Credit Cards

American Express® Gold Card Review: earn rewards when traveling

Consider the American Express® Gold Card review to a breakdown of the pros and cons, so you can make the best decision for your needs. Keep reading!

Advertisement

American Express® Gold Card: is it worth the $250 annual fee?

If you’re a foodie who loves to travel, the American Express® Gold Card review post is perfect for you.

With this card, you’ll earn rewards for dining at restaurants, shopping, and traveling. Also, you will pay no foreign transaction fees (See Rates & Fees).

How to apply for American Express® Gold Card

If you need a card to earn travel and shopping rewards, read on and learn about the application process for the American Express® Gold Card!

So, if you’re looking for a card to help you make the most of your culinary adventures, the American Express® Gold Card is definitely worth considering.

Learn more in our review below.

- Credit Score: Good/ Excellent;

- Annual Fee: $250;

- Regular APR: See Pay Over Time APR;

- Welcome bonus: 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

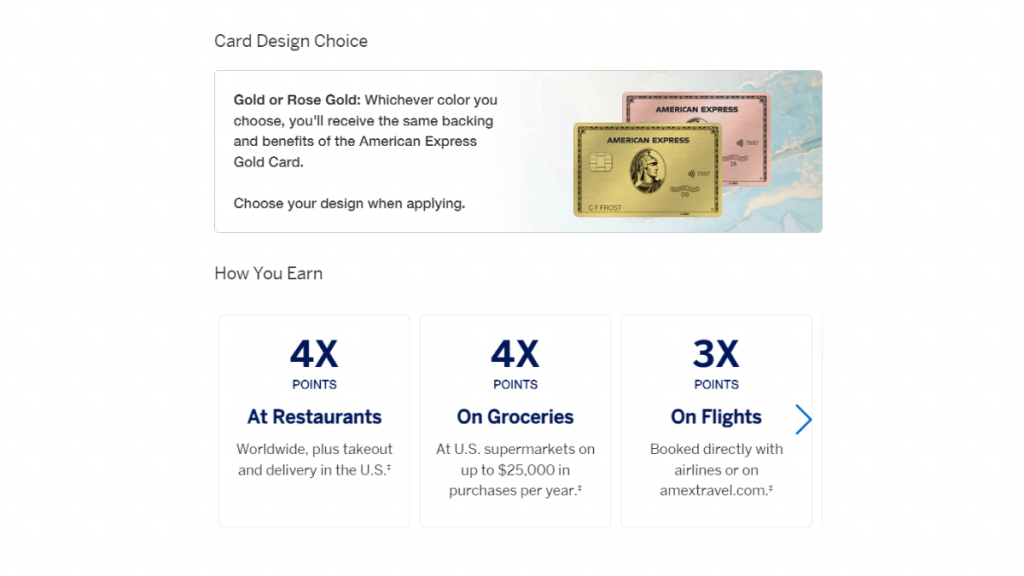

- Rewards: 4x points at worldwide restaurants and delivery in the U.S.; 4x points at U.S. supermarkets (up to $25,000 in purchases/year);

- Other rewards: 3x points on flights booked through airlines or on amextravel.com; and 1x point on other qualifying purchases.

- See Rates & Fees

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

American Express® Gold Card: how does it work?

American Express® Gold Card is a credit card full of benefits and rewards. But are these enough to cover the $250 annual fee? Let’s see how this card works so that you can decide.

The advantages of this card go especially for dining at restaurants, travel, and everyday purchases.

1. Dining at restaurants

First, you can earn 4x points for dining at restaurants worldwide. Also, takeout, supermarkets ($25,000 per calendar year in purchases), and delivery in the U.S and around the globe.

In addition, you can earn 1 point for other eligible purchases and enjoy up to $10 monthly in Uber Cash to use in Uber rides and UberEats orders.

Finally, you can use your card payments to earn monthly up to $10 statement credit at stores such as Shake Shack and The Cheesecake Factory.

Advertisement

2. Travel

Second, you can earn 3X Membership Rewards® points on flights booked with amextravel.com or directly with the airlines.

Plus, you can earn a $100 credit to delight when you book a hotel with American Express Travel.

Also, you won’t pay any foreign transaction fees with an American Express® Gold Card.

Still, you can have 24/7 travel emergency assistance with the Global Assist® Hotline. You can also opt for a baggage and car rental loss and damage insurance plan.

Plus, you can pay for your trips with points, covering part of your flights or prepaid hotels. Make sure you see the terms.

At last, you should consider the fees, which, except for the annual, are average-priced;

American Express® Gold Card: should you get one?

Review the pros and cons of the American Express® Gold Card and decide if you should get one.

Advertisement

Pros

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- See Rates & Fees

Cons

- Expensive annual fee;

- Only the best scores can apply.

Credit score required

To apply for an American Express® Gold Card, you must have good to excellent credit.

American Express® Gold Card application: how to do it?

If you like the American Express® Gold Card review, keep reading to learn how to apply for one. Read more!

How to apply for American Express® Gold Card

If you need a card to earn travel and shopping rewards, read on and learn about the application process for the American Express® Gold Card!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Trending Topics

Capital One Spark Cash Plus review: A charge card to run your business

Do you need a card to run your business? Look at the Capital One Spark Cash Plus review, and learn how this card works. Read on!

Keep Reading

Destiny Mastercard® Review: No Security Deposit, Just Credit Growth

Destiny Mastercard® offers a path to improve your credit score. Learn more about fees, benefits, and how it works!

Keep Reading

Luxury Black credit card review: is it worth it?

Some people want to know if the Luxury Black credit card is worth getting. Here's a detailed review to help you decide if you should get one.

Keep ReadingYou may also like

Costco Anywhere Visa® Business Card by Citi application: how does it work?

Learn how to apply for the Costco Anywhere Visa® Business Card by Citi, and enjoy the cashback options. Read on!

Keep Reading

Super+ Review: Your Key to Everyday Savings

Unlock the secrets of Super+ in our review and learn how it can improve your shopping experience for just $15/month.

Keep Reading

Learn to apply easily for Pick a Lender Personal Loan

Learn how to apply for Pick a Lender Personal Loan! Get up to $40K and use it for several purposes! Read on!

Keep Reading