Credit Cards

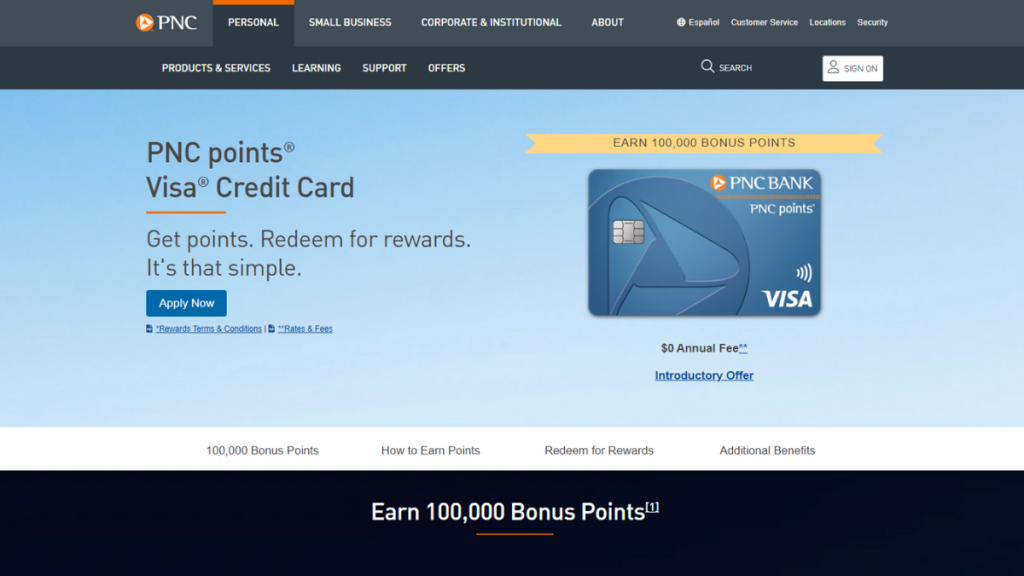

PNC points® Visa® Credit Card review: 100K bonus points

See our review PNC points® Visa® Credit Card to find out its amazing 0% APR on balance transfers! Discover the ins and outs to decide if it aligns with your lifestyle.

Advertisement

Are the points on purchase a real deal or just hype?

Imagine a card with no annual fee and up to 7 points on purchases – sounds tempting, right? That’s exactly what we’ll uncover in our PNC points® Visa® Credit Card review.

Apply for the PNC points® Visa® Credit Card

How do you apply for the PNC points® Visa® Credit Card and seize up to 7 points on all purchases? Here is our guide!

So, if you wonder if those points are worth anything, stick around as we break it down, exploring its essential features. Stay tuned!

- Credit Score: Excellent;

- Annual Fee: $0;

- Purchase APR: 18.24%% to 30.24% (variable);

- Cash Advance APR: 30.24% (variable);

- Welcome Bonus: Earn 100K bonus points by spending $1,000+ in the first 3 billing cycles. Also, enjoy a 0% APR on balance transfers for 12 cycles if done within 90 days. Variable APR of 18.24% to 30.24% applies later;

- Rewards: Earn 4 to 7 points on all purchases.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

PNC points® Visa® Credit Card: how does it work?

On the surface, this card appears to offer the best of both worlds – no annual fee and a generous up to 7 points on all purchases.

However, it’s crucial to understand that not all points are equal. Let’s navigate the intricacies to ensure you don’t mistake fool’s gold for true value.

Rewards

Using this card, you can earn 4 to 7 points per dollar and redeem for cash back, Apple products, travel, gift cards, or merchandise.

However, the value of these points may not be as high as you expect, and you may need to collect a lot of them to earn something valuable.

Advertisement

Boosting Points

There is a way to boost points, but it’s not an option for everyone. If you have a PNC Bank account, then you can get bonuses of up to 75% on your points.

You must keep a certain amount in your account or make regular deposits. Then it’s like a reward for being a good customer.

For example, if you keep $5,000 in your account each month, you can get a 75% bonus on your points.

Welcome Bonus

This credit card comes with two intro offers. So, let’s check them out.

Advertisement

0% APR on Balance Transfers

PNC Points Visa Credit Card offers 0% APR for balance transfers for 12 billing cycles when initiated within 90 days, then a variable APR of 18.24% to 30.24%.

A 0% intro balance credit card can save you money on interest charges, give you time to pay off your balance and improve your credit score.

Bonus Points

By spending $1,000+ in the first three billing cycles, you can earn a bonus of 100K points to redeem on the categories of your choice.

Other Benefits

- Cell Phone Protection;

- Zero Liability Fraud Protection;

- PNC Easy Lock;

- Alerts.

PNC points® Visa® Credit Card: should you get one?

This card could be perfect for those seeking a rewarding credit card experience without an annual fee.

So, review the PNC points® Visa® Credit Card pros and cons to determine if it aligns with your financial goals.

Pros

- Generous welcome bonus;

- No annual fee;

- Flexible redemption options.

Cons

- Points are not valuable;

- High variable APR.

Credit score required

This credit card requires good to excellent credit!

PNC points® Visa® Credit Card application: how to do it?

Learn how to apply for the PNC points® Visa® Credit Card below. Read on!

Apply for the PNC points® Visa® Credit Card

How do you apply for the PNC points® Visa® Credit Card and seize up to 7 points on all purchases? Here is our guide!

Trending Topics

TransUnion vs. Equifax: Decoding the Credit Reporting Giants

Understand TransUnion vs Equifax credit scores easily. Learn why they differ for better financial choices. Read on!

Keep Reading

American Express® Gold Card Review: earn rewards when traveling

This is an American Express® Gold Card review about its benefits. Read on to know about the rewards program, fees, and more.

Keep Reading

Visa vs. Mastercard: are they really different?

Find out if there's a big difference between the two major credit card companies: Visa vs. Mastercard, and which one is best for you to get.

Keep ReadingYou may also like

Up to $15,000: VivaLoan review

Thinking of taking out a loan? Check out our VivaLoan review to discover if this product is for you! Enjoy personalized rates and terms!

Keep Reading

Unlimited reward: Apply for British Airways Visa Signature® Card

Discover the few easy steps you need to take to apply for the British Airways Visa Signature® Card and get access to exclusive rewards today.

Keep Reading

R.I.A. Federal Credit Union Mastercard® Classic Card: apply today

Ready to take control of finances? Learn how to apply for the R.I.A. Federal Credit Union Mastercard® Classic Card today - $0 annual fee!

Keep Reading