Loans

Merrick Bank Personal Loan review: how does it work and is it good?

If you can’t afford another hard pull to your credit score, this lender will only do it when you say you’re ready. Check our Merrick Bank Personal Loan review and learn more!

Advertisement

Merrick Bank Personal Loan: no hard pulls until you’re ready, plus fast approval

In this Merrick Bank Personal Loan review you will learn whether this is the right loan for you, its pros and cons, and if you decide to get it we can show you how. Stick around!

How about not taking a huge blow to your credit score right from the get go? Merrick Bank will only make its hard pull on you when and if you decide to take the loan. Before that it will only run a soft inquiry which, if you decide not to move forward, will barely scratch your credit score.

Once you submit your application you can expect approval within a day or two, and loans range from $2,500 up to $12,000. Once you’ve been approved for the loan, your funds should show up in about a day or two.

Check out some important numbers for Merrick Bank’s offer.

How to apply for the Merrick Bank Personal Loan

This step-by-step guide will take you from zero to money in just a few simple steps.

| APR | 27.99% – 35.99% |

| Loan Purpose | Not specified |

| Loan Amounts | $2,500 – $12,500 |

| Credit Needed | 580 |

| Terms | 36 months |

| Origination Fee | 5% |

| Late Fee | N/A |

| Early Payoff Penalty | N/A |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

What is the Merrick Bank Personal Loan?

Merrick Bank is the perfect place for people with less than perfect credit scores. They provide an alternative to traditional banks that caters specifically towards this population of consumers, helping them get back on their feet and eventually buy homes or cars in some cases. They offer a range of financial products including personal loans with a 5% origination fee for people:

- 18 or older

- Requires proven income

- With a Federal or State ID

- With a bank account

Merrick Bank Personal Loan reports to all three major credit bureaus, so paying your balance on-time will help build a consistent history that is needed for good card offers or even better loans.

Is Merrick Bank Personal Loan good?

See the pros and cons of this loan next in our Merrick Bank Personal Loan review.

Advertisement

Pros

- Fast application and approval process

- No hard pulls until you say so

- Accepts applicants with fair credit

Cons

- Short loan range

- Origination fee of 5%

- 35.99% APR

Advertisement

Does Merrick Bank Personal Loan check credit scores?

Merrick Bank Personal Loans are available to applicants with fair credit, and the minimum accepted score is 580. So credit requirements are not too high. But of course the closer you are towards excellence on your reportable information such as income or assets, the higher are your chances of being approved for this loan!

Want to get a Merrick Bank Personal Loan? We will help you!

Applying for this personal loan is a simple and straightforward process which takes only a few minutes to complete. Everything is done online through Merrick Bank’s website. If you’d like to know what you must have at hand when you decide to apply, as well as a step-by-step guide on how to do it, click the link below. We have everything ready for you there.

How to apply for the Merrick Bank Personal Loan

This step-by-step guide will take you from zero to money in just a few simple steps.

Trending Topics

Apply for SimpleLoans123: Fast-track Approval

Unlock financial freedom! Apply for the SimpleLoans123 in just 3 steps with our easy-to-follow guide. Read on!

Keep Reading

Navy Federal cashRewards Credit Card Review: $250 bonus cash back

Review of the Navy Federal cashRewards Credit Card: perks, rewards, and who should consider this hidden gem. No hidden fees! Read on!

Keep Reading

The US economy could enter a state of stagflation soon

Economist Mohamed El-Erian warns that the US economy is on the brink of stagflation, even if the Fed manages to avoid a recession.

Keep ReadingYou may also like

First Phase Visa® Card application: how does it work?

The First Phase Visa® Card application process is uncomplicated. Find out the must-have requirements and where to apply. Read on!

Keep Reading

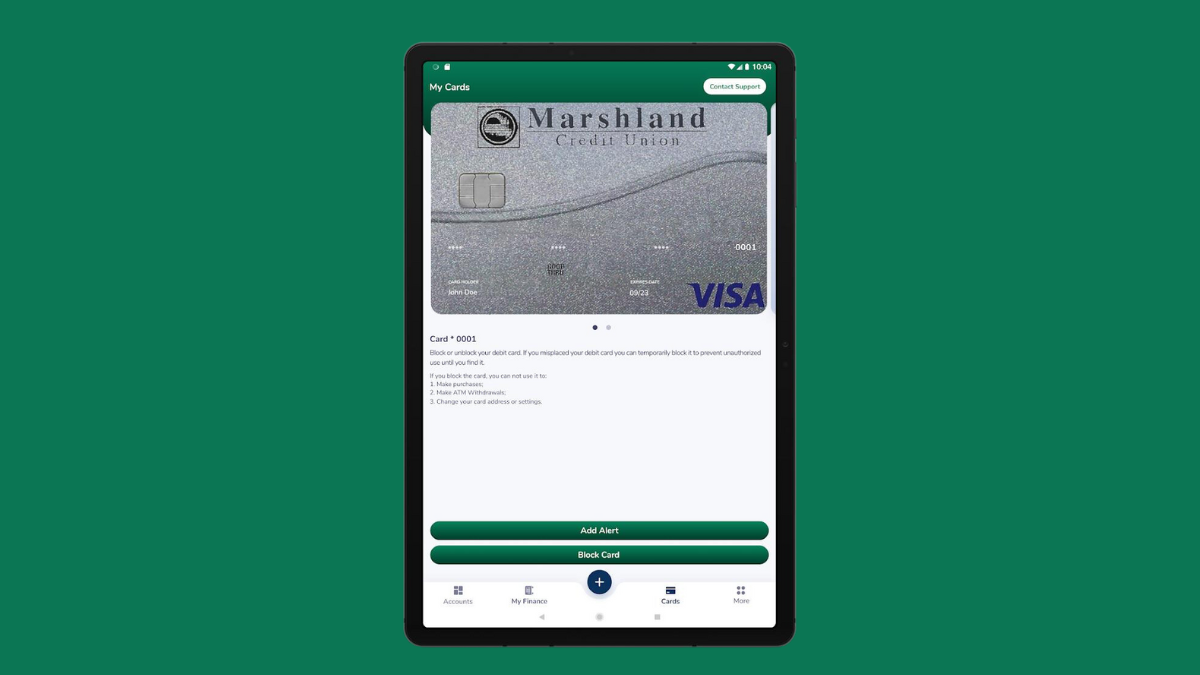

Enjoy $0 annual fee: Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Keep Reading

How to open an Axos High Yield Savings Account easily

With competitive APY, this account is perfect for your savings needs. Learn how to apply for an Axos High Yield Savings Account today!

Keep Reading