See a broker that can give you incredible investment options!

Ally Invest: a number of investment options available at low transaction fees

Advertisement

Ally Invest is an excellent choice if you plan on trading frequently and appreciate a complete trading platform. It offers low transaction fees on stocks, options and ETFs, with $0 cost per stock trades and $0.50 per options trade. This broker also offers 24/7 customer service via chat, email or phone.

Ally Invest is an excellent choice if you plan on trading frequently and appreciate a complete trading platform. It offers low transaction fees on stocks, options and ETFs, with $0 cost per stock trades and $0.50 per options trade. This broker also offers 24/7 customer service via chat, email or phone.

You will remain in the same website

Have a look at some of the benefits of holding an Ally Invest account.

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Discover the world of smart, user-centric investing with Ally Invest, where every feature and service is designed to support both seasoned traders and curious beginners.

This platform isn't just a portal to enter the stock market; it's your comprehensive companion in carving out your financial future in the investment world.

Dive in as we dissect its promising advantages and the few shortcomings to keep in mind.

Strengths and Special Offerings

- Self-Directed Trading: Ally Invest caters to the independent investor with a passion for hands-on market interaction, offering a platform for self-directed trading.

- No Account Minimums: Accessible investing is at the heart of Ally Invest, emphasized by their zero account minimum. This approach lowers the entry barrier for new investors.

- Competitive Pricing: With some of the industry's most customer-friendly pricing, Ally Invest makes trading more cost-effective.

- Robust Research Tools: Knowledge is power in the world of investing, and Ally Invest provides a wealth of research tools and resources.

- Managed Portfolio Options: For those who prefer a hands-off investment approach, Ally Invest offers automated, professionally managed portfolios.

Limitations to Consider

- Limited International Trading: If you're looking to diversify your portfolio globally, Ally Invest falls short. It primarily supports domestic trading, limiting exposure to international markets.

- No Physical Branches: The lack of brick-and-mortar locations means all consultations or customer service interactions are online or over the phone.

- Platform Complexity: The initial learning curve for mastering the platform might be steep for individuals new to investment tools.

- Inactivity Fees: Although the platform is great for active traders, those who are less active could face inactivity fees, potentially making it less cost-effective for sporadic traders.

In conclusion, Ally Invest emerges as a powerhouse in the digital investment arena, blending user-friendly trading with professional-grade resources.

While its services cater wonderfully to active, informed traders, the platform may pose certain limitations for those seeking global trading options or preferring in-person guidance.

As with any financial venture, prospective users should weigh these factors against their personal investment journey and goals.

Ally has lately moved its attention to millennial and female investors; nonetheless, its products are fantastic for beginner and active traders alike owing to reasonable rates, a strong and user-friendly interface, instructional assistance, useful tools like screeners, and good customer care.

With Ally Invest, you may access your cash or retirement account at any time with no fees and no minimum withdrawal amount. There is no minimum opening balance for a self-directed brokerage cash account.

Ally Invest makes money in the same ways that other banks do. Therefore, Ally Invest benefits from the common brokerage practice of payment for order flow.

How to start investing with Ally Invest?

Opening an account with Ally Invest is a simple process. In this article we’re going to show you how to do it. So read on and learn how to open your account!

Are you not so sure about opening your account through Ally Invest? If so, you can try a different more traditional bank account. This way, you can try applying to open a Chase Bank Account!

With this account, you'll be able to get incredible perks and find great account options. Therefore, you can read our post below to learn more and see how to open your account!

Chase Bank Account application

Chase Bank is one of the most popular banks in the United States. They offer a wide variety of accounts and services to their customers. Open you account now!

Trending Topics

Capital One Savor Cash Rewards Credit Card vs. Capital One Walmart Rewards® Mastercard®: card comparison

Capital One Savor Cash Rewards Credit Card or Capital One Walmart Rewards® Mastercard®? Compare them and find out which one is best for you!

Keep Reading

Women, Infants, and Children (WIC): nutritional support for families

Learn about the Women, Infants, and Children (WIC) program's services, who is eligible to, and how to apply for benefits. Keep reading!

Keep Reading

How to buy cheap flights on SkyScanner

Are you looking for ways to save money when you travel? Use these tips to buy cheap flights on Skyscanner. Keep reading!

Keep ReadingYou may also like

Bankruptcy vs. consumer proposal: which is the best choice?

