Reviews

Milestone® Mastercard® application: how does it work?

Are you looking for a way to build credit? If so, you can try with the Milestone® Mastercard®. And there is no need for security deposit! Read on to learn how to apply!

Advertisement

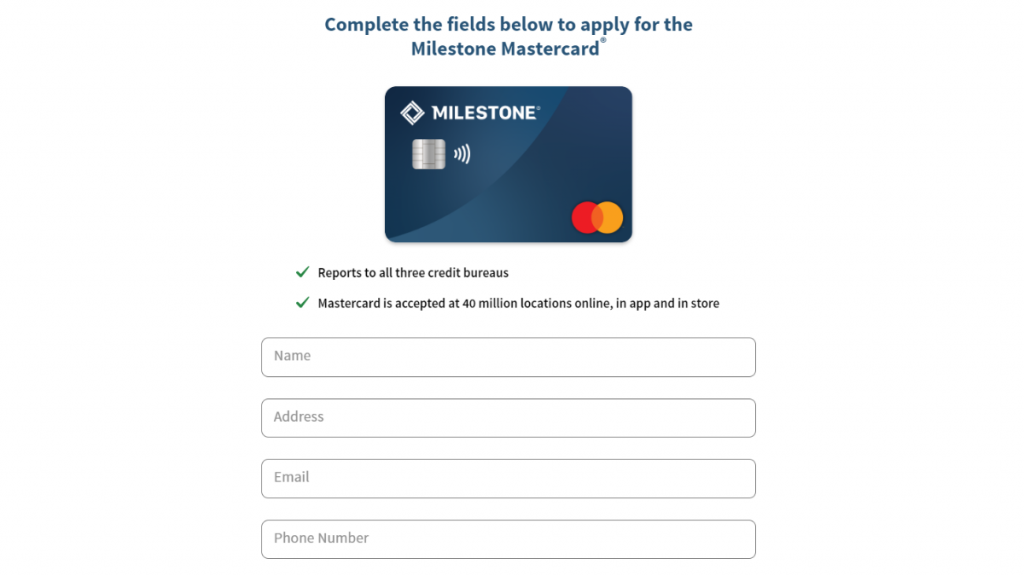

Milestone® Mastercard®: Easy online application

Applying for a Milestone® Mastercard® is online and easy. You can visit their website and go through their qualification process. Plus, they accept even poor scores!

If you want to apply, make sure you meet the requirements before:

- You must meet their credit criteria, which include income and debt review

- You must not have a previous account with Milestone

- You must not have delinquencies of any kind with a Milestone card

Also, make sure you read all the agreements and terms. Pay special attention to the fees since they’re above average.

If you decide to go with this card, have a look at the online qualification guide. Keep reading!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

Apply online

First, you’ll need to provide some basic personal and financial information.

Once you’ve submitted your data, your profile will go through an analysis to decide which of the Milestone cards will be addressed to you.

In case of approval, their team will send you an email with the card you’ve been accepted to have, the annual fees for it, and more.

One more time, remember to read the fine print. This credit card has high maintenance fees, so you’d better be informed about what you get.

Apply using the app

The app for the Milestone® Mastercard® is available, but only contains options to manage it.

There you’ll find things such as balance control, history, and payment set. However, you can’t apply using the app. Instead, visit the website to apply.

Advertisement

Milestone® Mastercard® vs. First Progress Platinum Prestige Mastercard® Secured Card

If the Milestone® Mastercard® is not what you are looking for, make sure you check the benefits and cons of another option to rebuild credit: The First Progress Platinum Prestige Secured Card.

Milestone® Mastercard®

- Credit Score: bad to fair;

- Annual Fee: $175 the first year; $49 thereafter;

- Regular APR: 35.9% variable for purchases;

- Welcome bonus: N/A;

- Rewards: N/A.

Advertisement

First Progress Platinum Prestige Mastercard® Secured Card

- Credit Score: Poor/Limited/No Credit;

- Annual Fee: $49;

- Regular APR: 15.24% (V) and 24.24% (V);

- Welcome bonus: No welcome bonus;

- Rewards: No rewards.

If you like the second option to start building your credit, make sure you check the post below. Here we go!

How to apply for First Progress Platinum Prestige?

If you need a credit card with benefits and for those with bad credit, check our post to learn how to apply for First Progress Platinum Prestige Mastercard Secured!

Trending Topics

Learn to easily apply for the Upgrade Personal Loan

Are you looking for personal loans of up to $50,000? If so, read our post to learn how to apply for Upgrade Personal Loan!

Keep Reading

Children’s Health Insurance Program (CHIP): see how to apply

A detailed description of how to apply for the Children's Health Insurance Program. Find out more here about it!

Keep Reading

Scotiabank Preferred Package Account Review

Explore our in-depth Scotiabank Preferred Package review for insights on its unlimited transactions, savings perks, and fee waiver criteria!

Keep ReadingYou may also like

Learn to apply easily for the Bad Credit Loans

Need a loan fast, but have bad credit? Don't worry! Our step-by-step guide lets you easily learn how to apply for Bad Credit Loan. Read on!

Keep Reading

Delta SkyMiles® Reserve American Express Card review

Read our Delta SkyMiles® Reserve American Express Card review if you want a top-of-the-line credit card with travel benefits!

Keep Reading

BOOST Platinum Card Review: Is it worth it?

Shop with the BOOST Platinum Card and enjoy $750 merchandise credit. No credit checks, perfect for low scores. Financial flexibility awaits!

Keep Reading