Loans

Pick a Lender Personal Loan review: how does it work and is it good?

Get the money you need fast! Pick a Lender connect you with several lenders and help you fulfill your financial needs. Don't wait - find out more now!

Advertisement

Pick a Lender Personal Loan: Get up to $40,000 in loan amounts!

Do you need a loan to cover a special purchase, consolidate debt, and lower your payments? So here is a Pick a Lender Personal Loan review to help you with this!

How to apply for Pick a Lender Personal Loans

Learn how to apply for Pick a Lender Personal Loan! Get up to $40K and use it for several purposes! Read on!

They are an online marketplace of lenders or lending partners who offer personal loans for several purposes. Keep reading and learn how to get the money you need fast! Let’s go!

- APR: It depends on your creditworthiness, terms, and loan amount, among other factors;

- Loan Purpose: Debt consolidation, travel, credit card consolidation, home improvement, auto, and others;

- Loan Amounts: $100 to $40,000;

- Credit Needed: All credit scores are considered;

- Origination Fee: It varies by lender;

- Late Fee: It varies by lender;

- Early Payoff Penalty: It varies by lender.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is Pick a Lender?

Pick a Lender offers several different types of loans— up to $40,000—for many different uses. Consumers can apply for traditional purposes such as debt consolidation, travel, and home improvement.

This loan marketplace is not among the most popular ones, but they claim to use 256-bit encryption with their 100% online form. So users can feel secure when applying for their loans.

The best part? All credit scores are considered to apply! Pick a Lender also offers upfront disclosure, so borrowers know exactly what they are getting into before signing any contracts.

The company promises fast funding so the money can be in your account the next business day. This makes it easy for those looking for quick solutions to access money quickly to cover expenses.

Plus, since Pick a Lender works with multiple lenders from across the country, borrowers have more options with competitive interest rates and terms tailored to their needs.

Fees

The different lenders in the platform calculate fees and other costs for their loans by checking borrowers’ credit scores, loan amounts, terms, and many other factors.

As a result, each loan is different and comes with charges up to each contract.

Advertisement

Is Pick a Lender Personal Loan good?

Pick a Lenders is a platform that allows borrowers to compare multiple offers in one place! But is it the right option for you? Then check out their pros and cons and find out!

Pros

- Personal loans for many purposes;

- Simple online application;

- Fast-funding;

- Loans up to $40,000;

- Connect with several lenders.

Advertisement

Cons

- There aren’t many reviews about their services;

- It’s not clear if their lenders are reputable.

Does Pick a Lender check credit scores?

Like other credit companies, the lenders in Pick a Lender will check credit scores to determine APR, origination fees, and other charges. However, the platform doesn’t require any minimum score for applying.

Want to get a Pick a Lender Personal Loan? We will help you!

Get access to up to $40,000 today with Pick a Lender Personal Loan! Discover how to apply for your loan – take the first step in our post below!

How to apply for Pick a Lender Personal Loans

Learn how to apply for Pick a Lender Personal Loan! Get up to $40K and use it for several purposes! Read on!

Trending Topics

U.S. Bank Cash+™ Visa Signature® credit card review: is it worth it?

The U.S. Bank Cash+™ Visa Signature® credit card will give you up to 5% cashback and charge you no annual fee. Check the review about it.

Keep Reading

Aer Lingus Visa Signature® Card application: how does it work?

Earn points, enjoy Premium travel protections, early boarding, and more! Find out how to apply for the Aer Lingus Visa Signature® Card.

Keep Reading

BMO Ascend World Elite®* Mastercard®* Review

Maximize travel with BMO Ascend World Elite®* Mastercard®*: top rewards, extensive insurance, luxury perks. Elevate your journeys!"

Keep ReadingYou may also like

Discover it® Miles Credit Card review: Earn miles on purchases

Check out the Discover it® Miles Credit Card review. Earn miles for every dollar spent and pay no annual fee! Read on for more information!

Keep Reading

Macy’s Credit Card: Quick and Easy Way to Apply

Learn to apply for Macy's Credit Card, enjoy exclusive perks, and compare it with Torrid for smart shopping choices. Keep reading!

Keep Reading

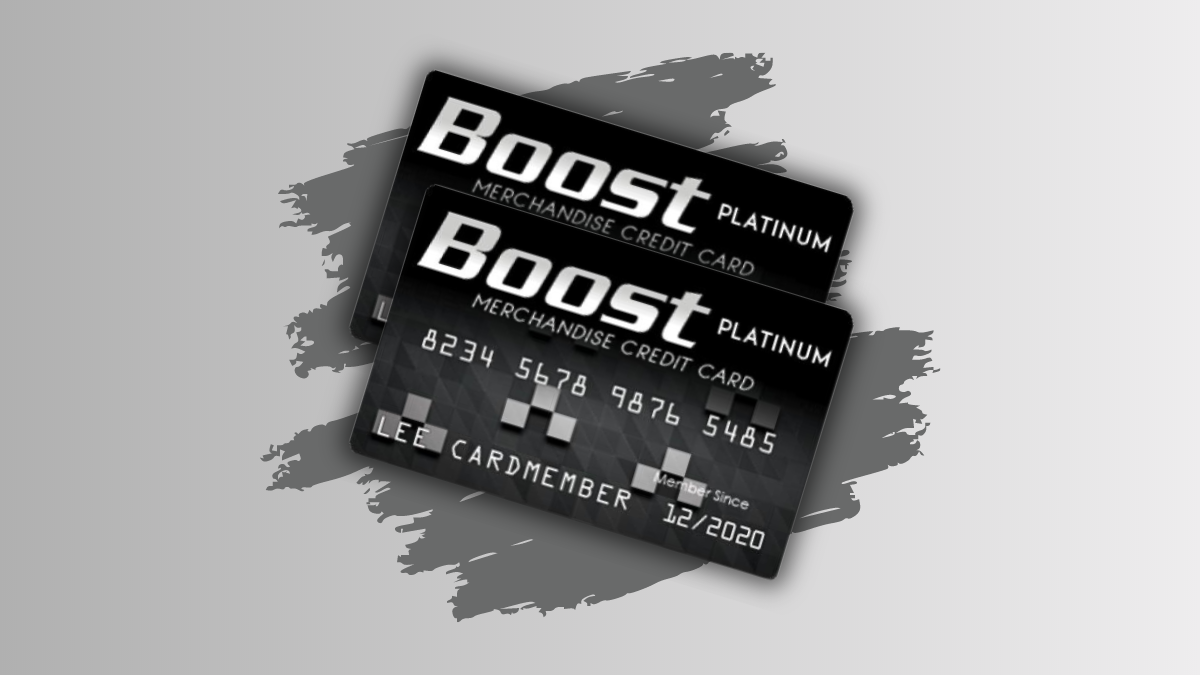

BOOST Platinum Card Review: Is it worth it?

Shop with the BOOST Platinum Card and enjoy $750 merchandise credit. No credit checks, perfect for low scores. Financial flexibility awaits!

Keep Reading