Credit Cards

Application for the OpenSky® Secured Visa® Credit Card

The OpenSky® Secured Visa® Credit Card can help you establish or rebuild your credit. Don't let bad credit keep you from getting the things you need. Learn how to apply today and get on the road to a better credit future.

Advertisement

Get approved in seconds and start building your credit rating today!

The OpenSky® Secured Visa® Credit Card is a great way to establish or rebuild your credit history. It’s a secured card, which means that you have to put down a security deposit in order to get the card.

The amount of the security deposit will be your credit limit. The minimum amount is $200 and you can deposit up to $3000.

It has an annual fee of $35 and there is a 25.64% variable APR for purchases and cash advances.

The card reports all payment information to Equifax, Experian and TransUnion, so if you manage to keep it to good use, you can repair your credit rating in over a few months.

If you need help building a better financial future, the OpenSky® Secured Visa® Credit Card is a great way to start! Keep reading to learn the details of the application process.

Apply online

The online application process for the OpenSky® Secured Visa® Credit Card could not be simpler. Just go to the OpenSky website and click on “Apply Now.”.

You will need to provide some personal information, like your name, address, and Social Security number.

You will also need to provide information about your employment and your income. OpenSky will review your credit history and determine whether you are eligible for the card.

If you are approved, you will need to provide a security deposit in order to get the product.

Once you have been approved, OpenSky will send you your new secured Visa card in the mail. You can start using it as soon as you receive it!

Keep in mind that this is a secured card, so you should only use it for emergencies or occasional purchases.

If you use the OpenSky® Secured Visa® Credit Card responsibly, you can start rebuilding your credit history and improve your credit score.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

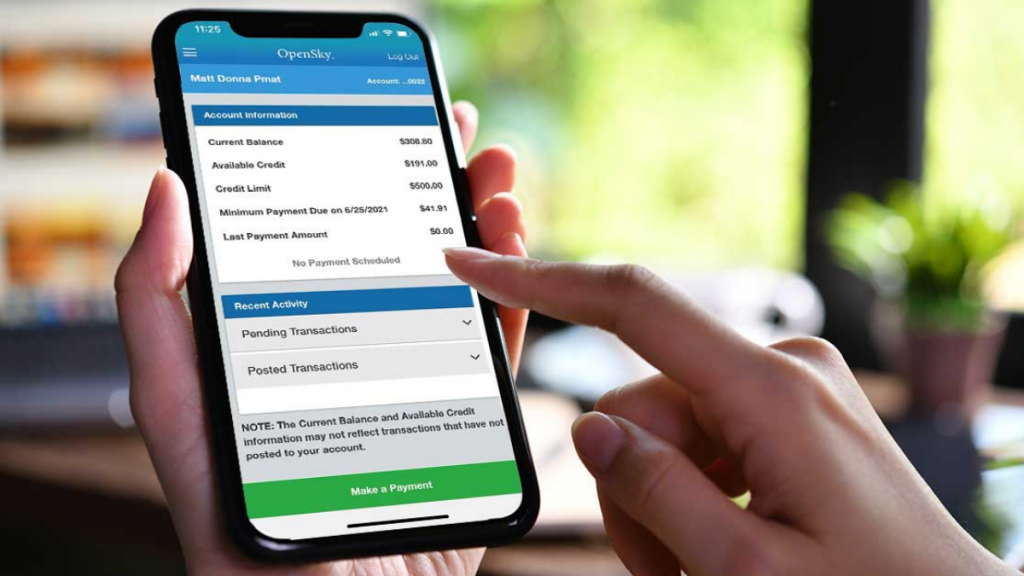

Apply using the app

OpenSky provides a mobile app for customers to manage their accounts.

You can activate your card on their website and use the application on your phone to view recently posted transactions and make payments. You can even check your next payment date and minimum payment due.

However, the application process is available only on their website.

OpenSky® Secured Visa® Credit Card vs. Assent Platinum Secured credit card

If you’re unsure whether the OpenSky Secured Visa is the best option for you, we brought another option. The Assent Platinum Secured card offers a low ongoing APR rate and is a great alternative to help you rebuild your credit history!

So check the comparison between the two cards below and follow the recommended link for the Assent credit card application process!

| OpenSky® Secured Visa® Credit Card | Assent Platinum Secured credit card | |

| Credit Score | No credit | Bad – Fair |

| Annual Fee | $35 | $49 |

| Regular APR | 25.64% variable APR for purchases and cash advances | 12.99% variable |

| Welcome bonus | N/A | N/A |

| Rewards | Up to 10% cash back rewards on purchases at over 40,000 retailers (see terms and conditions) | None |

Learn how to apply for the Assent Platinum Secured

Learn how to apply for Assent Platinum Secured, a card with no credit history required and that helps you build your credit score!

Trending Topics

Affordable Connectivity Program (ACP): see how to apply

Find out if you are eligible for the Affordable Connectivity Program, and get help with internet costs monthly. Read on!

Keep Reading

Apply for the Verizon Visa® Card: enjoy no annual fee

You can apply for a Verizon Visa® Card easily! Earn up to 4% cash back with no annual fee! Read on and learn more!

Keep Reading

How to Invest in a Mutual Fund: Essential Techniques for Success

Find out the essential techniques on how to invest in a mutual fund and reach investment success. Learn more!

Keep ReadingYou may also like

Get creative: 8 apps that turn photos into awesome caricatures

Take your photo editing skills to the next level with these top-rated apps to turn your photos into caricatures. Find out more!

Keep Reading

Apply for 123 Money Loans: Quick Cash

Need a quick loan for car repairs? 123 Money Loans can help - Apply for up to $5K online and get it done now.

Keep Reading

Interest rates might reach levels not seen since 2007

In its April’s Economic Update, CUNA revealed that as inflation slows, interest rates might exceed 2007’s economic levels. Read more now.

Keep Reading