Credit Cards

Navy Federal nRewards® Secured Card Review: Boost Your Credit

Dive into the world of credit-building and rewards with Navy Federal nRewards® Secured in our review. Redeem your points for travel, merchandise, and more.

Advertisement

Get all the details on the Navy Federal Secured Card with Rewards in one place!

Discover the ultimate way to improve your credit and earn! Navy Federal nRewards® Secured card is the perfect solution, and we’re here to give you a review.

Apply for the Navy Federal nRewards® Secured Card

Follow this guide to apply for the Navy Federal nRewards® Secured card and Unlock better credit today. $0 hidden fees!

Get ready to explore its incredible features, benefits, and hassle-free application process so you can make a smart choice. Don’t miss out on this fantastic opportunity – read on!

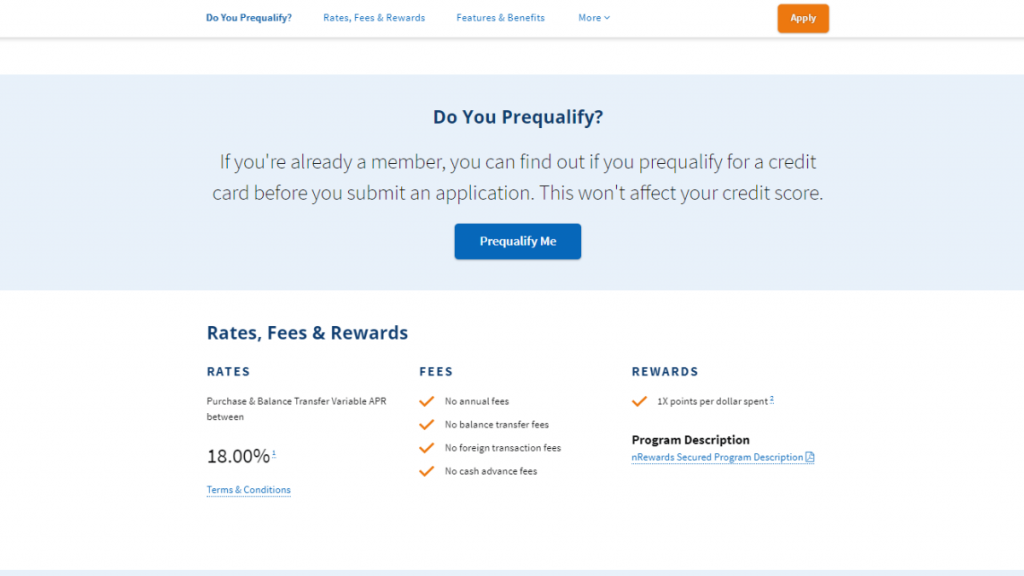

- Credit Score: 300-689 (Poor – Average);

- Annual Fee: $0;

- Purchase APR: 18.00% (variable);

- Cash Advance APR: 2% above the purchase APR;

- Welcome Bonus: N/A;

- Rewards: 1 point on all purchases.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Navy Federal nRewards® Secured: how does it work?

If you’re looking for a credit card that helps you build or rebuild your credit, then the Navy Federal nRewards® Secured is a solid option.

It stands out from other secured cards because it rewards you for every purchase you make.

You earn points to redeem for various rewards for every transaction you make.

Also, the card comes with many other benefits that can help you improve your credit score and financial health.

However, you should keep in mind that you need to be a member of the Navy Federal Credit Union to apply for this card.

Secured Deposit

To begin building your credit, you’ll need to deposit $200 when you open your account. This deposit will determine your credit limit.

Still, if you use your card responsibly for three months, you may be eligible for a higher credit limit without having to put down more money.

Also, after six months, Navy Federal will review your credit and may offer you an upgrade to a cashRewards unsecured card.

Advertisement

Flat Fees

Beyond the initial security deposit, there are no other fees for this credit card.

So it means no annual fees, balance transfer fees, foreign transaction fees, or advance fees for the Navy Federal nRewards® Secured.

3 Tips for Good Credit Utilization

Here are three simple and helpful tips to maintain good credit utilization:

1. Firstly, try to keep your credit card balance below the limit set by your bank.

2. Then, pay your credit card bills on time every month.

3. Lastly, avoid using your credit card for unnecessary or impulse purchases.

Advertisement

Navy Federal nRewards® Secured: should you get one?

Are you considering getting a credit card to build your credit score? If so, you should review the Navy Federal nRewards® Secured credit card more closely.

This product is designed specifically for individuals with limited or no credit history. See the pros and cons below.

Pros

- Earn rewards on all purchases;

- Potential for a credit limit increase without an additional security deposit;

- Minimal fees, making it cost-effective;

- Reports credit to the main bureaus.

Cons

- Requires a secured deposit;

- Limited to Navy Federal Credit Union members.

Credit score required

It is recommended to have a 300-689 (Poor – Average) credit score.

Navy Federal nRewards® Secured application: how to do it?

Ready to take the plunge into credit-building and rewards? So, stay tuned for our next article, where we’ll guide you through the application steps. Read on!

Apply for the Navy Federal nRewards® Secured Card

Follow this guide to apply for the Navy Federal nRewards® Secured card and Unlock better credit today. $0 hidden fees!

Trending Topics

No need to leave home: 10 best Pregnancy Test Apps to download

Expecting a baby? Don't miss out on our top 10 picks for the best pregnancy test apps to make your journey easier.

Keep Reading

Aspire® Cash Back Rewards Mastercard application: how does it work?

Find a complete application guide to the Aspire® Cash Back Rewards Mastercard that will get you started right now. Keep reading!

Keep Reading

Secured vs unsecured credit card: which one is right for you?

Wondering if you should get a secured vs. unsecured credit card? Here's what you need to know about both options. Read on!

Keep ReadingYou may also like

Anxiety Relief Hypnosis App review: Reprogram your anxious mind

Are you looking for a natural way to relieve your anxiety? Check out our Anxiety Relief Hypnosis App review.

Keep Reading

Application for the Fortiva® Card: how does it work?

If you need an incredible card that you can get even with a fair credit score, check out the Fortiva® Card application!

Keep Reading

Learn to apply easily for SpeedyNetLoan

Getting a loan online is easier and faster than you might think. Read this post to understand how to apply for a SpeedyNetLoan. Stay tuned!

Keep Reading