Credit Cards

The Perfect Card for Savvy Spenders: Marshland Visa® Credit Card review

With competitive rewards and low-interest rates, our review of the Marshland Visa® Credit Card shows why this card is a strong candidate for economic shoppers who want to save big. Keep reading!

Advertisement

A low-fee credit card that will widen your purchase power

Low Fees, Low Rates, and Rewards? Discover more about the Marshland Visa® Credit Card in our full review.

Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

This affordable shopping credit card gathers the best features to strengthen your purchase power. Read on for a view on rates, pros and cons, and much more!

- Credit Score: Not disclosed;

- Annual Fee: $0;

- Purchase APR: 25-day grace period, after that 9,90%;

- Cash Advance APR: 9,90%;

- Welcome Bonus: N/A;

- Rewards: Earn 1 point on every dollar spent with your card.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

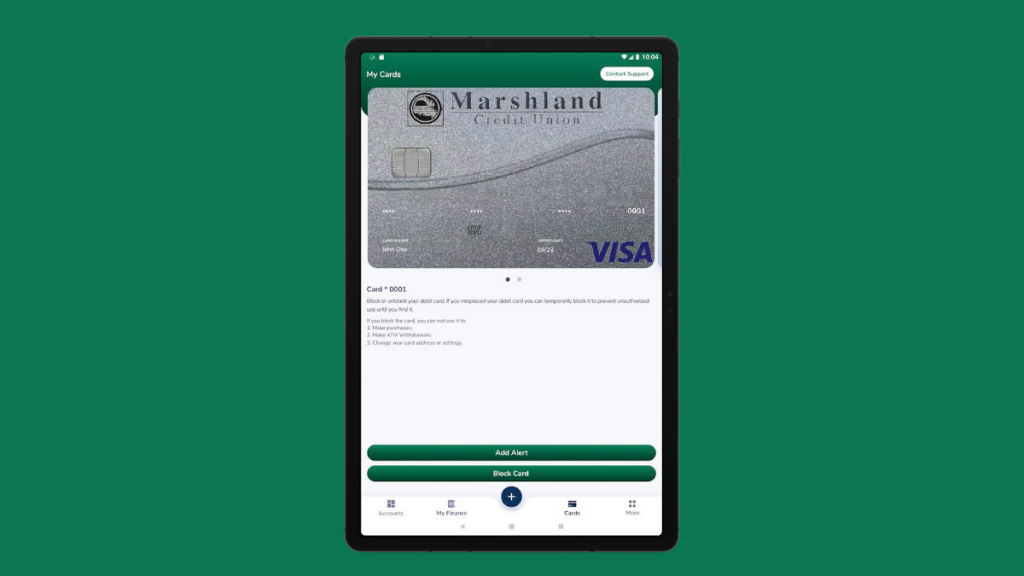

Marshland Visa® Credit Card: how does it work?

The Marshland Visa® Credit Card is designed for individuals who want to make the most out of their everyday purchases.

Strengths

The card comes with competitive rates, interest, a grace period, and rewards on all purchases.

With no annual fee and a low APR of just 9.90%, it is one of the most affordable credit cards in the market.

You also get a 25-day grace period, so you have more time to start paying your bills.

Additionally, the card offers Anytime Funds, which allows you to get cash anytime needed.

Advertisement

Rewards

For every dollar you spend with your card, you earn 1 point.

You can redeem these points for gifts, name-brand merchandise, or even a dream vacation at scorecardrewards.com.

Once you have collected enough points, you just need to access the website and redeem them for whatever pleases you.

Rates and Fees

When it comes to rates and fees, the Marshland Visa® Credit Card offers some of the most competitive rates in the market.

- There is no annual fee;

- Balance transfer fee: Up to $3 (lower than most rewards cards);

- Cash advance fee: Up to $3;

- Foreign transaction fee: Up to 1.0% (might not be the best choice for traveling abroad);

- Late Payment fee: 5% or $10, whichever is greater.

Advertisement

Marshland Visa® Credit Card: should you get one?

Indeed, the Marshland Visa® Credit Card is a good option for anyone who wants to avoid high fees and interest rates.

The card has a low APR, no annual fee, and a good rewards program. Then check out its advantages and disadvantages to make a smart decision.

Pros

- No annual fee;

- Competitive APR;

- Offers a 25-day grace period;

- Enjoy travel benefits;

- Earn 1 point on all your purchases.

Cons

- It charges a foreign Transaction fee.

Credit score required

Unfortunately, this information isn’t available online. However, feel free to give them a call for all the details.

Marshland Visa® Credit Card application: how to do it?

Get your Marshland Visa® Credit Card hassle-free with our step-by-step guide.

Furthermore, follow our instructions for a quick and effortless application process. So read on!

Apply for Marshland Visa® Credit Card

Learn how to apply for Marshland Visa® Credit Card and get 1 point per $1 spent on all your purchases. Read on and find out the steps.

Trending Topics

Copper – Banking Built For Teens review: fees, rates, and more

Get your teens started in finances with Copper- Banking Built for Teens review! An account specifically tailored towards kids.

Keep Reading

Ascent Student Loans Review: affordable options for you!

Discover the main features of Ascent Student Loans with our review. Get the inside scoop on their student loan options - up to $400,000!

Keep Reading

Bank of America Business Advantage Travel Rewards Card: apply today

Learn how to apply for the Bank of America Business Advantage Travel Rewards Card! Earn unlimited points on purchases!

Keep ReadingYou may also like

Mogo Prepaid Card Review

Read our Mogo Prepaid Card review to learn how this product can help you reduce your carbon footprint and manage your spending.

Keep Reading

Holiday shopping: 7 best credit card safety tips

Take these credit card safety tips to protect your hard-earned money from thieves and hackers during the holiday. Learn how to be safe.

Keep Reading

6 Best High Interest Savings Accounts in Canada: earn the most interest

Here is a list with some of the best high interest savings accounts in Canada for you to stash your money for the long or short term.

Keep Reading