Unsure if you should file for bankruptcy or consumer proposal? We will help you decide which option is best for your financial future.

Keep Reading

Application for the Total Visa® Card: how does it work?

The Total Visa® Card targets your bad score. Start rebuilding credit. Get it right now with an online application. Check it out!

Keep Reading

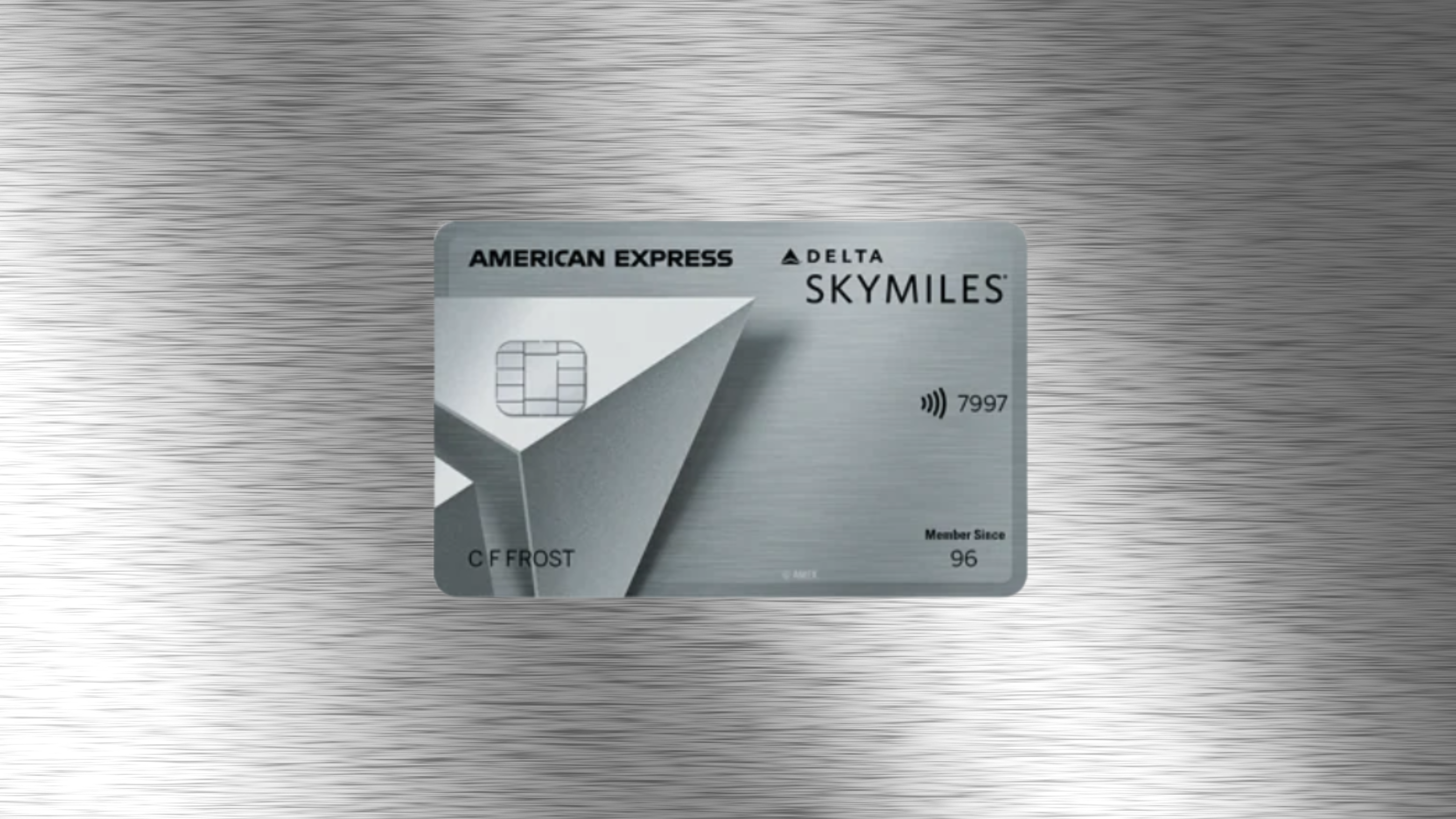

Delta SkyMiles® Platinum American Express Card application

Do you love to travel and earn card perks while doing so? Read our post about the Delta SkyMiles® Platinum American Express Card application!

Keep Reading