocket Loans

- APR: 9% – 29.99%;

- Loan Purpose: Any purpose (except illegal activities and as a student loan);

- Loan Amounts: $2,000 to $45,000;

- Credit Needed: At least 640;

- Origination Fee: Up to 9%;

- Late Fee: Not disclosed;

- Early Payoff Penalty: Not applied.

Further, check out our post below and learn how to apply for Rocket Loans.

Learn to apply easily for Rocket Loans

Learn how to apply for Rocket Loans and take control of your finances today! Borrow up to $45K and receive it in one business day!

Trending Topics

Get financial fitness with 7 steps: put your finances in shape!

If you don't know how to manage your money, you need to learn these steps to financial fitness. Your future self will thank you later.

Keep Reading

Sable bank account review: how does it work and is it good?

Are you looking for a better way to manage money? So, read this Sable bank account review to learn about its benefits - with a $0 annual fee!

Keep Reading

Bull vs bear market explained: understand how they affect you

In this article, we explore the bull vs. bear market, how they can impact your investments and the current state of the markets in the USA.

Keep ReadingYou may also like

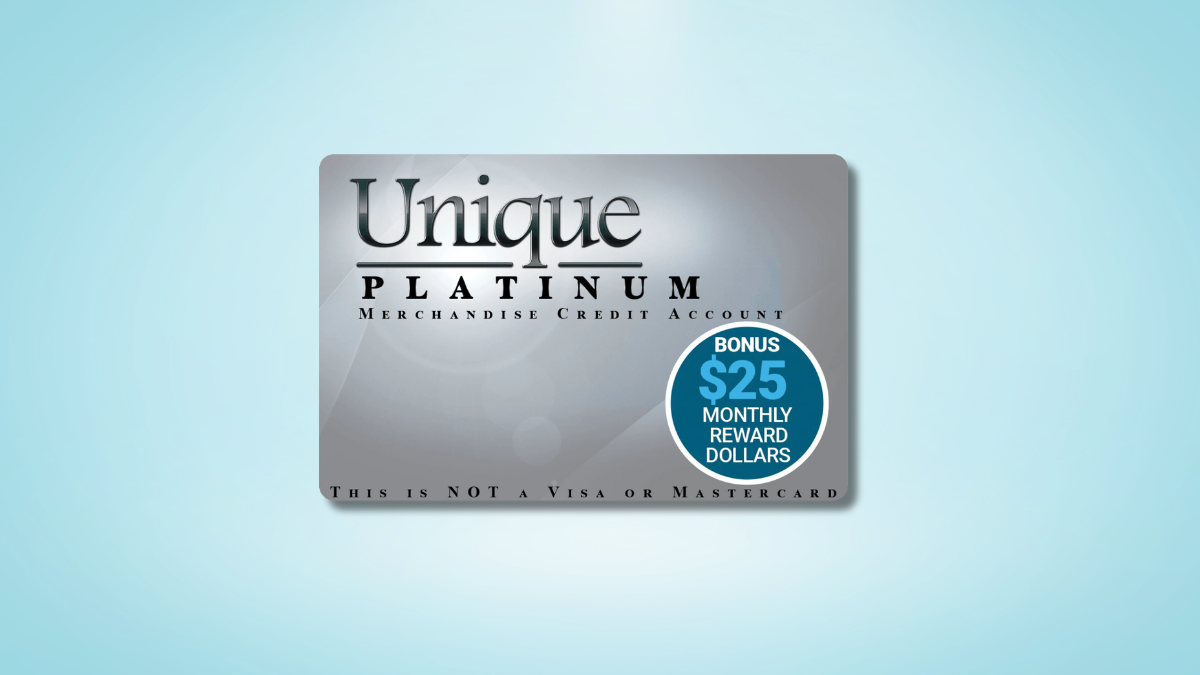

Apply for Unique Platinum Card: quick and simple

Elevate your spending power with the Unique Platinum Card - apply today and enjoy exclusive benefits that only a select few can access.

Keep Reading

How to buy cheap JetBlue Airways flights

Ever wonder how to buy cheap JetBlue Airways flights? Learn the strategies people are using that save them hundreds. Read on!

Keep Reading

Apply for the First Latitude Select Mastercard® Secured Credit Card

The First Latitude Select Mastercard® Secured Credit Card is a low maintenance option with a modest annual fee. Check out how to apply!

Keep Reading